Hard Vs Soft Inquiries

Its crucial to know the difference between each of these before you start mortgage shopping because it directly affects you and your credit score. Organizations perform soft inquiries or soft credit checks to do a background check or to send you gift offers for loans in the mail. Soft inquiries are usually not initiated by you and as such they commonly have zero effect on your credit score.

Hard inquiries are more detailed credit reports that are requested by you, or on your behalf. These come into play when youre applying for a new loan, such as a , mortgage, or auto loan. When you initiate a credit check in this way, youre essentially requesting a new loan. This is exactly what happens during the pre-approval process.

You can expect a hard inquiry on your credit when you apply for a pre-approval. The credit bureaus can see that youre applying for a loan and they evaluate your credit accordingly. They take a look at your current loan status and your payment history and go from there.

It is pretty common for people to see a difference in their credit score when house shopping and getting pre-approved. However, dont panic its usually a pretty tiny drop, nothing that cant be fixed quite easily with good credit habits over time.

Need help fixing your credit?

Whats The Difference Between Pre

A pre-approval uses verified information to approve you, as a buyer, for a mortgage loan. A pre-qualification doesnt.

A pre-qualification uses estimates, not verified information. Its a non-verified estimate of how much a home buyer can qualify for and gives the home buyer an estimate of the interest rate they will be paying on their mortgage.

A pre-approval is the process where a lender verifies your information and approves you for a mortgage. After completing a pre-approval, you receive a formal document that confirms the mortgage size and interest rate you can obtain from your lender.

|

Pre-Qualification |

|

| Provides an early estimate of mortgage affordability | Provides written commitment of mortgage affordability |

| Quoted based on self-attested estimates | Quoted based on accurate and verified information |

| Answer questions about your financial situation | Submit documents proving your financial situation |

| Self-reported credit score | Hard credit inquiry |

Banks, credit unions, and other lending institutions take precautions before lending money. Lenders pull credit reports to assess an individuals present and historical financial behavior. These assessments divide into categories known as soft inquiries and hard inquiries.

Learn more about the difference between pre-qualification and pre-approval.

Prequalified Vs Preapproved For Your Mortgage: Whats The Difference

Both prequalification and preapproval provide borrowers with an estimation of how much home they can afford. However, a mortgage preapproval is a more official step that requires the lender to verify your financial information and credit history. Documents required for a preapproval may include pay stubs, tax returns and even your Social Security card.

This means a preapproval is a stronger sign of what you can afford and adds more credibility to your offer than a prequalification. This will also allow you to show sellers a preapproval letter to demonstrate that your financial information has been verified and you can afford a mortgage. However, check with your lender to be sure.

Read Also: Syncb/ppc Account

You May Like: What Is The Mortgage On A 3 Million Dollar Home

What To Do If Your Prequalification Application Is Denied

There are some steps you can take to improve your situation if your prequalification application is denied. Equifax recommends obtaining a copy of your credit report and reviewing it for errors and areas where you can improve. Perhaps you need to start making extra payments to reduce your debt, or find a cosigner for a small loan or retail card to develop your credit history. Youll also want to ask the lender the reason for the denial. If the lender requires two years of employment history, for example, and you only have a year and a half, youll know to look for another lender or wait six more months before applying again.

When Should You Seek Prequalification

Theres no time like the present to seek prequalification, according to Majour Bey, a sales manager at AnnieMac Home Mortgage in Netcong, N.J.

Its 100% free and by talking to a mortgage professional early, they can calm your nerves about things you thought would be a big deal, Bey said. Seeking prequalification early, and from several lenders, can help you better prepare for your mortgage application and help you comparison-shop for your best rates.

Read Also: What Does Private Mortgage Insurance Cover

Does Home Loan Pre

When youâre on the hunt for a home, it can feel overwhelming â there are plenty of properties to consider and home loan options to weigh up. This is where home loan pre-approval can come in handy.

But, does getting pre-approved by lenders damage your credit score? In this article, we explain what pre-approval is and how it works, as well as its benefits and how it affects your credit score.

How Can A Mortgage Pre

Whenmaking a conditional offer on a house, a common term is the financing clause. Offering to buy a home without a financing clause can make your request stand out. However, if you end up not being able to finance the purchase, the seller will keep your deposit and can sue you for damages associated with the termination of the offer.

You may have to pay for any differences in price if the seller has to sell for a lower amount than your initial offer! Having a mortgage pre-approval can give you the confidence to waive the financing condition, but remember that mortgage pre-approvals are not guaranteed, and you should make sure not to exceed your maximum limit.

Don’t Miss: How To Choose A Good Mortgage Lender

Monitor Your Credit While Shopping For A Home

While getting prequalified for a mortgage might not affect your credit scores, you want to make sure other negative marks don’t hurt your credit right before you apply for such a large loan. A credit monitoring service could quickly alert you to changes in your credit reports. Experian offers free monitoring of your Experian credit report.

You may want to monitor your other two credit reports as well, because mortgage lenders may use all three of your reports and credit scores based on each report. The Experian IdentityWorksSM Premium program has a free 30-day trial and comes with three-bureau monitoring and multiple FICO® Scores for each report, including the FICO® Score version commonly used for home loans.

How Does Mortgage Rate Shopping Affect Your Credit Score

Part of the mortgage pre-approval process includes a credit inquiry, which occurs when a lender checks your credit. This is a necessary part of the process, yet it is also one of the factors that keep homebuyers from getting pre-approved. So lets get a few things straight:

It is true that

It is true that too many inquiries can negatively affect your credit score. Too many inquiries signals to the lender that you are aggressively seeking credit, potentially indicating that you are in financial trouble or have a significant amount of debt. Plus, consumers who have several inquiries are more likely to declare bankruptcy than those who have none.

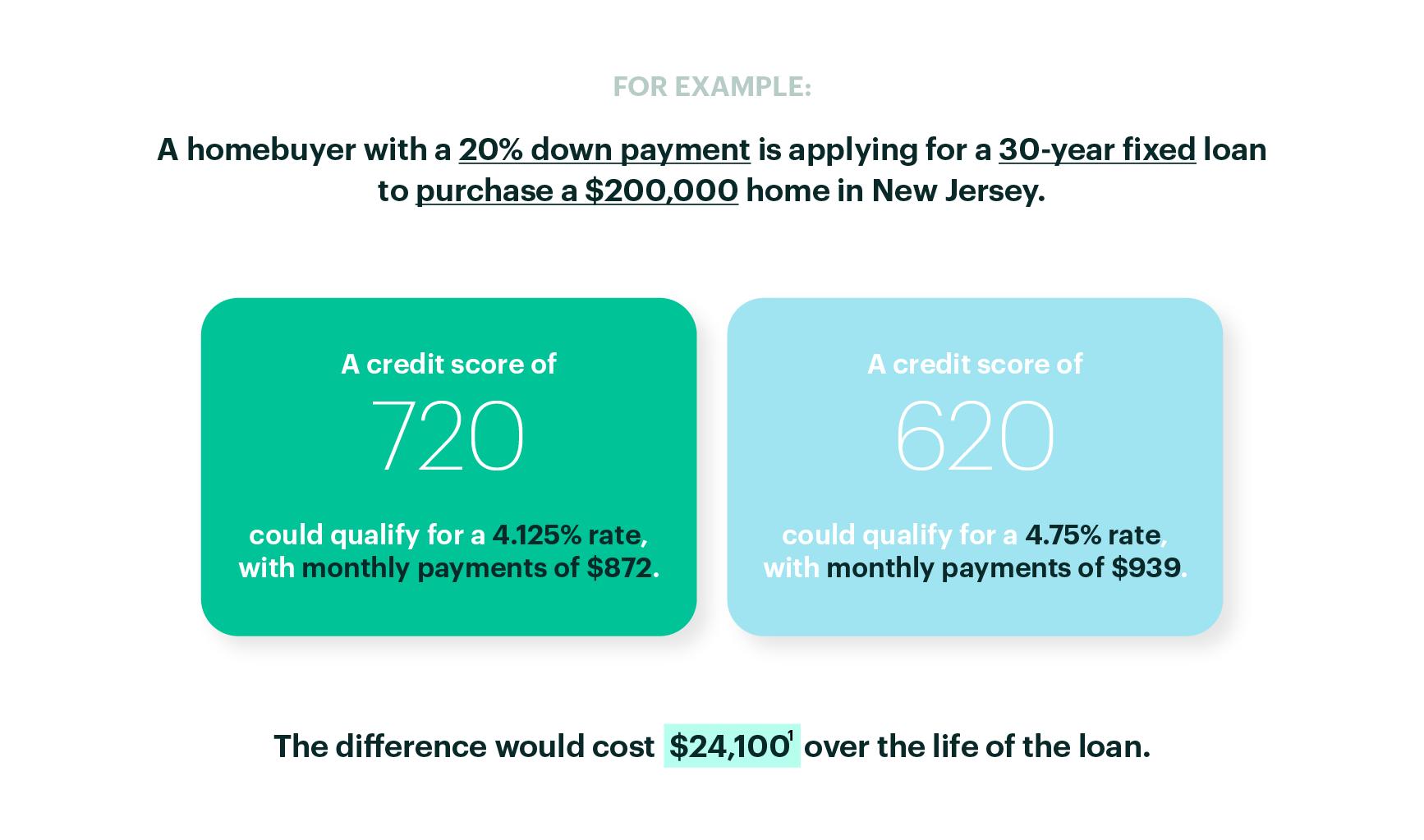

It is also true that a lower credit score means a mortgage will come with a higher interest rate and be more difficult to qualify for.

It is not true that

It is not true that credit inquiries made during the pre-approval process will have a lasting impact on your credit score.

The credit inquiries that occur during pre-approval are hard credit pulls, which typically only affect credit scores by less than five points and vary according to the type of creditor conducting the inquiry, the type of loan, and the homebuyers current credit profile. The score reduction is usually short-lived, and the inquiry drops off credit reports after two years.

Read Also: What Is Typical Debt To Income Ratio For Mortgage

When Should You Get A Mortgage Preapproval

You should get a mortgage preapproval if youre serious about looking for and making an offer on a home within the next two months. Preapproval letters are good for 30 to 60 days, according to the Consumer Financial Protection Bureau .

If it takes you longer than a month or two to find a home, the lender may need to update your preapproval with more recent pay stubs and bank statements. If your house hunt takes more than 90 days, the lender may also need to pull a new credit report, which may impact your credit score.

How Is My Credit Score Determined

Your credit score demonstrates to lenders how risky of a borrower you are. Your score will gradually rise over time if you pay your bills and debts on time. However, it will drop significantly if you miss a payment.

Other factors that harm your credit score include:

- Applying for too many loans and receiving multiple âhard credit checksâ

- Not having a credit history

In Canada, there are multiplefree services to check your credit score.

Recommended Reading: What Is The Longest Mortgage Term Available

Mortgage Preapproval Explained In Less Than 5 Minutes

The Balance / Shideh Ghandeharizadeh

A mortgage preapproval details how much a lender is willing to let you borrow for the purpose of buying a home. Some sellers require a mortgage preapproval before they’ll accept your offer to buy a house.

Having a mortgage preapproval letter tells sellers that you’re serious about buying. They may be more willing to negotiate with you if you have the letter in hand. The letter expedites the homebuying process.

Submit Your Applications Within 45 Days

Generally, every time you apply for a new line of credit, a lender runs a hard inquiry and your credit score may temporarily be lowered. Because of this, submitting too many applications for new credit can damage your credit score since you’ll be seen as a riskier borrower.

When it comes to mortgages, however, lenders expect you to shop around and you can do so as much as you need to within 45 days of getting your first hard inquiry without harming your credit score further.

This is where it can be handy to go in with the knowledge gained from already being pre-qualified and aware of which lenders will most likely fit your financial needs. That way, you won’t have to waste valuable time during the 45-day window doing too much additional research for new lenders.

Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on , and to stay up to date.

Read Also: Do Different Banks Offer Different Mortgage Rates

Having A Mortgage Can Improve Your Credit

A mortgage affects your credit score as long as it appears on your credit report. Managing this large, single debt well over the loan period can help improve your credit score.

Having a good mix of credit types demonstrates that you can handle different types of debt and can improve your score. A good credit mix might include a mortgage, a few credit cards, and a car loan. Too many credit cards can hurt your credit score, warns the Federal Trade Commission.

While its highly unlikely youâll pay off your mortgage in a month, paying off credit cards in full every month can have big benefits for your credit score. In fact, thats one of the best ways to improve or maintain it, says the CFPB.

Making your monthly payments on time no matter what the credit type can help increase your score. Consider making an automatic monthly mortgage payment , so you never have to worry about remembering to make a payment on time.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Recommended Reading: What Is A Mortgage Deed

Does Preapproval Affect Your Credit Score

Getting preapproved for a mortgage has an impact on your credit score. Thats because when lenders check your credit, they perform a hard inquiry, which can drop your score by a few points. The good news is that the effect is small, and gets even smaller as time passes: Hard inquiries come off your report entirely after two years.

If youre planning to get a preapproval from more than one lender, aim to do it within a 45-day window to avoid more damage to your score than necessary. Inquiries within this time frame will be counted as one inquiry, instead of multiple.

How Long Your Credit Will Be Impacted By A Traditional Pre

Hard inquiries can stay on your credit reports for up to two years, but the impact of them diminishes over time. FICO says it only considers inquiries from the last 12 months when calculating your scores.

To reduce the effects of hard inquiries, you can request pre-approvals and submit mortgage applications within a short window.

Recommended Reading: Can Reverse Mortgage Interest Be Deducted

Should You Get Preapproved

Getting preapproved for a mortgage loan is one of the most important steps in the home buying process. Its not required, but it does show home sellers that you are serious about buying and will tell you how much home you can afford. Dont skip this step, even if a hard inquiry could cause your credit score to dip slightly.

Does Applying For A Mortgage Hurt Your Credit Score

Similar to a mortgage pre-approval, applying for a mortgage involves a hard inquiry on your credit report, which could lower your credit score by a few points. If you fill out multiple mortgage applications within the 14 to 45-day shopping window, then it will only count as a single inquiry.

The mortgage shopping window only applies to credit checks from mortgage lenders or brokers credit cards, according to the Consumer Financial Protection Bureau, and other inquiries will show separately on your credit report.

After you close on a new mortgage, your credit score may go down again temporarily. Because of this, it may be difficult to get other loans or with the terms you prefer. You may have to wait several months before applying for a larger loan.

On the other hand, a mortgage can also help build your credit over the long run if you make timely payments.

You May Like: Can I Get A Mortgage Without A Tax Return

Two Ways To Check Your Credit:

There are two ways to check your credit: a soft credit check and a hard credit check. Essentially, you are the only one who would see a soft credit check it is not seen by other lenders, and it has no impact on your credit score. A hard credit check indicates that a lender is going to give you credit, showing up when other lenders conduct credit checks on you, and it can impact your credit score. Here is a deeper look at the differences between a soft credit check and a hard credit check:

Soft credit check. Lenders use soft credit checks when deciding if they should pre-approve you for a credit card. A lender may also use a soft credit check if your current lender pulls a credit report for an account review or when a debt collector reviews a recent credit report. Checking your own credit rating will also get logged as a soft credit check.

Hard credit check. Lenders use a hard credit check, on the other hand, when you apply for a loan, commonly a car loan or a mortgage, or a credit card. A hard credit check indicates that you want to take on added debt. It should be noted, as well, that other potential lenders will be able to see any hard credit checks and can therefore impact your credit score. However, any negative impacts will likely only happen if you take out numerous hard credit checks.

What Is The Difference Between Pre

The major difference between pre-approval and pre-qualification for a mortgage is that pre-approval uses verified information to approve you for a loan and pre-qualification does not. Rather than using verified information, pre-qualification uses an estimate. In other words, pre-qualification uses a non-verified estimate of the kind of loan you will qualify for and gives you an estimate of the interest rate that you will end up paying on your mortgage.

Pre-approval, on the other hand, is the part of the process where the lender will verify your financial details and approve you for the mortgage. It is the part that ends with you receiving formal documentation confirming the interest rate and mortgage size that you can get from your mortgage lender.

Pre-approval, which is valid for 90 days, gives a written commitment of your mortgage affordability. Its quoted using verified information, uses documents detailing your financial situation, and utilizes a hard credit inquiry. Pre-qualification, on the other hand, estimates your affordability at one time, gives an early estimate of affordability, and is quoted using a self-attested estimate. It also uses answered questions on your financial situation and is a self-reported credit score.

Don’t Miss: What Is Mortgage Insurance Based On

What Happens To Your Credit Score After A Pre

When a lender checks your credit for a mortgage pre-approval, they run a hard inquiry. A hard inquiry can cause your score to dip slightly. The impact on your credit will be minimal. The drop in score that comes after a pre-approval wont cause the lender to change their mind when it comes time to apply for a mortgage.

The drop is temporary. If you continue to pay your bills on time and are punctual with your mortgage payments once you receive one, your credit score will soon recover.