Mortgage Rate Predictions For The Next 5 Years

While predicting mortgage rates for the next five years is a tall order, especially considering the unprecedented fluctuations over the past two years, one main factor that experts say will impact rates in the long term is the low level of housing inventory.

When rates come down, were going to be in store for another hot housing market where there are more buyers than sellers jacking up prices because we havent solved the problem of there not being enough homes, says Daryl Fairweather, chief economist at Redfin. Its still that affordability problem. Thats going to stay with us.

As far as which direction interest rates go in the years ahead, Fairweather expects declines. However, the timeline for this downward trend remains uncertain.

In every scenario, rates are going to come back down, says Fairweather. Its just a matter of when.

Dennis Shirshikov Strategist At Awningcom And Professor Of Economics And Finance At City University Of New York

2023 mortgage rate forecast: 9.25% , 8.75%

What will drive mortgage rates in 2023?

Continued inflation will drive rates up for the foreseeable future into 2023, says Shirshikov. Monetary tightening and the Federal Reserve raising its interest rate to combat inflation will also create additional upward pressure… I think that rates for 30-year and 15-year fixed-rate mortgages will be driven closer together as the long-term economic risk of recession increases and banks are less willing to lend.

Falling inflation and a huge drop in demand for mortgages could bring interest rates down significantly. The onset of a recession due to excessive monetary tightening could also bring down rates.

Advice for home buyers and homeowners

Refinance and purchase sooner rather than later if you plan on doing it at all.

When Will Mortgage Rates Go Up

Mortgage rates have surged since the start of 2022, which reflects investors views that the economy is too hot and that the Federal Reserve will take any necessary steps to cool it down and rein in inflation.

Rates for U.S. Treasury bonds, which mortgage rates follow, have hit some rough patches this year: in late February, when Russia invaded Ukraine, and over the summer when investors grew concerned about a weakening economy. During those periods, bond yields fell, and mortgage rates followed.

Most mortgage-market experts think rates are in for a period of choppiness over the next several months but that rates are likely to settle where they are nowwith the 30-year fixed-rate mortgage about 6%for the rest of the year.

Read Also: What Happens With A Reverse Mortgage When Owner Dies

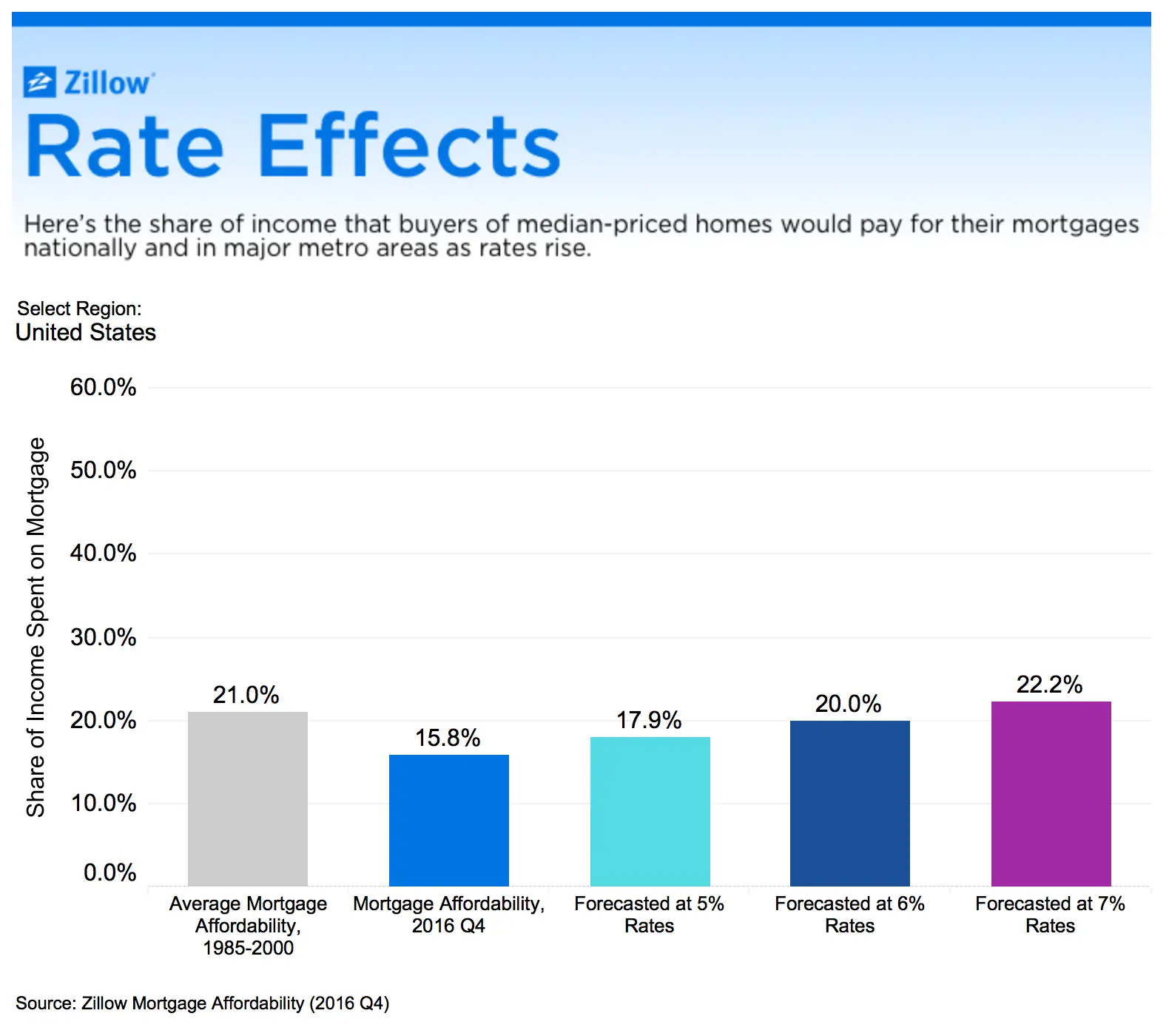

What Current Mortgage Rate Predictions Mean For Homebuyers

Falling mortgage rates may give homebuyers some much needed relief from the sticker shock of rates that have doubled since March of this year. Lower rates also mean a lower monthly payment which means you can qualify for a higher-priced home.

Lenders measure your debt-to-income ratio by dividing your total debt including your mortgage payment by your before-tax income, a lower rate. A 43% maximum DTI ratio is the benchmark for payment affordability and a lower monthly payment equals a higher potential loan amount.

Unfortunately, the rate drops may not be enough to make housing affordable for first-time homebuyers with prices remaining persistently steep. First-time homebuyers should plan on saving up as much as possible before they buy, and be realistic about what they can afford, Channel said.

Below, you can see how the recent drop in rates would affect how much house a buyer earning $85,000 annually with $250 of existing debt qualifies for now, compared to a month ago.

| Interest rate | Maximum monthly payment at 43% DTI ratio | Maximum home price |

|---|---|---|

| $2,795 | $403,421 |

The bottom line: The slight drop in mortgage rates allows this buyer to look at homes over the $400,000 price range which is more than $13,000 of extra buying power in just a month.

Boyd Rudy Associate Broker Dwellings Michigan

2023 mortgage rate forecast: 5.0% , 4.5%

What will drive mortgage rates in 2023?

Rudy emphasizes that Federal Reserve policy decisions, inflation, and unemployment can all affect mortgage rates. Then there are the current housing market and demand for mortgages to consider. If more people are looking to purchase or refinance homes, this can drive up rates as lenders become more competitive for business.

A potential decrease in inflation could lead to lower interest rates. Additionally, if the job market continues to improve and the economy sees sustained growth, this could also drive rates down. On the policy side, actions taken by the Fed can have a significant impact, as well.

Advice for home buyers and homeowners

Do your research and consider all your options before making a decision. It may be tempting to lock in an interest rate now before rates go higher, but its important to ensure you have found the perfect property for you and can afford the monthly payments.

Waiting a little longer for the right house could end up saving you money in the long run. For those seeking to refinance, carefully consider whether or not will save you enough money to justify the fees and closing costs. It may be more beneficial to wait until interest rates drop lower or until you improve your credit score.

You May Like: Does It Matter What Mortgage Lender You Use

Next Steps For Borrowers

- If you havent refinanced, get to work. Nearly everyone expects rates to climb in 2022, so rates are unlikely to be more attractive than they are now. Theres an urgency to acting sooner rather than later, McBride says.

- Keep a cash-out mortgage in mind. Home prices have soared, and mortgage rates remain low enough that tapping home equity is the best way to finance home improvements.

- Remember to shop around. Savvy shopping can help you find a better-than-average rate. With the refi boom slowing, lenders are eager for your business, McBride says. Lenders are thirsty for volume, he says. Just because rates are trending toward 3.5 percent doesnt mean you have to settle for the average.

What Determines Mortgage Rates

Lenders consider a range of factors when setting their mortgage rates, includingthose offered by competing lenders and the cost of getting the money needed from the financial or wholesale markets to fund the loans. The cheaper things are for the lender, the lower its rates can be, explained Which?.

Another factor is the cost of borrowing, known as the interest rate, which is set by the Bank of England base rate. If the Banks interest rate rises, home loans will usually become more expensive as lenders pass on the increase in the bank rate to their customers, said MoneySuperMarket. So a higher base rate usually translates to higher monthly mortgage payments.

You May Like: Who Has The Best Mortgage Loan Rates

Mike Hardy Managing Partner At Churchill Mortgage

2023 mortgage rate forecast: 5.375% , 4.875%

What will drive mortgage rates in 2023?

An under-tightening by the Fed or an unforeseen black swan event would cause mortgage rates to rise. The good news is that short of another major unforeseen event, I think we are close to the peak for mortgage rates, says Hardy.

Recessions are, by nature, deflationary. The Fed is in a tight spot, as time to tame inflation while not stopping economic growth. But as we get deeper into a recession, we will see mortgage rates trend downward.

Advice for home buyers and homeowners

Unless there is a dire need for cash, I would wait to refinance for at least six to nine months, as I fully expect rates to trend down in 2023 while we endure this slowing economy in recession. A backup plan is to take a home equity line of credit and then restructure and consolidate any debt in 2023.

Summary Of Current Mortgage Rates

Mortgage rates moved lower this week

- The current rate for a 30-year fixed-rate mortgage is 6.49%, a of 0.09 percentage points from a week ago. The 30-year rate averaged 3.11% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 5.76%, down 0.14 percentage points week-over-week. The 15-year rate averaged 2.39% a year ago this week.

You May Like: What Is A Mortgage Quote

How High Will Inflation Go

The main driver of anxiety in markets, and the key catalyst for central bank action right now, is inflation, which hit a four-decade high of 9.1% in June. The source of inflation is a mix of demand and supply factors, but not always interconnected.

Pent-up demand, particularly for travel, means inadequate supply to supply chains still rattled by Covid-19, while Russias invasion of Ukraine, and the ensuing energy insecurity, have ramped up the price of oil and gas.

AUD/USD

| 0.00060 |

It means central bankers are unsure how effective monetary tightening will be against several mitigating factors, with rate rises potentially adding more pain without addressing the underlying problem of high prices.

According to the OECD, inflation in the euro area is expected to come down gradually over the next 18 months, hitting 5.5% by the end of this year and falling to 3.9% by the end of 2023.

The Congressional Budget Office , which advises Congress, has revised its projections upwards. It stated: As interest rates rise as they are projected to do in CBOs economic forecast federal spending on interest payments, including payments to foreign holders of US debt, would increase substantially.

More generally, the United States fiscal position would be more vulnerable to an increase in interest rates because costs to service the debt rise more for a given increase in interest rates when debt is higher than when it is lower.

After The Most Recent Fed Rate Hike Where Are Mortgage Rates Headed

- to copyLink copied!

- to copyLink copied!

- to copyLink copied!

WASHINGTON

The Federal Reserve hiked its benchmark lending rate this week for the seventh time this year, capping a year of intense pressure on the housing market that pushed mortgage rates above 7% for the first time since 2002.

But now that the Fed has signaled a softer approach to cooling the economy instead of rolling out bumper rate hikes, potential home buyers are left to wonder: Will mortgage rates come back down? Or have buyers missed their chance?

No one knows exactly where mortgage rates will go in the months ahead. But most experts agree that we have seen the end of 3% mortgages for some time.

Mortgage rates have run up so far and so fast this year that many would-be homebuyers can no longer afford to buy a home. At the end of 2022, when rates were at 3%, few predicted that just a year later rates around this weeks 6.33% would come as a relief, having dropped from over 7%.

After starting the year at an average 3.22%, according to Freddie Mac, the 30-year fixed-rate mortgage took off last spring as the Federal Reserve embarked on a historic campaign to battle decades-high inflation by raising interest rates. By fall, mortgage rates had more than doubled, eventually topping 7% in October. Rates have receded slightly in recent weeks, but loans are still expensive especially compared to the historically low rates buyers were getting during the pandemic.

Recommended Reading: Can You Repay A Reverse Mortgage

Expert Mortgage Rate Predictions For December

Nadia Evangelou, senior economist & director of forecasting at the National Association of Realtors

Prediction: Rates will moderate

Thanks to the rate-friendly inflation data, mortgage rates dropped back below 7%. It seems that the higher federal funds rates are starting to cool off inflation. And, if inflation continues to decelerate over the next several months, mortgage rates will likely stabilize below 7%.

Thus, rates will be in the 6%-7% range in December. Thats still double the previous years rate, but its better than an 8% rate, which is the historical average for the 30-year fixed mortgage. The monthly mortgage payment decreases by $250 when the rate drops by one percentage point.

Selma Hepp, deputy chief economist at Corelogic

Prediction: Rates will moderate

Recent sharp decline in mortgage rates reflects the latest data, which suggests a slowdown in the rate of inflation and a potentially less aggressive approach by the Fed as the inflation forecast gains some clarity. Mortgage rates are likely to stay at the current below-7% level barring any new economic or geopolitical shocks.

Joel Kan, associate vice president of industry surveys and forecasts at Mortgage Bankers Association

Prediction: Rates will drop

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will rise

Taylor Marr, deputy chief economist at Redfin

Prediction: rates will moderate

Rick Sharga, EVP of market intelligence at Attom Data Solutions

Prediction: Rates will moderate

Mortgage Interest Rate Faq

What are current mortgage rates?

Current mortgage rates are averaging 6.33% for a 30-year fixed-rate loan and 5.52% for a 15-year fixed-rate loan, according to Freddie Macs latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Will mortgage rates go down next week?

Mortgage rates could decrease next week if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders account for the Federal Reserve continuing to take aggressive measures to counteract inflation or if a global event brings economic uncertainty.

Will mortgage interest rates go down in 2023?

If the historically high inflation of 2022 continues to dissipate and the economy falls into a recession, its likely mortgage rates will decrease in 2023. Although, its important to remember that interest rates are notoriously volatile and are driven by many factors, so they can rise during any given week.

Will mortgage interest rates go up in 2023?

Mortgage rates may continue to rise in 2023. High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in 2022. However, if the U.S. does indeed enter a recession, mortgage rates could come down.

What is the lowest mortgage rate right now? Will there be a housing crash? What is the lowest mortgage rate ever?

You May Like: How Much Income For Mortgage Calculator

Phil Greely Broker Realogics Sothebys International Realty Seattle

2023 mortgage rate forecast: 6.75%

What will drive mortgage rates in 2023?

Getting inflation under control is the top agenda of the Federal Reserve. only tool to make this happen is raising interest rates, explains Greely. This causes business-to-business borrowing to become more expensive, which will lead to higher unemployment. This will make short-term loans more expensive and, with a trickle-down effect, mortgage rates higher, too. We are in a rising interest rate environment for at least the next six months.

Its possible that political pressure, a world war, or some other black swan event could cause the Fed to pivot. But until you see inflation reduce for several months, you likely wont see rates go down much.

Advice for home buyers and homeowners

Home buyers need to purchase within their budgets, no matter what the rate is at the time they buy. Its okay to purchase with an 8% rate, but you need to be able to afford that monthly payment without stress. This will mean you may have to buy less house than you could have a year ago.

Do not purchase with the expectation that you can refinance in a year, as a lower rate is not promised. Ensure you can afford your loan, regardless of the rate. Meanwhile, anyone refinancing right now needs to seriously consider why they are doing so. If you need to access equity for some reason, consider a home equity line of credit rather than a cash-out refinance.

Have Homebuyers Missed Their Chance

Even as the rates are trending up, most predictions show theyre unlikely to rise by much.

It is inevitable in the coming months that mortgage rates will be rising, said Lawrence Yun, chief economist for the National Association of Realtors. But nothing alarming. Maybe we will reach 3% average for the year and that will still be considered historically low.

A bigger problem for buyers is rapidly rising home prices.

The housing market has been on fire, with record low inventory driving up home values. In January, existing home sales were up 24% from last year and the median home price rose 14% from a year ago, according to the National Association of Realtors.

Rising rates and rising home prices amid a short supply of homes will undoubtedly challenge many homebuyers, said Hale. However, still historically low mortgage rates and rising rents in some of the most affordable markets for homeownership will help drive those on the fence to seriously consider buying instead of renting.

Hale said buyers currently in the market should be prepared for some rate moves from week-to-week, she said. If youre shopping right now, Hale said, look at your target home price and calculate what happens to your budget if rates move up.

Still, for most homebuyers, rising interest rates wont be as big a challenge as rising prices or finding a home in the next few months. Together, these factors are likely to temper the housing market.

Also Check: Is 4.75 A Good Interest Rate For Mortgage

Mortgage Interest Rates Forecast: Will Rates Go Up In 2023

Mortgage rates have risen since the start of 2022, reflecting investors’ concerns that the economy is heating up and that the Fed will cool it down and reign in inflation. U.S. Treasury bond rates, which mortgage rates follow, encountered two tough patches this year: in late February, when Russia invaded Ukraine, and in mid-May when investors worried about poor consumer spending. Bond yields and mortgage rates declined throughout these times.

The Federal Reserve does not determine mortgage rates, and the central bank’s choices do not have the same direct impact on mortgage rates as they have on other products such as savings accounts. The Fed does, however, determine borrowing costs for short-term loans in the United States by changing the federal funds rate. The federal funds rate can have an impact on 10-year Treasury bond yields, which are used to calculate most mortgage rates.

Essentially, the Fed does not set mortgage rates directly, but its policies can affect the financial markets and movers who do. Most analysts predict that mortgage rates will continue to rise given the inflation numbers continuing to increase. Since mortgage rates are tied closely to the performance of the 10-year Treasury market plus a margin to account for the additional riskiness of home lending. The long-term mortgage rates are expected to rise due to the overall turmoil in the worlds economy.

Also Read: How To Invest in Mortgage Estate Notes?