What Deposit Do I Need For A Mortgage With A Low Credit Score

Typically, the larger your deposit, the better the interest rates you will be offered. A lower LTV ratio means that the lending is lower risk, and therefore a lender can extend an offer of a lower rate.

LTV means the size of the borrowing as a proportion of the value of the property.

So, for example, if you want to purchase a property costing £100,000 and have a £25,000 deposit, you are looking for a mortgage with a 75% LTV ratio.

Average LTVs tend to be around:

- 95% as a maximum for a residential mortgage.

- 85% as a maximum for a buy-to-let mortgage.

- Sometimes the maximum LTV is higher for a bad credit mortgage.

Generally, your deposit requirements will be:

- 5-10% with minor credit rating issues, particularly if they are small, happened around 2-3 years ago, and you meet all other criteria.

- 15% or above for more serious credit score issues, such as lots of defaults, CCJs, or credit which is significantly in arrears. Sometimes if these issues occurred several years ago, they will have less of an impact.

Keep Your Credit Score Consistent During Your Mortgage

It’s important to keep your credit and finances consistent during the mortgage application process, especially if you’re not confident in your credit rating. While processing your mortgage, underwriters are working to verify your financial information and ensure you’ll be able to handle the responsibilities of your mortgage. You should try very hard to maintain your credit rating through the mortgage process, which means

- Dont apply for new credit

- Don’t miss credit card or loan payments

- Avoid making any large purchases

- Dont switch jobs

- Ensure any significant deposits to your account have a paper trail

If you think a decision might have a negative impact on your credit rating, you should probably avoid it at all costs while your mortgage application is being processed. If you’re unsure, speak with your loan officer before making any decisions.

How Do Mortgages Work

A mortgage is a type of loan you can use to purchase a home. It’s also an agreement between you and the lender that essentially says you can purchase a home without paying for it in full and upfront you’ll just need to put some of the money down usually between 3% and 20% of the home price and pay smaller, fixed monthly payments over a certain number of years, plus interest.

For example, you probably wouldn’t want to fork over $400,000 for a home upfront, though you might be more willing to pay $30,000 upfront. Having a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for the remaining $370,000. You would then agree to repay that amount plus interest to the lender over the course of 15 or 30 years depending on your terms.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance payments in addition to your monthly mortgage payments, however you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.

You May Like: Which Bank Is Best For Mortgage

Home Loans For Borrowers With Bad Credit

- Conventional non-conforming loan Even with bad credit, you might be able to qualify for a conventional loan thats non-conforming, or falls outside of Fannie Mae and Freddie Mac requirements for factors like credit score. This can be an option if youve declared bankruptcy or are otherwise credit-challenged.

- FHA loan FHA loans are insured by the Federal Housing Administration and allow lenders to accept a credit score as low as 580 with a 3.5 percent down payment, or as low as 500 with a 10 percent down payment. The drawback here is that youll pay mortgage insurance.

- VA loan If youre a member of the military, a veteran or married to someone who has served in the armed forces, one of your benefits is the VA loan program backed by the U.S. Department of Veterans Affairs. You dont have to come up with a down payment for this type of loan, and there are no minimum credit score requirements, although lenders do have their own credit standards.

- USDA loan If you meet certain qualifications earn less than a certain amount each year and want to buy a property in a certain area the U.S. Department of Agriculture-backed lending program can help you become a homeowner with subpar credit.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Recommended Reading: Can You Use A Mortgage Loan To Build A House

Which Are The Best Lenders For Bad Credit Mortgages

The best lender for you depends on your circumstances, borrowing requirements, and the property you wish to purchase.

Every lender has different criteria, and the terms you might be offered will change significantly depending on whether you have some minor credit score issues, a clean credit rating, or multiple problems on your credit file.

Lenders don’t just consider credit scores, but also look at:

- Earnings – how much you earn, whether you are a PAYE salaried employee or self-employed. Specialist lenders will also consider non-regular income such as dividends, commission, benefits and bonuses.

- Age – some lenders are happy to lend to borrowers of any age, whereas others have a maximum age of 75 and others of 85. Niche lenders are happy to lend to applicants of any age provided they can demonstrate affordability.

- Property – standard properties are always easiest to borrow against. Non-standard houses, such as those with a thatched roof, or a timber frame, are best mortgaged through a specialist lender.

- Deposit – the higher the deposit, the more lenders you can apply to. Bad credit lenders will usually require a higher deposit than mainstream lenders.

How Is My Mortgage Rate Decided

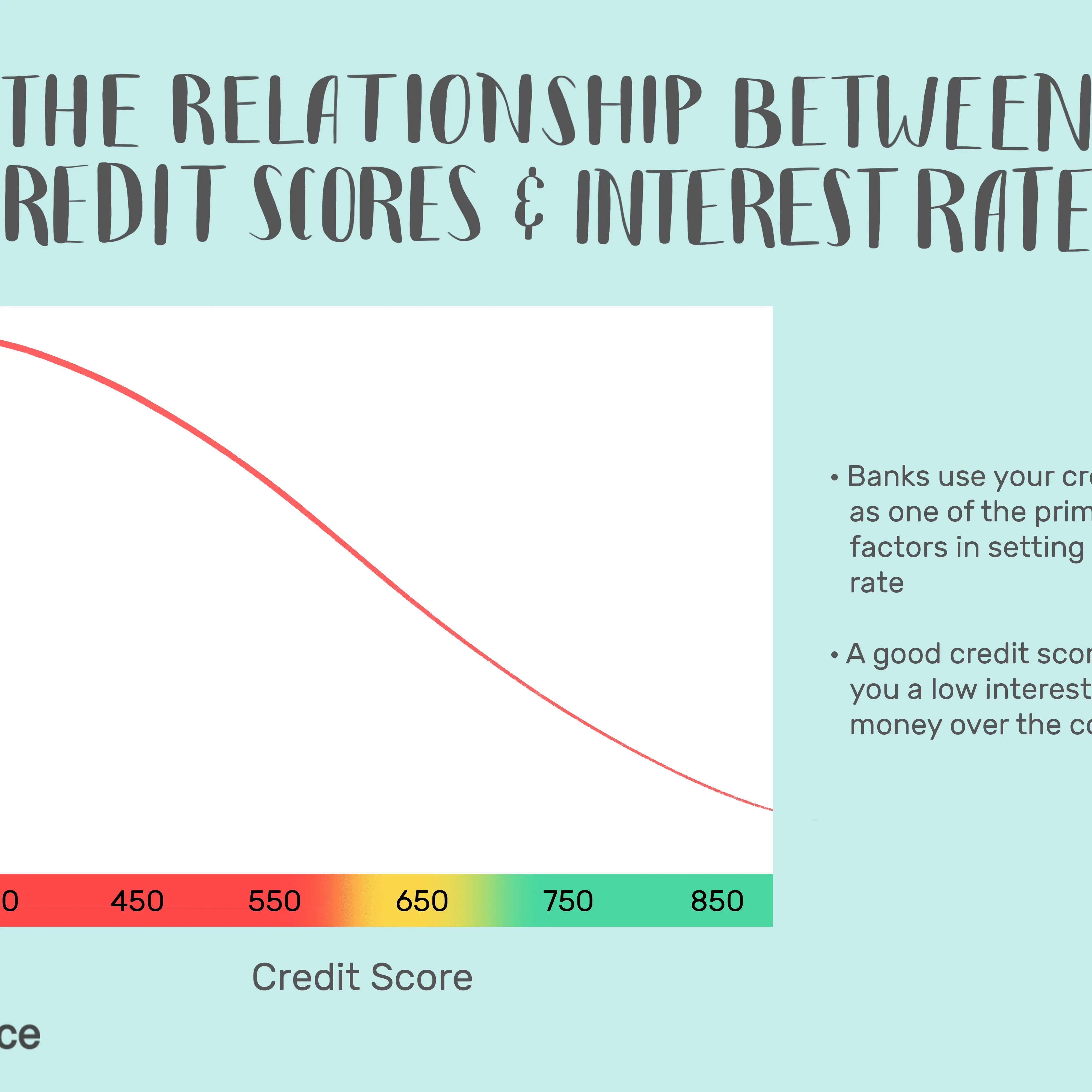

Mortgage rates change almost daily and can depend on market forces such as inflation and the overall economy. While the Federal Reserve doesn’t set mortgage rates, they do tend to move in reaction to actions taken by the Federal Reserve on its interest rates.

While market forces may influence the general range of mortgage rates, your specific mortgage rate will depend on your location, credit report and credit score. The higher your credit score, the more likely you are to be qualified for a lower mortgage interest rate.

Read Also: Can I Get Preapproved For A Mortgage More Than Once

Whats The Lowest Credit Score To Buy A House

Across the industry, the lowest possible credit score to buy a house is 500. But theres a limited number of mortgage lenders that allow such low scores and their interest rates are typically higher.

The most common loan type for bad credit borrowers is an FHA loan. The Federal Housing Administration technically allows FICO scores between 500 and 579 with a 10% down payment. But most FHA lenders stick to the agencys higher threshold of a 580 score with 3.5% down since its less risky for the lender.

Private lenders might also offer non-qualified mortgage programs that are not backed by any government agency and have more lenient rules. These programs might allow credit scores as low as 500, though interest rates on non-QM loans tend to be substantially higher than those on conforming and government-backed loans. So its typically better to go with an FHA loan or another standard home loan program if you qualify.

Bad Credit Mortgage Calculator

Got bad credit? You could still get a mortgage. We’re specialist bad credit mortgage brokers with a proven track record of making homeownership possible for people like you.

You may have to pay an early repayment charge if you remortgage.Your home could be repossessed if you dont keep up repayments on your mortgage.This calculator is only an estimate of how much you may be able to borrow. Talk to a mortgage broker or lender to get a more accurate figure.

Read Also: What Documents Needed To Refinance Mortgage

Check Out An Fha Streamline Refinance

If your current mortgage is backed by the Federal Housing Administration , you may qualify for an FHA streamline refinance. You wont need income documentation or a home appraisal, though youll need to prove youve made payments on time the past 12 months. A few drawbacks: You cant roll costs into the loan, unless you get an appraisal or ask the lender to increase your interest rate, and youll have to pay FHA mortgage insurance again.

Rate Forecasts From Bankrates Greg Mcbride Cfa

- Federal funds rate: 5.25-5.50%

- 10-year Treasury yield: 3%

- 30-year fixed-rate mortgage: 5.25%

- Home equity line of credit : 8.25%

- Home equity loan: 8.75%

- Money market account: 0.34%

- One-year CD: 1.8% for national average, 5% for top-yielding

- Five-year CD: 1.5% for national average, 4.1% for top-yielding

- Savings account: 0.29% for national average, 5.25% for top-yielding

- Five-year new car loan: 6.90%

- Four-year used car loan: 7.75%

Also Check: How Long It Takes To Get Mortgage Approved

How Many Mortgage Lenders Offer Bad Credit Lending

Over the past few years, the market for lending to low credit score applicants, or those with bad credit mortgages, has increased dramatically. This means there is now a much better chance of securing a low-interest rate than ever before.

There are also specific products for low credit score borrowers, designed to be lower-risk and affordable.

Some of the most significant changes to bad credit mortgage interest are:

- Applicants with any number of CCJs can now secure a higher loan to value ratio.

- Those with a discharged bankruptcy also have a wider choice of higher LTV lending.

- Homebuyers with minor credit issues can usually secure interest rates comparable with those available on the high street.

Can I Remortgage With Bad Credit

You can remortgage with bad credit. Remortgaging with bad credit can be more difficult than remortgaging with good credit but its still possible depending on the seriousness of your bad credit. If you want to remortgage with bad credit, lenders might want to charge you a higher interest rate.

Read our Guide How to Remortgage with Bad Credit to find out your options.

If you have bad credit and youre looking to remortgage, its a good idea to work with a specialist mortgage broker. A specialist mortgage broker will advise you on the lenders who are most likely to accept you, and can submit your application for you.

Were experts in all kinds of bad credit mortgages, get in touch with us and we’ll look at your remortgage options.

Don’t Miss: What Is An Origination Fee On A Mortgage Loan

Can You Buy A House With A 500 Credit Score

Yes, the FHA mortgage carries a credit score minimum of 500. However, if youre not buying a home in the next 30 days, you have time to improve your credit score. Get a mortgage pre-approval to see your current mortgage credit score. Let us help you get to a 580 score, then 620, then even higher to maximize your mortgage options.

Length Of Work History

As important as having an income is, having a history of receiving that income is just as crucial.

Your mortgage lender is going to want to see that youll continue to get paid. This is one of the risk factors theyll examine closely when you apply for a mortgage.

Mortgage lenders will sometimes approve you with as little as a year of work history, but ideally, they like to see 2 years.

Youll also want to try to avoid changing jobs in the middle of the mortgage process. If your income structure totally changes or youre moving into a different field, a lender wont necessarily be able to count on that income continuing in the future.

You May Like: What Is A Jumbo Mortgage Loan Amount

Build Up Your Deposit

Youll find it much easier to get a bad credit mortgage if you have a deposit of 30% or 40% compared to 10%. So, after youve met any existing debt repayment arrangements, focus on saving for your mortgage deposit.

Another way to increase your deposit size relative to the property value is to look at cheaper properties. A £30,000 deposit is only 10% if youre buying a £300,000 property whereas its 15% if youre buying a £200,000 property.

Is It Possible To Get A Good Mortgage Interest Rate With Poor Credit

Every mortgage lender offers different rates, and these can change very quickly.

The best way to get a great interest rate is to understand the criteria of the lender you’re looking to apply to – including both their eligibility and affordability requirements.

Once you are assured that you meet the requirements, you can apply for a mortgage in confidence and be in a strong position to negotiate better terms.

Revolution Brokers work with thousands of clients who have a low credit score or adverse credit history. We analyse your circumstances, recommend the lenders we know will be happy to lend to you and submit your application documents to meet all the criteria.

Don’t Miss: Do Mortgage Lenders Match Rates

Surge Mastercard: 2499% 2999%

The Surge Mastercard® offers some basic benefits, such as cash advances and $0 fraud liability. The card charges annual, monthly maintenance , additional card, penalty, and foreign transaction fees. You may be considered for credit limit increases if you make timely payments.

| Yes | 8.5/10 |

You can manage and make payments, as well as check due dates, view statements, and more through online and mobile device access. You must agree to receive electronic statements to access your free credit score.

How To Avoid A Bad Credit Refinance

You may avoid a bad credit refinance altogether if you:

- Reduce your credit card balances. For the best scores, dont charge more than 10% of your total available credit.

- Pay your bills on time. Any new late payments will set your credit score back.

- Avoid authorized user cards and cosigned debt. Youre responsible for the credit actions of others in cosigning arrangements, so stay away from them if you can.

- Limit any new credit applications. Your score is dinged every time you apply for a new credit account, so wait on any new credit inquiries until after your refinance is complete.

Recommended Reading: Should I Refinance My Mortgage To Pay Off Debt

Bad Credit Home Loan Options

These seven mortgage loan programs can help borrowers with lower credit achieve their homeownership goals. Requirements and credit score minimums vary by program.

The best mortgage for you will be one that provides flexible qualification guidelines and allows you to comfortably afford your monthly mortgage payments. Carefully compare loan terms and interest rates with your loan officer to decide which of these programs works best for your situation.

Check Your Home Buying Eligibility

Its possible to buy a house with bad credit. Youll likely pay a higher interest rate, but you could get onto the homeownership ladder now and start building equity. And you can always refinance to a lower rate later once your credit improves.

Want to find out whether you qualify for a home loan? Talk to a lender about your options. Consulting with a mortgage loan officer is free and will help you determine which bad credit mortgage program is best for you.

Also Check: What Does A Mortgage Consist Of

Should You Buy A Home With Poor Credit

Having poor credit could make your home loan more expensive. The best available rates are generally for borrowers with the highest scores. If your credit needs work and you move forward with your mortgage application anyway, you could get stuck with a higher interest rate than necessary for the length of your loan.

Case in point: If you have a credit score of 760 or above, as of this writing, you might qualify for an APR of 3.080% on a 30-year fixed $200,000 mortgage. That would leave you with a monthly payment of $852 for principal and interest, and you’ll pay a total of $106,825 in interest over the life of your loan. But if your credit score is a 620, your interest rate could jump to 4.669%. That, in turn, will give you a monthly payment of $1,033 for principal and interest and leave you paying a total of $172,037 in interest over the life of your loan.

But rates aside, if your credit score is low, you may want to think about why that is before getting a mortgage. Is it simply a matter of not having a lengthy credit history? Or is it because you’re not in a strong place financially and have frequently been late with bills or run up a high tab on your credit cards? If it’s the latter, then it might be a good idea to delay your mortgage application and work to improve not just your score, but also your entire financial picture.

Why Is Credit Card Interest So High

The fundamental cost to credit card issuers is funding how much it costs to provide credit. Funding costs stem from external borrowing, internal operations, or a combination of both.

The funding rate is often expressed as an increment above the prime rate, the lowest interest rate at which money can be commercially borrowed.

Historical prime rate changes since 1955.

One of lendings operating costs is nonperformance, i.e., late payments, loan defaults, collection costs, legal costs, etc. Keep in mind that, when a borrower defaults on a loan, a reputable lender loses not only the anticipated interest revenue but also at least part of the principal amount it lent out. All of these costs must be covered by the interest rates charged to subprime borrowers.

Rather than charge all borrowers the same interest rate to cover all expenses, card issuers graduate their interest rates based on risk. This makes sense since it rewards creditworthy borrowers for their good behavior while assigning the higher costs to subprime borrowers who are the most likely to default on payments.

Card issuers need high interest rates to make the whole enterprise worthwhile. In other words, they must make enough of a premium over the risk-free rate available from U.S. Treasury debt to garner a profit commensurate with the risks they undertake. Issuers count on relatively high interest rates to help pay the costs of financing, operations, marketing, collecting, and compliance.

Read Also: How Does Private Mortgage Insurance Work