Who Can Claim The Home Mortgage Interest Deduction

Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to $750,000 worth of mortgage debt on their primary or second home. For debts incurred before December 16, 2017, these numbers increase to $1 million and $500,000, respectively. The home must be a qualified home, which the IRS defines in Publication 936.

Choose The Correct Tax Forms

Youll need to itemize your deductions to claim the mortgage interest deduction. Since mortgage interest is an itemized deduction, youll use Schedule A , which is an itemized tax form, in addition to the standard 1040 form. This form also lists other deductions, including medical and dental expenses, taxes you paid and donations to charity. You can find the mortgage interest deduction part on line 8 of the form. Youll put in the mortgage interest information found on your 1098 in that section. Pretty easy.

Now comes the tricky part. If you make money from the home whether using it as a rental property or using it for your business youll need to fill out a different form. Thats because the way interest is deducted from your taxes depends on how you used the loan money, not on the loan itself.

If you are deducting the interest you pay on rental properties, you must use Schedule E to report it. This form is used for supplemental income from rental real estate. If you use part of your house as a home office or if you use money from your mortgage for business purposes, you may need to fill out a Schedule C to report it. This form is used for profit or loss from a business you owned or operated yourself. Youll list mortgage interest as an expense on both of these forms.

Whatever mortgage interest youre deducting and whatever form youre using, its important to know what qualifies as interest and what isnt deductible. If you are itemizing your deductions, read on.

Is The Mortgage Interest Tax Deduction Really A Big Deal

In this episode, were answering a question were asked about pretty frequently, especially around tax season, If I have a mortgage, do I get a mortgage interest write-off? Were sharing why mortgage interest tax deductions are a big deal, and how your mortgage interest can help you during tax season!

You May Like: How Much Money Do You Get With A Reverse Mortgage

Interest On The Mortgage For A Second Home

You can use this tax deduction on a mortgage for a home that is not your primary residence as long as the second home is listed as collateral for that mortgage. If you rent out your second home, there is another caveat. You must live in the home for more than 14 days or more than 10% of the days you rent it out whichever is longer. If you have more than one second home, you can only deduct the interest for one.

Can You Write Off Mortgage Interest When Working From Home

If your home is your primary place of business, or you use a specific space in your home solely for business purposes , you can deduct mortgage interest but only up to the amount of space used each month . Lets say you ran a laser hair removal business in your basement, and only used the basement for that purpose. If your basement is 20% of the total square footage of your property and you ran your business full-time for a whole year, you could reclaim up to 20% of your total mortgage interest payments, depending on how many days each month you were using the space for your business.

Note: this only applies when you run your own business from home. If youre working for an employer and work from home, mortgage interest is not tax-deductible.

Read Also: Can A Senior Get A Mortgage

Mortgage Interest Is Deductible On Loans Up To $750000

Loans that are used to buy or build a residence are referred to as “home acquisition debts.” The term refers to any loan you take for the purpose of “acquiring, constructing, or substantially improving” a qualified home.

It used to be that you could deduct interest on home acquisition debts of up to $1 million for your main home and/or your secondary residence, but the TCJA reduced this to $750,000 beginning with tax year 2018. The limit drops even more, to $375,000, if you’re married and filing a separate return.

Let’s say you borrowed $1 million against your primary residence in 2021. That exceeds the $750,000 limit set by the TCJA, so you can only claim mortgage interest paid on the first $750,000 you borrowed.

What Loans Qualify For A Mortgage Interest Deduction

There are a few types of home loans that qualify for the mortgage interest tax deduction. These include a home loan to buy, build or improve your home. While the typical loan is a mortgage, a home equity loan, line of credit or second mortgage may also qualify. You can also use the mortgage interest deduction after refinancing your home. Just make sure the loan meets the previously listed qualifications and that the home in question is used to secure the loan.

You May Like: How To Calculate Reverse Mortgage

When You Itemize Without The Interest Deduction

If you have enough deductions to itemize, even without the mortgage interest, thats a different story. In that case, you simply multiply your mortgage interest by your tax rate.

If the Reynolds family has $15,000 in Schedule A deductions, plus their home interest deduction, and they earn $200,000 a year, they would multiply $13,401 by .28, because they would be in the 28 percent bracket.

- $13,401 * .28 = $3,752 per year

- $3,752 / 12 = $313 per month

You can see that the mortgage interest deduction is potentially more helpful to those in higher brackets, and those who already itemize.

A Home Mortgage Is An Incentive To Save On Taxable Income

Mortgages are an incentive to purchase a home. The government has used the home purchase as an incentive. They want people to have homeownership for various reasons, and the way they incentivize is by putting money in your pocket.

Many people dont know how much money is going into their pockets. Sometimes theyre overestimating or underestimating. In this episode, were going to try to give four examples, for different people. These are just examples of their income and their loan amount size, and were going to quantify the savings, the daily savings, what that looks like.

Example 1: Someone with a taxable income of $50,000. Theyre typically going to be in a 12% tax rate, okay? Thats what were going to base this off of. They have a home thats about $208,000. They have a mortgage of about $195,000. They pay really close to $8,000 in interest, based off of that 4% that were using, the 4% is just an example. For $8,000 in interest to the bank, they save $950 a year, and that calculates to be $2.60 a day. And what can you buy for $2.60 a day? We decided you can purchase a 6-pack of brand named soda each day. Which ends up being a $900 savings. Before the house, you had to pay us $960 more in taxes, then because of the interest write-off, you paid $960 less.

Thanks for listening and reading the Mortgage Brothers Show. Let us know if you have any questions youd like us to answer on this podcast. You can email your questions to or .

Also Check: What Is The Easiest Mortgage To Qualify For

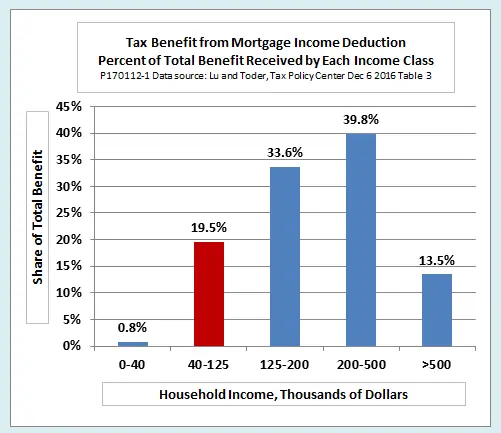

Benefits Go Mainly To Higher

Little of the deductions benefits go to households that have difficulty affording a home. Data from the Census Bureaus American Housing Survey show that in 2011, 10.5 million homeowners faced what HUD calls severe housing cost burdens, meaning they paid more than half of their income for housing. Some 90 percent of those homeowners had incomes below $50,000, yet JCT estimates for 2012 show that homeowners with incomes below that level received only 3 percent of the benefits from the mortgage interest deduction.

At the same time, 77 percent of the benefits from the mortgage interest deduction went to homeowners with incomes above $100,000, almost none of whom face severe housing cost burdens. Some 35 percent of the benefits went to homeowners with incomes above $200,000 taxpayers in this income group who claimed the deduction received an average subsidy of about $5,000.

The deductions benefits are concentrated among higher-income households for several reasons.

Why Is Some Mortgage Interest Not Tax Deductible

As mentioned above, the deductibility of mortgage interest is often dependent on whether your loan is secured by the value of the mortgaged property being used as collateral. If the loan is unsecured, like a personal loan, the interest typically cannot be deducted. Whats more, if youre looking to have the interest on a home equity loan or HELOC deducted but have used it for purposes other than purchasing or improving your home, like paying off credit card debt, you will likely be unable to do so.

Recommended Reading: Can I Get A Mortgage With No Credit

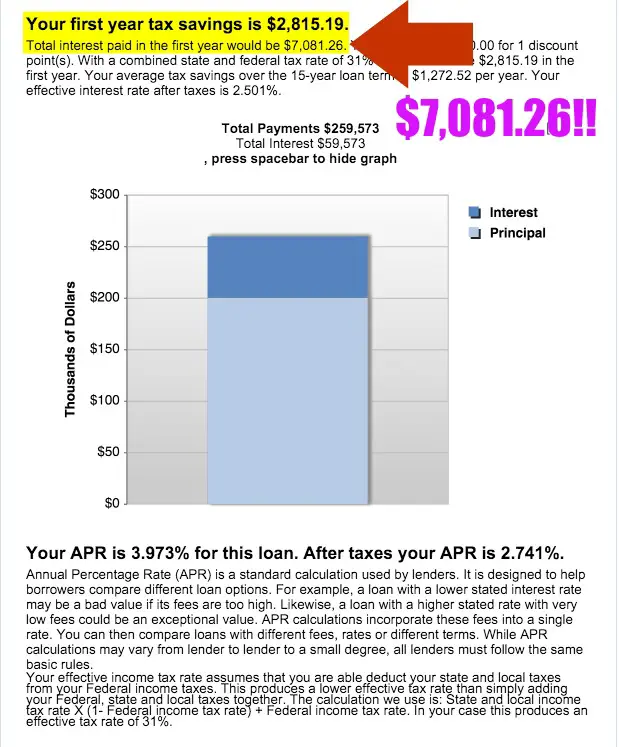

Mortgage Tax Savings Calculator

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

How The Mortgage Interest Tax Deduction Works

When you deduct your mortgage interest, you save between ten and almost 40 percent of your interest costs. Note that you dont calculate the deduction from your entire payment, just the interest.

Because interest costs are higher in the first years of your mortgage, you get to deduct more at first, usually when you need it most.

The chart below shows tax brackets for a married couple filing jointly.

Recommended Reading: How To Pay Down Your Mortgage Faster

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework

While the Unified Framework announced by the Trump Administration and Congressional leadership last month would not repeal the home mortgage interest deduction , other provisions in the proposal would make the deduction irrelevant for all but a small fraction of homeowners. Only 4 percent of households would claim the deduction, down from 21 percent under current law . The effective subsidy rate for those who still claim the MID would fall by nearly halffrom 22 percent to about 13 percent .

The proposal would reduce the net economic value of the MID in several ways. First, in 2018 it would increase the standard deduction from $6,500 to $12,000 for single filers and from $13,000 to $24,000 for married couples filing jointly. Any household with total itemized deductions below those new thresholds would benefit from taking the standard deduction.

Second, the proposal would eliminate all itemized deductions except for mortgage interest and charitable donations. If homeowners cannot deduct state and local income, sales, and property taxes, the remaining deductions will fall short of the standard deduction for all but the very wealthy and the very generous. As a result, we estimate that only 4.5 percent of households would itemize under the plancompared with 26.6 percent under current law .

Posts and comments are solely the opinion of the author and not that of the Tax Policy Center, Urban Institute, or Brookings Institution.

Should I Refinance Calculator

Use our refinance calculator to determine how much money you could save with a refinance loan from Cherry Creek Mortgage. Our tool will help you clarify the difference in your current and potential payments and see how much money you could be saving every month by refinancing now.

Using biweekly payments can accelerate your mortgage payoff and save you thousands in interest. Use this calculator to compare a typical monthly payment schedule to an accelerated biweekly payment.

Don’t Miss: What Does It Take To Become A Mortgage Broker

Mortgage Interest And The Standard Deduction

You cannot deduct mortgage interest in addition to taking the standard deduction. To take the mortgage interest deduction, youâll need to itemize. Itemizing only makes sense if your itemized deductions total more than the standard deduction, which is between $12,200 and $24,400 for the 2019 tax year, depending on your filing status.

Whatever tax savings you get from itemizing your mortgage interest are as a result of not only mortgage interest you pay, but also to your charitable donations, property taxes, mortgage insurance, state income tax or sales tax, and anything else you itemize.

What might your savings from itemizing look like under various scenarios? The savings vary a lot based on how much mortgage interest you pay and your filing status, as well as how much state tax you pay and how much your other itemized deductions add up to.

For example, if youâre married filing jointly and you have $19,000 in itemized deductions, including $5,000 of mortgage interest, youâre much better off taking the $24,400 standard deduction. In this case, if you itemize your mortgage interest deduction ends up being zero because it doesnât reach the standard deduction limit. Yet, you could be single with only $17,000 in itemized deductions, including $5,000 in mortgage interest, and save more than $1,000 by itemizing because the standard deduction for single filers is $12,200..

You Must Be The Obligor

The mortgage can’t be in someone else’s name unless it’s your spouse and youre filing a joint tax return. You’re entitled to deduct only the mortgage interest that you personally paid, regardless of who received the Form 1098 from the lender.

You must also have a contractual obligation to pay the loan back. Your home must act as security for the loan, and your mortgage documents must clearly state that.

Read Also: How Much Is A Mortgage On 1.4 Million

Do All Mortgages Qualify For This Tax Deduction

The home mortgage interest tax deduction comes with several qualifying rules.

This includes interest you paid on loans to buy a home, home equity lines of credit , and even construction loans. But the TCJA placed a significant restriction on home equity debt beginning with the 2018 tax year. You can’t claim the deduction for this type of loan unless you can prove that it was taken out to “buy, build, or substantially improve” the property that secures the loan. You cant claim the tax deduction if you refinance to pay for a college education or wedding, either.

The tax deduction is also limited to interest you paid on your main home or a second home. Interest paid on third or fourth homes isn’t deductible. The home can be a single-family dwelling, condo, mobile home, cooperative, or even a boatpretty much any property that has “sleeping, cooking, and toilet facilities,” according to the IRS.

How The Mortgage Interest Deduction Works

The name says it all: The mortgage interest deduction allows you to deduct only the interestânot the principalâyou pay on your mortgage.

Letâs say your monthly mortgage payment is $1,500. You donât get to deduct $1,500. Look at your mortgage statement and youâll see that perhaps $500 of your payment goes toward principal and $1,000 goes toward interest. The $1,000 is the part you can deduct.

The interest you pay decreases slightly each month, with more of your monthly payment going toward principal. So your total mortgage interest for the year isnât going to be $12,000 it might be more like $11,357 or $12,892.

In the later years of your mortgage, that same $1,500 payment may put $1,000 toward your principal and only $500 toward interest. The mortgage interest deduction saves you more in the early years.

You May Like: Who Is A Lender In Mortgage

How To Put The Money In Your Pocket

Okay, you probably think. Its great that I get this money back at the end of the year, but thats not helping me pay my mortgage right now.

Its time to grab your latest pay stubs and make friends with this helpful IRS withholding calculator. Youll input your income and withholding amounts, and be sure to add your estimated mortgage interest deduction.

The IRS will tell you how many exemptions to claim on your W-4. By increasing your exemptions, youll have less tax withheld, and more cash available to make your mortgage payments.

Do You Need To Make The Mortgage Interest Deduction Worth It

iQuanti: As tax season rolls around yet again, you may be thinking about ways to lower your taxable income and keep as much money as you can in your pocket. Tax deductions lower your overall taxable income and could end up moving you into a lower tax bracket. The most common deduction for homeowners is mortgage interest.

But how much do you need to pay your lender in a year to make the mortgage interest deduction worth it?

What are Tax Deductions?

There are two types of ways to take a tax deduction: standard and itemized. The standard deduction amount for the tax year 2021 is $12,550 for single filers, $25,100 for joint filers, and $18,800 for the head of household. The standard deduction simplifies the filing process as one lump sum is removed from taxable income.

Itemizing deductions involves tracking individual expenses throughout the year and totaling up eligible expenses to form the same lump sum, just with a bit more work. If you decide to itemize, you should anticipate the amount of your itemized deductions will be greater than the standard deduction amount for your filing status.

Common tax deductions if you itemize include:

Medical and dental expenses )

Student loan interest

Breaking Down the Mortgage Interest Deduction

So, lets talk about when taking the deduction is worth it.

As a single filer, youd need to have paid mortgage interest greater than the standard deduction of $12,550.

How to Claim the Mortgage Interest Deduction

Also Check: Is It Difficult To Refinance Your Mortgage