What Are Interest Rates Based On

Fixed mortgage interest rates operate in their own market. Theyre not directly tied to the Federal Reserves fed funds rate, although this benchmark rate can help influence the direction mortgage rates are headed. Other factors that influence mortgage rates include the health of the economy, the inflation rate, and how much demand lenders are seeing for home buying and refinancing. Only adjustable-rate mortgages are directly tied to market indices and therefore to the Feds benchmark rate.

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

Don’t Miss: What Does Buying Points On Mortgage Mean

Should You Refinance A 30

Refinancing is an option for people who have built up equity in their home by making consistent mortgage payments over the years. When you refinance your home loan, you’re taking out a new loan to replace your old mortgage at a better interest rate.

If you’ve only had your mortgage for a few years and have less than 20% equity in your home, the numbers may not work out in your favor. That’s because if your loan-to-value ratio is too high, you’ll only end up paying more interest over a longer period of time, defeating the purpose of refinancing to begin with.

Real Estate Deal Volume & Appreciation

- Fannie Mae anticipates home sales which were at 6 million units in both 2018 and 2019 will end 2020 with 6.2 million transactions and will see 6.1 million transactions in 2021.

- Real estate appreciation in the United States during 2018 and 2019 ran at 5.1% and 4.2%. In 2020 Fannie Mae anticipates home prices to increase 5.5% and increase a further 2.6% in 2022.

You May Like: What Is Refinancing Your Mortgage

The Surprise Mortgage Rate Drop

In 2018, many economists predicted that 2019 mortgage rates would top 5.5%. That turned out to be wrong.

In fact, rates dropped in 2019. The average mortgage rate went from 4.54% in 2018 to 3.94% in 2019.

- At 3.94% the monthly cost for a $200,000 home loan was $948

- Thats a savings of $520 a month or $6,240 a year when compared with the 8% longterm average

In 2019, it was thought mortgage rates couldnt go much lower. But 2020 and 2021 proved that thinking wrong again.

Current 30 Year Mortgage Refinance Rate Increases +018%

The average 30-year fixed-refinance rate is 5.59 percent, up 18 basis points compared with a week ago. A month ago, the average rate on a 30-year fixed refinance was higher, at 5.79 percent.

At the current average rate, youll pay $569.04 per month in principal and interest for every $100,000 you borrow. Thats $7.51 higher compared with last week.

Read Also: What Determines Your Mortgage Rate

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

5.311% APR

Compare current mortgage rates

» MORE: Estimate your monthly mortgage payment

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

You May Like: How Many Times Can I Apply For A Mortgage

How Do Mortgage Rates Work

The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control.

Lenders will have a base rate that takes the big stuff into account and gives them some profit. They adjust that base rate up or down for individual borrowers depending on perceived risk. If you seem like a safe bet to a lender, you’re more likely to be offered a lower interest rate.

Factors you can change:

-

Your . Mortgage lenders use credit scores to evaluate risk. Higher scores are seen as safer. In other words, the lender is more confident that you’ll successfully make your mortgage payments.

-

Your down payment. Paying a larger percentage of the home’s price upfront reduces the amount you’re borrowing and makes you seem less risky to lenders. You can calculate your loan-to-value ratio to check this out. A LTV of 80% or more is considered high.

-

Your loan type. The kind of loan you’re applying for can influence the mortgage rate you’re offered. For example, jumbo loans tend to have higher interest rates.

-

How you’re using the home. Mortgages for primary residences a place you’re actually going to live generally get lower interest rates than home loans for vacation properties, second homes or investment properties.

Forces you can’t control:

» MORE: What determines mortgage rates?

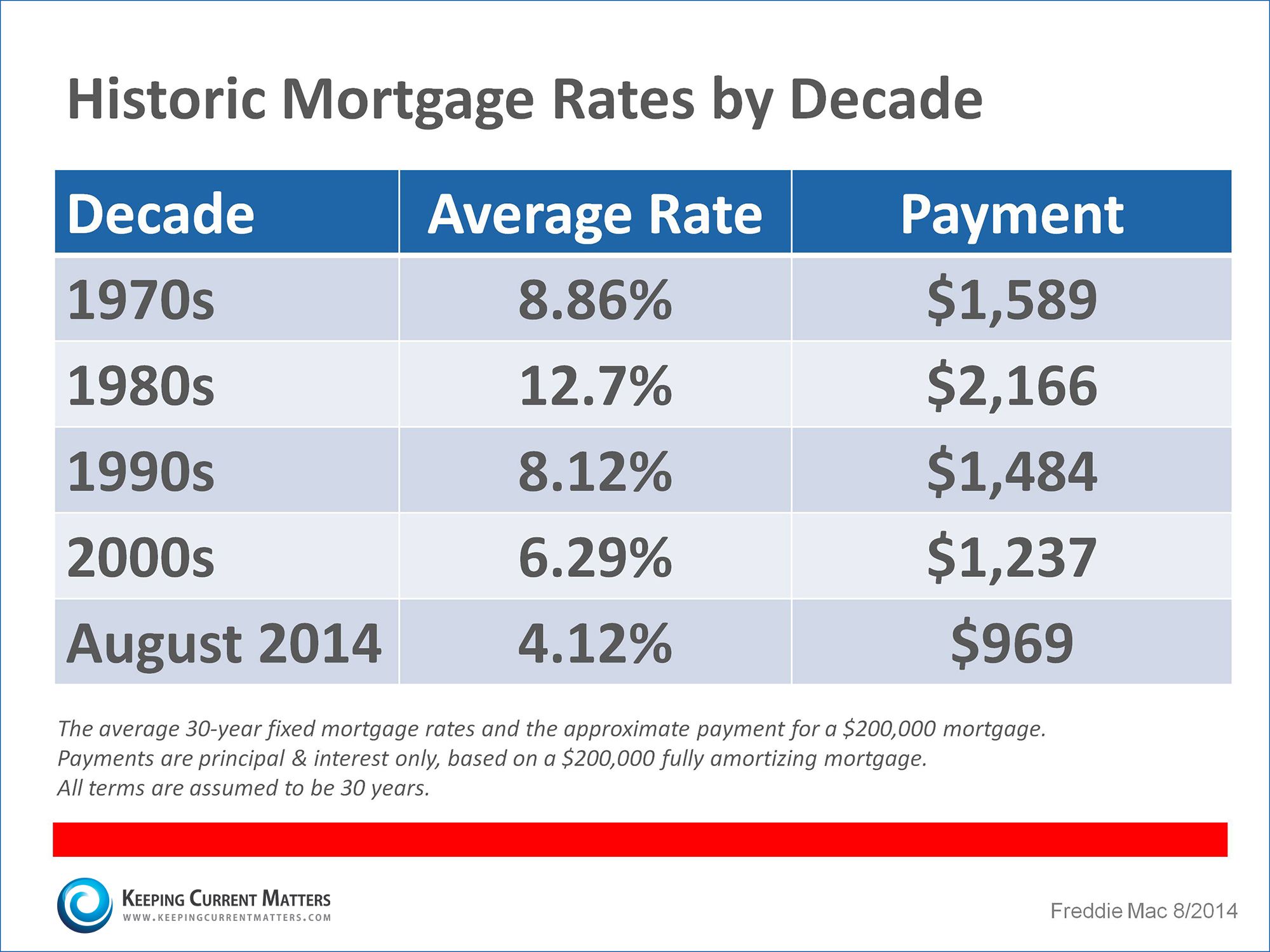

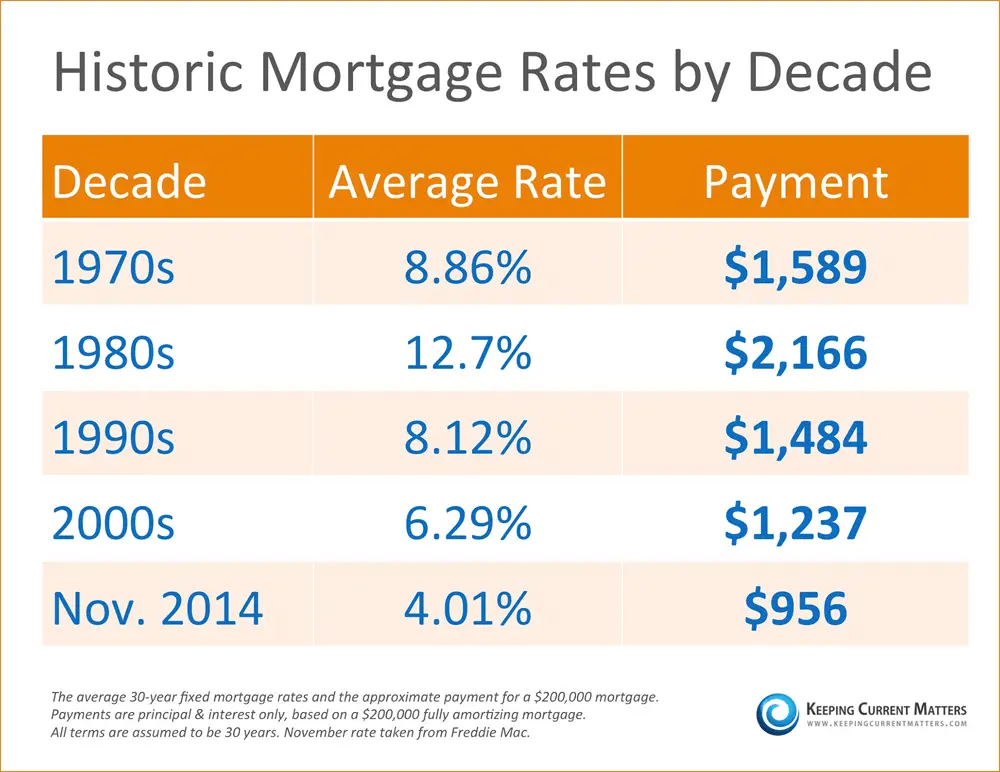

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Read Also: How To Determine Mortgage Pre Approval Amount

What Are The Advantages Of A 30

The biggest advantage to a 30-year mortgage is the ability to spread loan payments out over the maximum amount of time. That keeps the monthly payment much more affordable and makes homeownership accessible to more people.

Another advantage is that paying more in interest can help you make a bigger tax deduction, if you itemize your deductions.

See Other Mortgage Types

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic.png)

| Avg. Days on Market | Home Costs as % of Income |

|---|

Methodology A healthy housing market is both stable and affordable. Homeowners in a healthy market should be able to easily sell their homes, with a relatively low risk of losing money. In order to find the big cities with the healthiest housing markets, we considered the following factors: stability, affordability, fluidity and risk of loss. For the purpose of this study, we only considered U.S. cities with a population greater than 200,000.

We measured stability with two equally weighted indicators: the average number of years people own their homes and the percentage of homeowners with negative equity. To measure risk, we used the percentage of homes that decreased in value. To determine housing market fluidity, we looked at data on the average time a for-sale home in each area spent on the market – the longer homes take to sell, the less fluid the market. Finally, we calculated affordability by determining the monthly cost of owning a home as a percentage of household income in each city.

Affordability accounted for 40% of the healthiest markets index, while each of the other three factors accounted for 20%. When data on any of the above four factors was unavailable for cities, we excluded these from our final rankings of healthiest markets.

Read Also: How To Market Yourself As A Mortgage Loan Officer

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W-2 forms or pay stubs to prove a steady income. If youre self-employed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Tips To Get The Lowest Mortgage Rate

To get the best rate possible, it helps to get your finances ship-shape before applying for a mortgage.

For example, managing debts well and keeping your credit score up can help you qualify for a lower interest rate. As can savings for a bigger down payment.

Dont worry. Nobodys expecting miracles. But small improvements can make a worthwhile difference in the mortgage rate youre offered.

Here are some quick hits:

Few of us can afford to boost our savings and pay down our debts at the same time. So focus on areas where you think you can make the biggest difference. Youll see the biggest improvement in your credit scores by paying down high-interest, revolving credit accounts such as credit cards.

The other big way to lower your interest rate is by shopping around.

Mortgage lenders have flexibility with the rates they offer. Some will offer you lower rates than others because theyre more favorable toward your particular situation.

You May Like: Can I Get A Mortgage To Buy A Foreclosure

Mortgage Interest Rates Today For Aug 17 202: 30

Today, mortgage rates moved in opposite directions. If you’re in the market for a home loan, see how your future mortgage payments could be affected by interest rate hikes.

Today rates followed a split path. While 15-year fixed mortgage rates saw an increase along with 5/1 adjustable-rate mortgages, interest rates on 30-year fixed-rate mortgages sank a bit.

Though mortgage rates have been rather consistently going up since the start of this year, what happens next depends on whether inflation continues to climb or begins to retreat. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. Right now, they’re particularly sensitive to inflation and the prospect of a US recession. With so much uncertainty in the market, if you’re looking to buy a home, trying to time the market may not play to your favor. If inflation rises and rates climb, this could translate to higher interest rates and steeper monthly mortgage payments. For this reason, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Mortgage Interest Rates Forecast For August 2022

Rising inflation and the Federal Reserves moves are all putting pressure on mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

Experts are forecasting that the 30-year, fixed-rate mortgage will vary from just above 5% to as high as 7% by the end of 2022. Here are their more detailed predictions, as of late July 2022:

Also Check: What’s The Difference Between Quicken Loans And Rocket Mortgage

How To Compare 30

If you compare loan offers from mortgage lenders, youll have a better chance of securing a competitive rate. Heres how to compare:

Dos And Donts When Looking For A Mortgage

Homeownership is a big responsibility, and you will want to make sure you are prepared to take on such a large debt. While youre filling out the columns, consider these recommendations.

Dos When Looking for a Mortgage:

- Start by calculating how much you can afford each month.

- Consider how long you plan to stay in the house. You might have a job that requires you to move frequently.

- Do you plan to start a family? You should anticipate how much space youll need.

- Is the house near good schools?

- Can you reasonably expect the house to improve in value?

Donts When Looking for a Mortgage:

- Dont borrow your limit on a 30-year mortgage. You might love the backyard or the walk-in closet, but that money could be used elsewhere. Youll need to build an emergency fund should something bad happen. If the refrigerator breaks or you need to repair the roof, you need to have cash on hand to handle these kinds of problems. You should also have money to set aside for retirement savings.

- Dont put less than 20% down. Otherwise, youll need private mortgage insurance to protect the lender in a foreclosure. Plus, a 20% down payment keeps your monthly payments affordable.

The word mortgage literally translates to death pledge. Seems like a rather ominous word to associate with something youll live in, but no, that isnt referring to mortgages as a suicide mission.

About The Author

Read Also: What Is Needed For Mortgage Approval

Historic Mortgage Rates: Important Years For Rates

The longterm average for mortgage rates is just under 8 percent. Thats according to Freddie Mac records going back to 1971.

But mortgage rates can move a lot from year to year even from day to day. And some years have seen much bigger moves than others.

Lets look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways.

How Much Is A 30

The 30-year fixed-rate mortgage calculator estimates your monthly payment as well as the loans total cost over the term. With a home price of $400,000, an $80,000 down payment and a 4% interest rate, the monthly mortgage payment would be $1,528, excluding other costs, such as property tax, home insurance and homeowner association dues.

Also Check: What Mortgage Loan Do I Qualify For

Summary Of Current Mortgage Rates

Average mortgage rates are lower this week

- The current rate for a 30-year fixed-rate mortgage is 4.99% with 0.8 points paid, down 0.31 percentage points from a week ago. The 30-year rate averaged 2.77% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 4.26% with 0.6 points paid, a decrease of 0.32% percentage points week-over-week. A year ago, the 15-year rate averaged 2.10%.

- The current rate on a 5/1 adjustable-rate mortgage is 4.25% with 0.3 points paid, 0.04 percentage points higher/lower compared to last week. The average rate on a 5/1 ARM was 2.4% a year ago.

- Categories