What Fees Can My Lender Charge Me

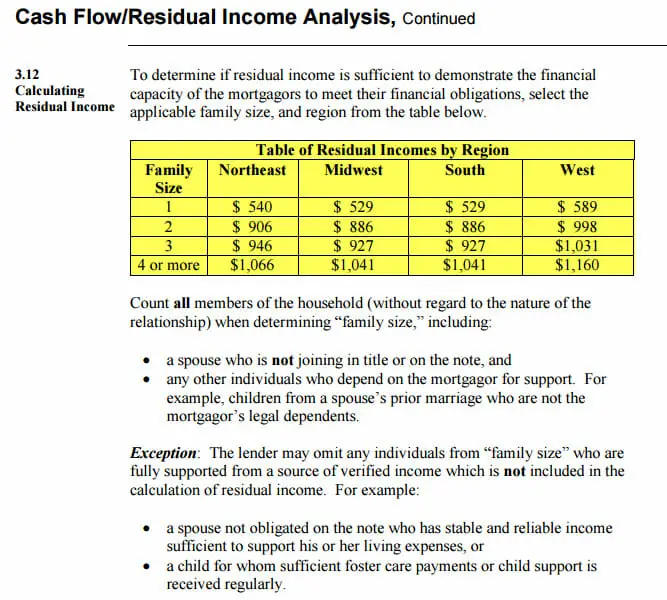

With respect to reverse mortgages under New Yorks Real Property Law sections 280, or 280-a, lenders may only charge those fees authorized by the Department in Part 79.8. All costs and fees must be fully disclosed and reasonably related to the services provided to or performed on behalf of the consumer. Specifically, a lender may charge the following fees, among others, in association with a reverse mortgage loan:

- An application fee

Availability: 19 States And Dc With More To Come

The lower minimum age requirement applies to 19 states and the District of Columbia, according to RMF. Those states are: Arizona California Colorado Connecticut Florida Georgia Hawaii Illinois Michigan Montana New Jersey New Mexico Nevada Ohio Oregon Pennsylvania Rhode Island South Carolina and Virginia.

RMF plans on rolling out the new minimum age requirement to other states in the future, but certain legislative and/or regulatory restrictions need to be properly taken into account before they decide to offer additional details, DeMarkey says.

Its sort of premature to talk about any other specific states that were going to be launching in, he says. I will say, generally, were going to continue to launch in more states in the weeks and months ahead. And if they dont have any age restrictions, then were going to be launching in those states with a minimum age of 55, as well.

According to initial outreach conducted by RMD, at least one reverse mortgage professional John Luddy of Norcom Mortgage in Avon, Ct. has already identified at least one couple who can benefit from this new minimum age requirement. Though the borrower himself was over 60 and already in discussions for an Equity Elite loan, his wife was not quite yet that old and wouldve had to be listed as a non-borrowing spouse on the loan. That is no longer the case once this age requirement is implemented, Luddy said.

I Have A Reverse Mortgage And I No Longer Wish To Live In My Home What Should I Do

Living in the mortgaged property as your primary residence is a condition of any reverse mortgage loan. If you no longer wish to live in your home or doing so is no longer possible, you should speak to your lender/servicer as soon as possible to discuss your options. You should also speak to an attorney or housing counselor. To locate a free housing counselor in your area, please visit the Departments website.

You May Like: Does Rocket Mortgage Do Manufactured Homes

Do I Have To Complete In

The answer depends on the type of reverse mortgage loan for which you are applying. In New York, in order to get a proprietary reverse mortgage loan , the borrower must either complete in-person counseling or waive such requirement in writing. In order to get a HECM reverse mortgage loan , a borrower may not waive the counseling requirements but he or she may opt to complete the required counseling either in person or over the telephone. You can find a list of non-profit housing counselors on the Departments website.

Funding Your Retirement And Living The Goodlife

Retirement funding is one of the most important aspects of financial planning. This is even more important for those with little or no retirement savings, who account for nearly half of Americans over the age of 55, according to AARP.

A reverse mortgage can help. At GoodLife, our reverse mortgage application process is fast. It requires just four simple steps to complete. We help you get the funding you need quickly and efficiently, so you can focus on what matters most: enjoying your retirement. By tapping into your home equity and using it to power your retirement, you can add a critical line of cash flow to your retirement portfolio. To find out how much you may be eligible to receive in reverse mortgage proceeds, try out our free calculator or speak with a GoodLife Reverse Mortgage Specialist to learn more about funding your retirement.

Recommended Reading: How To Calculate Mortgage Down Payment

How Does A Reverse Mortgage Work

A reverse mortgage has very different moving parts compared to a regular mortgage. With a reverse mortgage:

Your age is the most important factor in how much you qualify for. The minimum age may be 62 for a reverse mortgage, but older borrowers have more reverse mortgage borrowing power. Theres a catch for married couples: Lenders consider the youngest borrowers age for the maximum loan amount.

You must have at least 50% equity in most cases. Lenders want to ensure you dont end up owing more than your home is worth, so they set a much higher initial equity requirement than regular mortgage programs. A home appraisal is always required as part of the reverse mortgage process to get an unbiased opinion of your homes value from a licensed real estate appraiser.

You dont have to meet any debt-to-income ratio requirements. No mortgage payment means no DTI ratio requirements, which are a major factor in qualifying for a regular mortgage. However, you will have to prove you have the resources to pay ongoing homeownership costs like homeowners insurance, property taxes and maintenance costs.

Your interest rate will have an impact on how much you qualify for. Because interest charges are added to your loan every month, the lower the interest rate, the more youll be able to borrow.

You have more choices for how you can convert your equity into cash. Instead of making payments each month, you can choose from one or a combination of the following six ways to tap your equity:

Cost Of A Reverse Mortgage

A reverse mortgage is not free money interest and fees will be added to your mortgage balance each month. That means the amount you owe on your mortgage will go up when signing on for this type of loan.

In addition, the borrower is still required to pay property taxes and homeowners insurance.

The major benefit of a reverse mortgage is the cash flow benefit of eliminating the monthly mortgage payment, as well as accessing equity in the form of a line of credit or lump sum payment, says David Reyes, financial advisor with Reyes Financial Architecture. Many financial experts suggest treating reverse mortgages as a last resort, since it often doesnt make financial sense to sacrifice home equity for income.

Overall, a reverse mortgage should be considered as part of a retirement plan for seniors, says Reyes. In some cases, the senior may only eliminate their monthly mortgage payments. In other cases, depending on their equity, they may eliminate their monthly mortgage payment and get access considerable amount of cash. In other situations, with a home thats free and clear, the homeowner or senior can have access to a large line of credit that can be tapped into when the need arises.

Also Check: Is Total Mortgage A Good Company

What Can You Do If You Don’t Qualify For A Reverse Mortgage

While the majority of applications for a reverse mortgage are approved, there are still some that get denied. If you find yourself in this situation, you shouldn’t worry too much. There are other things you can do to get the cash you need without having to qualify for a reverse mortgage.

Sell and Downsize

Assuming that you and your spouse are the only ones living in your home, then it might be a good idea to sell and downsize. This way you can have the cash you need without having to qualify for a reverse mortgage. Not to mention, you can also save on costs such as insurance, property taxes, and utilities.

Sell Your House to Your Family

Whether it’s a son, daughter, grandkids, or any other family member that’s interested in buying your home, try to work out a deal with them so that they can buy your home from you. This way, you can keep your home in the family while also getting the cash you need. You can also rent the house to your family if they’re not interested in buying it outright.

Reverse Mortgage Pros And Cons

Pros:

- There is no monthly payment required for as long as you live .

- While there are no required monthly payments, you can ELECT to make payments. You can pay as often or as infrequently you as you desire. This loan is all about financial freedom for homeowners aged either 55 plus or 62 plus depending on the program.

- You still retain ownership of your home.

- Since you still own your house, you can still leave the home to your heirs.

- You have many choices in terms of how you receive your loan proceeds. For example, you can get monthly payments for life, higher monthly payments for a set term, a lump sum, line of credit, or a combination all the above.

- Since the funds you receive are not income , the money is tax free.

- You have the ability to choose how you use your money. The bank does not dictate how you use the funds from a reverse mortgage. The only exception is if you dont pass the financial assessment. In that case, some of the money needs to be set aside for a tax and insurance escrow account.

- Youll be able to better manage expenses during your retirement. Often times, retirees experience a reduction in income. The ability to eliminate your mortgage payment and / or have access to extra funds during retirement can be largely beneficial.

- You can age in place and stay in your home which youll still own.

- This doesnt impact your social security income.

Cons:

Don’t Miss: Is Nationwide A Good Mortgage Lender

What Is Private Mortgage Insurance And How Will It Affect My Reverse Mortgage

Private mortgage insurance or PMI is an insurance policy taken out and paid for by a borrower for the benefit of the lender. Whether the reverse mortgage loan is made in accordance with the HECM program or New York Real Property Section 280 or 280-a , it is likely that an additional monthly amount will be added to the balance of your reverse mortgage to cover the cost of the PMI. It is important that you discuss the financial impact of PMI with your lender and a housing counselor or attorney before getting a reverse mortgage.

Now A Younger Spouse Can Be Listed As A Nonborrowing Spouse

In 2013, a federal court ruled that the HUD regulation that allows lenders to demand that surviving spouses immediately repay reverse mortgage loans upon the death of their spouses violates federal law. Under revised HUD guidelines:

- For loans issued on or after August 4, 2014, the nonborrowing spouse may remain in the home after the borrower dies, and the loan repayment will be deferred, if specific criteria are met.

- For HECMs taken out before August 4, 2014, the lender can choose to assign the mortgage to HUD and the nonborrower spouse can remain in the home so long as specific criteria are met.

If you’re thinking about taking out a reverse mortgage with a nonborrowing spouse, be very careful and be sure to talk to a lawyer or HUD-approved housing counselor to learn how to protect the nonborrowing spouse in this situation adequately.

You May Like: How Much Net Income Should Go To Mortgage

Can You Qualify For Reverse Mortgage At Age Of 55

No, the minimum age to be eligible for a standard reverse mortgage is 62.A recent development in reverse mortgage on 9/1/21 has now started offering proprietary reverse mortgage programs to people 55 and older. today to learn more!

A reverse mortgage does not have any defined end date. Instead, this typically ends either when the homeowner passes away or permanently moves out of the house. Therefore, if reverse mortgages offer to homeowners who are, say, 55 years old, the loan on lenders books can last for 40 or 50 years or more.Further, the loan amount typically depends on the age, the older you are, the more loan amount you may receive. If you are younger than age 55, the payments or credit line will be set at a much lower amount. So, for these reasons there is no reverse mortgage for age 55, you can get it only when you turn 55 or older.Another reason for the minimum age of 55 is that reverse mortgages are there to help retirees who have little money but significant equity in their homes. Reverse mortgage loan helps these retirees turn their home equity into cash without any burden of the monthly loan payments. Instead, the lender pays you a monthly amount until you live in our house or alive.

Reverse Mortgage Spousal Requirements

Spouses may sign into the HECM loan as borrowers if they are over the age of 62. Borrowers under the age of 62 may file as a non-borrowing spouse, which permits them certain privileges and rights over the property, even if they are not a co-borrower.

In the past, if a partner under the age of 62 was identified on the title of the property, that persons name had to be omitted in order for the qualifying borrower to obtain a reverse mortgage loan. However, in their 2017 amendment to the rules, the HUD made changes to the HECM program that overturned this provision. Even if they do not apply for the loan, HUD now allows non-borrowing spouses to stay on the title. This eliminates the requirement that non-qualified partners be excluded from the title before a couple can apply for an HECM.

If the borrowing mortgagee passes away while the loan is still active, qualified non-borrowing spouses listed on the reverse mortgage loan file will be allowed to stay in the home. However, they must meet HUD conditions and confirm annually that they are the late mortgagees non-borrowing spouse, and are still occupying the home.

You May Like: What Are The Interest Rates On A Mortgage

How The Money Is Paid Out

The loan amount available through a reverse mortgage depends on the age of the borrower , as well as the homes appraised value, current interest rates, and in the case of the HECM program, the FHA lending limit of $970,800in 2022. Theres a variety of choices when it comes to how borrowers receive payments from a HECM reverse mortgage. Options include:

Age Requirements For A Reverse Mortgage

A reverse mortgage may be a great way for homeowners to access the equity theyve built up in their home over the years. One of the main factors that goes into determining eligibility and how much money you can receive is age.

Home Equity Conversion Mortgage

A Home Equity Conversion Mortgage , commonly known as a reverse mortgage, is a Federal Housing Administration insured loan. A reverse mortgage enables borrowers to pay off their current mortgage loan which eliminates their monthly mortgage payments and can provide additional cash flow.1 The loan typically becomes due when the last surviving borrower dies, sells the home, or permanently moves out.

To be eligible, homeowners must be 62 years of age or older.

Non-Borrowing Spouse

For HECM loans that are insured by the FHA, an individual who is married to a reverse mortgage applicant and is living in the home as their primary residence is known as an eligible non-borrowing spouse. Upon passing of the last remaining borrower, an eligible non-borrowing spouse may be able to have the repayment of the reverse mortgage deferred if certain requirements are met.2

A spouse can be an eligible non-borrowing spouse by choice or due to being under the age of 62.

Depending on the state, the minimum age requirement can be as low as 60 years of age. Please reach out to a direct-lender to review requirements.

- Age of the youngest borrower

- Current interest rates

Disclosures:

Also Check: Is Fairway Mortgage A Broker

How To Spot A Reverse Mortgage Scam

Below are some tips to avoid becoming a victim of reverse mortgage scams:

- Dont reply to unsolicited reverse mortgage offers by email or over the phone.

- Never give out confidential personal information over the phone or by email.

- Contact a HUD-approved counselor if youre not sure an offer is legitimate.

- Dont sign anything you dont understand.

Reverse Mortgage Options For Younger Spouses

Many homeowners want to know, what are the options for couples when one spouse is younger than 62? When facing financial hardship, it is tough to simply hear that you dont qualify for the reverse mortgage. It may be helpful to discuss the options with a financial planner specializing in planning for retirement and working with aging clients and/or with a HUD approved reverse mortgage counselor.

Take Cash Out With a Traditional Refinance

Homeowners who are too young to qualify for a reverse mortgage may find they can be approved for a traditional refinance. Though there is no minimum age requirement, qualification will be based on other criteria such as credit history and income requirements. Social security, IRA or pension distributions, and other retirement income can often be used to qualify for a traditional mortgage, though it must be documented, and sufficient to show that the borrowers will be able to repay the loan as agreed.

A cash out refinance can be used to access some of the equity in the home in a lump sum. Unlike with a reverse mortgage, with a traditional refinance monthly payments will be required soon after closing and for the duration of the loan term. It can take careful planning to ensure that the sum borrowed is enough to make these monthly payments as well as help cover day to day expenses until the homeowners are no longer living, or are ready to sell the property.

Alpha Mortgage does offer traditional refinancing solutions as well.

Take Out a HELOC

Read Also: Who Does 100 Percent Mortgages