Does This Method Work

Some credit card issuers also report the nature of your relationship to the primary account holder to the credit bureaus. Lenders may take this relationship into consideration when youre applying for credit.

Buying tradelines doesnt always work. Lenders and credit reporting agencies view this practice as deceptive, so theyve reworked the scoring model to try to reduce the impact of bought tradelines. If youre still interested in buying a tradeline as a last resort, do your due diligence. Companies that sell tradelines may try to scam customers. The benefits of buying tradelines are temporary and unreliable.

Rather than going through a company and paying hundreds of dollars for a tradeline, you can ask a relative or friend to make you an authorized user on one of their accounts. That would be more likely to have a positive effect on your credit score, and it wouldnt cost you any money.

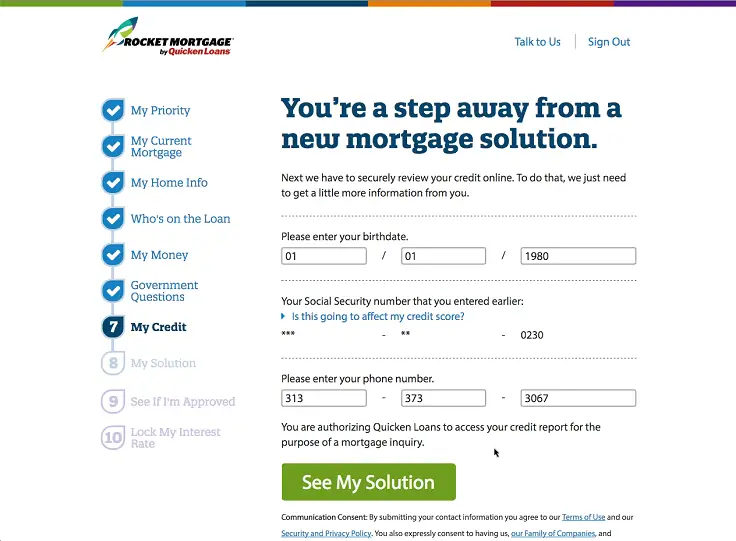

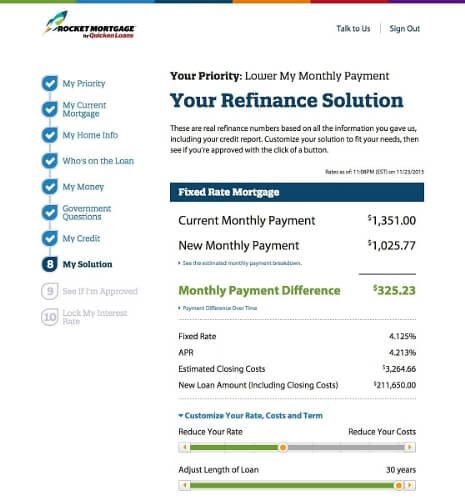

What Does Rocket Mortgage Do

Rocket Mortgage is a company that deals in mortgages and finances. A large, widely known mortgage lender in the U.S, Rocket Mortgage provides mortgage loan services to individuals.

Rocket Mortgage collects information about people, their finances, their homes, and finance reports. These are used to give the borrowers a range of available loans and interest rates. It is the responsibility of Rocket Mortgage to put the borrowers through the mortgage process from the start to the finish point. They also assist in payment management.

Rocket Mortgage are mortgage lenders that render reliable and quick online service to their service customers.

Rocket Mortgage offers various loan options for buying homes and refinancing.

What Credit Score Do I Need To Get Approved

You can get approved with a , as long as you meet our other eligibility criteria. Check your credit score through our sister company, Rocket Homes®.

Keep in mind that the score we use might be slightly different from the one you get from your credit card company or other source. We use a FICO® Score, but educational sources might use a different credit scoring model, such as a VantageScore.

We still encourage you to apply even if you think your score is slightly below 580. Our free Fresh Start program can help you boost your credit just call 769-6133.

Read Also: Is The Mortgage Industry Slowing Down

Reducing Credit Report Errors In The Future

Lets face it. Dealing with credit report errors isnt fun. Its something pretty much everyone would like to avoid if possible.

In this digital age of data breaches and stolen information, its important for all of us to play defense when it comes to our financial lives. Staying on top of our important personal data and disputing errors right when we see them will help us save money and reduce our overall financial stress.

Everyones situation is different. Be sure to speak with a financial expert or advisor before making any major financial decisions.

How Can I Have More Than One Credit Score

Because there are many different credit scoring models, its possible to have more than one credit score. Theres a chance that one credit bureau may have more information on your credit report than another, or maybe your lender doesnt report to all three credit bureaus.

You could also have varying credit scores depending on what type of lender you are working with. A mortgage lender will use a different scoring model than an auto lender.

Bottom line dont worry if you have more than one credit score because its very common! Its okay to have more than one as long as they arent significantly different. If you do spot an inaccuracy or see something incorrect, request a dispute from the credit bureau within 30 days of receiving your credit report.

Don’t Miss: What Are Current Mortgage Rates In Oregon

Tips For Building And Maintaining Good Credit

It can take a while to build up to an excellent score, especially when it comes to the length of credit history aspect. That means even though you may have established your credit history, building strong financial habits is what will increase or maintain your credit score. To get started out on the right foot, here are some responsible credit-building tips and strategies you may want to keep in mind.

What Are The Three Major Credit Bureaus

There are three credit bureaus that collect, analyze and report information on your credit report. These bureaus are Equifax, Experian and TransUnion.

The credit bureaus are responsible for collecting information from your creditors, such as credit card companies, mortgage lenders and banks. They then report this info on your credit report. The information provided in your credit report helps determine your and helps lenders decide if they will approve you for a loan.

Your credit score is the number lenders look at when determining if you are a good credit risk. Credit scores range from 300 850. The higher your credit score, the easier it is to get approved for loans. Consumers should aim for a 670 score or higher to have good credit for the best chances of securing reasonable rates and terms.

Also Check: How Much Is Mortgage Payment On 95000 House

How Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Transunion

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge. There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

What Are The Requirements For Getting A Loan With Rocket Mortgage

We look for certain things when we evaluate a loan application. While the approval process is unique to each person, here are some general guidelines.

Ideally, your monthly expenses shouldnt be more than 45% of what you earn each month. For a better understanding, read Debt-To-Income Ratio : What Is It And How Is It Calculated?

When you purchase or refinance a home, we need to trace your assets. We also like to see a two-year work history with proof of current, stable income.

There are certain circumstances in which a credit score of 580 is enough, but typically you need a credit score of 620. Check your credit score through our sister company, Rocket Homes®. Our free Fresh Start program can help you boost your credit just call 769-6133.

Whether youre purchasing or refinancing, youll typically need an appraisal. We work with an independent, third-party appraisal management company to order the appraisal for you.

Recommended Reading: How To Understand Mortgage Payments

What Are The Three Credit Bureaus

Your credit reporting information determines if you can obtain a loan, get insurance and hook up utilities without a down payment. Sometimes it even affects your ability to secure certain jobs.

Three credit bureaus report information about you, and they can hold a lot of control over your financial life. So, what are the three credit bureaus, and what do they report about you?

Youll learn everything you need to know about the credit bureaus and how you can ensure they have the correct information about your financial life below.

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2

- FICO® Score 5

- FICO® Score 4

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

Read Also: What Is The Interest Rate To Refinance A Mortgage

How Do I Raise My Score

There are several ways you can improve your credit score including:

Is Upstart Right For You

2 As of December 31, 2021, and based on a comparison between the Upstart model and a traditional credit-score only model. The APR calculation compares the two models based on the average APR offered to borrowers up to the same approval rate. The hypothetical credit-score only model used in Upstart’s analysis was developed in connection with the CFPB No Action Letter access-to-credit testing program and was built from a traditional credit score only model trained on Upstart platform data. APR for the scorecard was averaged for each given traditional credit score grouping.

3 Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

4 The majority of borrowers on the Upstart platform are able to complete the application process automatically without providing additional supporting documents, however final approval is conditioned upon passing the hard credit inquiry. Loan processing may be subject to longer wait times if additional documentation is required for review.

5 If you accept your loan by 5pm EST , your funds will be sent on the next business day. Loans used to fund education related expenses are subject to a 3 business day wait period between loan acceptance and funding in accordance with federal law.

Images are not actual customers, but their stories are real.

You May Like: When You Sign A Mortgage You Are

What Does My Credit Score Need To Be For A Mortgage

The minimum credit score required to get a mortgage varies by loan type:

| Type of Loan | |

| 700-740 | 10-20% |

1With a credit score between 500-579 you may still qualify for an FHA loan if you can put at least 10% down.

2No minimum credit score established by either the USDA or VA, but lenders are allowed to set their own requirements.

If youre a first-time home buyer, you may be surprised you could get approved for a mortgage loan with a credit score below 600.

But the score you see in a credit monitoring app, or in your credit card statement, wont necessarily be the score your lender sees when it pulls your credit.

The score your lender sees will likely be lower. So if your credit is borderline, youll want to understand how lenders evaluate your credit score and credit history before moving forward with a loan application.

Report Your Current Bills

If you already make on-time payments for your regular bills, then finding a way to report those can be a good option. For example, your rent, utility, and cell phone bills could provide an outstanding record of on-time payments.

Check into services like Rental Kharma and RentTrack to see if it is worth it to put these bills on your credit report. It could help to accelerate your progress toward an excellent credit score.

You May Like: How To Calculate Your Mortgage

What Is A Tradeline On A Credit Report

Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. She is the founder of Wealth Women Daily and an author.

A tradeline is the credit industrys term for an account on a credit report. Credit card accounts, personal loans, and mortgages are all examples of a tradeline that would appear on a credit report.

Why Do Credit Scores Differ

You might find that you have different credit scores depending on who you talk to or where you get your credit score. This is because there are numerous credit scoring models and even industry-specific credit scores that certain businesses prefer to use.

Along with different credit scoring models, each model has various versions. For example, FICO and VantageScore are two of the most popular credit scoring models, but even within those two, there are 16 different FICO versions and 4 VantageScore versions.

You might even find you have different credit scores between the credit bureaus. This is because they each weigh information slightly differently, and not all creditors report to all three bureaus. You might have a car payment at a bank that only reports to TransUnion, for example.

Some lenders also use industry-specific credit scores, such as the auto industry. If they only care about certain factors, they may prefer to use an industry-specific credit score versus the overall credit score.

You May Like: What Income Can Be Used To Qualify For A Mortgage

How Your Fico Score Is Calculated

FICO® is a California-based company that tabulates the namesake consumer credit score using five key pieces of credit data to determine your score. The factors that affect the outcome of your score include your payment history, the amount owed on existing accounts, the length of your credit history, any new credit accounts and the types of credit in the mix.

How Does My Credit Affect My Ability To Get A Mortgage

Your credit score is one of the many factors that determine if you qualify to get a mortgage and at what interest rates. Lenders look at your credit score, income, debt levels and several other factors when theyre deciding if they will lend you money.

Its important to understand your credit score and the factors that influence it as you start searching for a home. This will help you understand what you might qualify for and give you time to improve your credit before applying for a mortgage if you need to.

Read Also: What Documents Do Mortgage Lenders Require

How Are Credit Scores Calculated

Your credit score is calculated using scoring models that gather information based on your credit reports which are generated by the three main credit bureaus . Two of the most common credit scoring models are VantageScore 3.0® and FICO®.

Your credit score is based off many factors including payment history and the number of accounts you have open. It will never be based off personal information such as race, gender or religion.

Typically, credit scores range from 300-850.

Contact Your Mortgage Lender And Ask If They Report To Experian

If your mortgage account does not appear on your credit report, the first thing you should do is contact your mortgage company and ask them if they report to Experian. If your lender confirms that they do report to Experian, you can request that they contact their Experian representative for help in determining why the account is not appearing in your report. Ask them to review the identifying information on the account to ensure that the account is being reported under the correct name and Social Security number.

You also can contact Experian and explain the situation so that it can be researched. You can reach Experian by phone at , or by mail at:

Experian P.O. Box 9701 Allen, TX 75013

Simply explain that you have an account that’s not appearing on your report and that the lender has verified it is in fact being reported. Be sure to include your complete identification number, including your Social Security number, so that Experian can locate your credit information.

Unfortunately, if your lender does not report, you won’t be able to have your account added. When you apply for credit in the future, ask the lender if they report account history to one or more of the national credit reporting companies. If they don’t, you might consider applying elsewhere to ensure your positive account payments help you build a strong credit history.

Also Check: What Is Mortgage Debt To Income Ratio

What Happens When The Forbearance Is Over

When your forbearance is ending or you’re ready to resume payments, you can check in online on Rocket Mortgage®. Were here to help figure out how to bring your loan current. Here are some options you might have: