Pros Of Discount Points

- Lower interest rate Credit score aside, buying points is a way to ensure that youre given a great interest rate. That decision can save you a lot of money on interest costs over the life of the loan.

- Lower monthly payment Your interest rate helps determine your monthly payment. The lower your rate, the lower your monthly payment.

- Tax deductible If you itemize deductions on your tax return and meet all other requirements for taking a mortgage interest deduction, you may be able to write off money you spend on discount points.

Mortgage Q& a With Our Mortgage Officers

We asked our Facebook fans for their mortgage-related questions for our experienced local mortgage loan officers.

Are mortgage interest rates negotiable?

Ruby Manihani

How do I lock in a good rate?

Laura Kemnitz

What is the difference between a fixed-rate and an adjustable-rate mortgage?

Jeri Maher

When should you refinance to a lower rate? If we save just 1\2 percent is it worth it?

Berta Williams, Advantis Mortgage Loan Officer, Fremont Branch, Visit Bertas website

What are the benefits of a shorter term loan compared to a 30-year term?

Berta Williams

What is private mortgage insurance, and do I need it?

Verenice Leon

What are mortgage points?

Ruby Manihani

What are closing costs, and how do I know how much they’ll be?

Laura Kemnitz

How much will my credit score affect my interest rate?

Jeri Maher

Give Yourself Extra Time

Negotiating with lenders and sellers takes time. Consider taking a vacation day to spend extra time on negotiations. If you cant take time off from work to negotiate, be sure to give yourself extra leeway between your offer and your targeted closing date. The extra long window of time will ensure that you have ample time to negotiate with lenders before you finalize the loan details.

Read Also: Mortgage Recast Calculator Chase

Scrutinize Your Closing Cost Statement

Closing costs are what you pay the lender to process the transaction. They include loan origination fees, appraisal fees, title insurance, taxes, and other costs. The total can be hefty, usually about 3% to 4% of the whole loan amount. Sometimes, however, you can negotiate them.

Parker suggests first asking your lender for an estimate of closing costs. Since they vary from bank to bank, make sure to itemize those fees so you know exactly what costs to expect at closing, he says.

Even before you apply for a loan, request an estimate. This will give you a general idea of what the lender might charge.

When shopping around with multiple lenders, ask for specifics regarding interest rates and closing costs, Parker says. Having all rates and fees itemized will strengthen your position in the homebuying process.

Find a better deal on closing costs elsewhere? Simply ask your loan officer to lower or waive some of these fees. Loan origination or application fees and title insurance are most likely negotiable. Others, like property taxes and credit check costs, are less likely to be changed, according to Rocket Mortgage.

When negotiating, dont be afraid to be direct.

A consumer shouldnt be scared of hurting someones feelings, Heck says. Its a huge financial transaction. Ask the questions you need to: Is this my best option?Do you have any other programs or deals that you think might be better?

Consider Total Loan Costs

While the interest rate youre given is important, it isnt the only thing to consider when trying to save money on your mortgage. You also have to consider the total loan costs, including any fees associated with closing on your home loan. While youll pay many of those fees upfront when you close on your new home, others can be rolled into your loan amount, which can raise your monthly payment and increase the amount you pay overall.

That said, some of these fees, particularly any administrative fees charged by the lender, may be negotiable. For example, you may be able to get the lender to waive its application fees or reduce its loan origination fee. But other fees arent up for discussion. An appraisal fee, for example, is often set by the appraisal company itself rather than the lender, and often cant be negotiated.

You May Like: Monthly Mortgage On 1 Million

Make A Larger Down Payment

Simply put, the more money you put down towards your mortgage, the less you will owe on the loan. If you can make a larger down payment, you could have more equity in your home from the start. Not only will you need to repay less principal , you’ll also pay less interest over the life of the loan since it is calculated on the principal owed.

While some loans have low down payment options, the ability to pay more can reduce mortgage rates and monthly payments. The smaller the down payment, the riskier lenders view your loan, and the higher the interest rate you may have to pay.

After You Get A Loan Estimate

When you have an accepted offer on a home, youll want to get loan estimates from a few lenders. Once you have a written loan estimate, negotiations can start in earnest. Talk to loan officers from multiple banks and ask whether they have room to reduce or eliminate certain fees.

Tell the loan officers about offers from other lenders. Negotiating the best deal may take a few hours or even a few days, especially if you have two or more lenders competing for your business. However, the discussions you have with your loan officers could save you some serious cash when it comes time to close.

Once youre certain you have the best deal, let the lender know that youre ready to move forward with them. Normally, the loan officer will let you lock in a rate at that point. Once your rate is locked in, you wont have much room for negotiation after that aside from a few small fees such as attorneys fees at closing.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Negotiate Up Front With Lenders

One of the easiest ways to cut your closing costs is to consider them up front as youre shopping around for a mortgage lender. Most homeowners know to talk to a few mortgage brokers to get the best interest rate on their loan, but then fail to apply the same tactic when it comes to closing costs. One lender may charge more in closing fees than another one down the street. Armed with that information, you can approach your preferred lender to see if it will give you a break.

The mortgage industry is competitive, and many lenders do have wiggle room in terms of the fees that they pass on to you. Be wary, though, if a lender offers you a credit toward closing costs. The tradeoff often is a higher interest rate over the life of the loan.

Break Down Your Loan Estimate Form

The lender is required to give you theloan estimate form within three days of completing a mortgage application, but theres nothing keeping them from giving it to you sooner, so ask for it. This form includes an itemized list of costs, including your loan amount, interest rate and monthly payments. On page two it has a section called Services you can shop for, including:

- Pest inspection

- Survey

- Fees for the title search and the settlement agent, and for the insurance binder

The vendors listed on the form could be your lenders preferred vendors, but youre not required to work with them, and your lender is also required to offer alternatives. You can shop around for lower-priced vendors for different services on your own however, if your independently-selected vendor changes its pricing before closing, youll be on the hook for any increase. If you choose a lender-provided vendor instead, its pricing isnt allowed to change by more than 10 percent from the original quote.

Additionally, if youre buying a home, note that the seller or sellers real estate agent might be the ones who chose the title and escrow provider. If you want to get new vendors in this case, youll need to negotiate the purchase agreement with the seller, not with your mortgage lender.

Recommended Reading: Reverse Mortgage For Condominiums

Factors That Determine Your Mortgage Rate

Mortgage rates are primarily driven by whats going on in the bond market and mortgage-backed securities, but then vary based on a number of additional factors. When you request a quote, the lender calculates a customized rate based on criteria including your personal credit and income situation, the type of loan youre seeking, and characteristics of the home itself. Heres how it breaks down.

Realizing The System Was Unequal

Loan officers are salespeople and, under the old system of mortgage lending, each had incentive to offer customers the highest mortgage rates possible in order to maximize bank revenues and their own personal commission.

Of course, borrowers were free to check with other lenders to see if they could do better. Just like you can shop for deals when you buy a car.

But a closer analysis of this practice revealed that all customers were not treated equally.

Some customers received very high mortgage rates, and some received very low mortgage rates. Sometimes, loan officers willingly reduced closing costs, and other times they did not. It depended on their individual style of operating.

Mortgage rates sometimes varied by as much as 50 basis points between borrowers of similar traits and characteristics, at the same lender. And it was much easier for discrimination to creep into the process.

You May Like: Can You Get A Reverse Mortgage On A Condo

Using Discount Points To Negotiate A Lower Mortgage Rate

Want to negotiate a lower mortgage rate from your lender? Try paying points at closing. Borrowers can use this strategy to “buy down” the mortgage rate assigned to their loans, thereby paying less interest over time.

Definition: A discount point is one of two types of mortgage points . A point is equal to one percent of the amount being borrowed. Example: One point on a $300,000 home loan equals $3,000. Two points on the same size loan would equal $6,000. Discount points are a form of prepaid interest. You can pay them at closing to secure a lower mortgage rate on your loan. It’s like paying some of the interest up front, to avoid paying it over the long term.

There is an inverse relationship between mortgage rates and discount points. Borrowers can secure a lower rate by paying more discount points at closing.

The amount of interest reduction will vary from one lender to the next. Generally speaking, one discount point will lower the mortgage rate by 0.25%.

Example: If a lender offers a rate of 5% with no points, the borrower might choose to pay one point at closing to reduce the rate to 4.75%. Two points would bring it down to 4.5%. In this scenario, the borrower is using prepaid interest to negotiate a lower mortgage rate from the lender.

It’s a tradeoff. You’re paying more up front, and out of pocket, to secure a lower mortgage rate over the long term.

Speak To Multiple Lenders

Some people make the mistake of getting a loan with the first lender they speak to. They feel comfortable with them, the loan terms seem pretty good, and the interest rate is competitive. But this is the worst thing you can do. You can almost always get a better deal. Even if you love your loan officer, you can negotiate the terms to get the best deal on your loan possible.

You should get a loan estimate from at least 3-4 lenders. Compare the interest rate, closing costs, and other fees they are charging. Most likely, you will notice there is a pretty wide variance in the loan offers this is pretty normal. Some lenders will charge a higher interest rate and make the money back on the closing costs charges.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Ways To Improve Your Mortgage Negotiation Strategy

Now that you know its possible to negotiate mortgage rates, its crucial to approach the mortgage process strategically. Heres how to get a lower interest rate on a mortgage.

How Mortgage Rate Negotiations Used To Work

A mortgage loan officer or mortgage broker acts as a gobetween. They connect you, the consumer, with the lender or investor putting up the money for your home loan.

Brokers work independently, functioning as the sales force for wholesale mortgage lenders. Loan officers are the sales force for the lender that employs them.

Loan officers and mortgage brokers typically work for commissions. And of course, they want to maximize this income. No one wants to work for free.

In the past, there were only three ways for lending professionals to increase their commissions:

- Increase the interest rate

- Increase the closing costs

- Increase the loan amount

This is where the idea of shopping around for a mortgage first came from. There was always a chance that at least one loan officer would be willing to work for a smaller commission, which would get you a better deal.

Also Check: Rocket Mortgage Vs Bank

The Rate Is Always Negotiable

Rob McLister, founder of mortgage rate comparison website RateSpy, says posted rates arent the final word. Theres only a minority of cases you have lenders that have strict every-day low prices all season that are inflexible, he says. But even then the lenders can make exceptions for strong clients.

Understand The Different Costs

Closing fees come in different sizes and from various sources. There are the fees that the lender charges, and then there are also state and federal taxes that homebuyers have to pay. Lender fees are going to vary from one bank or mortgage broker to the next, and this is where you can find the most potential savings. On the other hand, theres little to no room for negotiation with things such as city, county, and state transfer taxes, prepaid property taxes, and recording fees.

The most common costs that homeowners will face to close on the home include a land survey, a home appraisal, credit checks, a loan origination fee, an application fee, and home inspection fees. A borrower may also purchase points to lower the interest rate over the life of the mortgage loan. The amount that someone is going to pay in closing costs depends on the financial company and the mortgage-related fees that it charges, the state in which the home is located, and how much the loan is for.

In 2019, the highest average closing costs, excluding taxes, were in the District of Columbia , New York , Hawaii , California , and Washington , while the lowest were in Indiana , Nebraska , Iowa , South Dakota , and Arkansas .

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How They Mess With Your Interest Rate

Theres no end of ways that lenders can increase your interest rate without you realising it. Here are just a few of the more common ways they do it:

- Hiking your rate when your fixed rate expires.

- Not passing on a RBA rate cut.

- Increasing rates by more than the RBA.

- Blaming new legislation or capital requirements to increase your rate.

- Discontinuing your loan product then offering a new product with good rates to new borrowers.

- Cancelling your professional package discount without telling you for any number of reasons hidden in the fine print of their terms and conditions booklet.

Like we said, the banks have decades of experience and have gotten very good at ignoring loyal customers. In fact, theyve almost conditioned us to believe its normal to have your rate hiked from time to time.

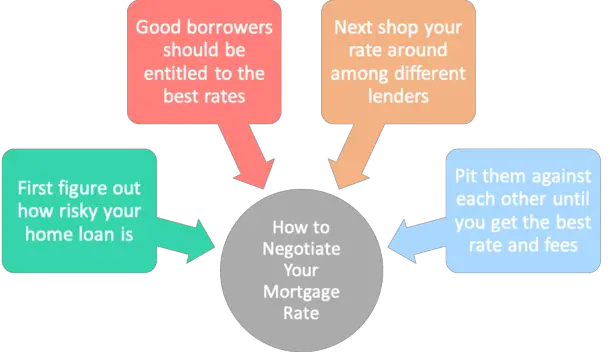

Ways To Negotiate Your Mortgage Rate

Many people arent aware they can negotiate their mortgage or refinance rate. Actually, its totally possible. But its not as simple as haggling over percentage points.

To negotiate your mortgage rate, youll have to prove that youre a creditworthy borrower. And youll have better luck if you come to the table with a lower quote from another lender inhand.

Here are four strategies you can use to try to get a lower rate before you lock:

We cover each strategy in more detail below.

But the basic facts are: If you have strong financials, and youre willing to look at more than one lender, you can usually find a lower rate for your mortgage.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates