When A Rise In Interest Rates May Affect You

A rise in interest rates often means that it will cost you more to borrow money.

A rise in interest rates may affect you if:

- you have a mortgage, a line of credit or other loans with variable interest rates

- youll need to renew a fixed interest rate mortgage or loan

Your financial institution could also increase your interest rate if you do not make payments on your credit card or loan.

The Us Housing Market Stares Down An Even Bigger Economic Shockmortgage Rates Near 7%

Unbeknownst to buyers lining the sidewalks outside of frenzied open houses this spring, the Pandemic Housing Boom was already in its final inning. In March, Fortune published a pair of articles titled The housing market enters uncharted waters and An economic shock just hit the housing market arguing just that: The red-hot housing market would quickly shift in the face of spiked mortgage rates, which had jumped from 3.2% in January to over 4% by late March.

Not only did higher mortgage rates help to cause the Pandemic Housing Boom fizzle out, but it was replaced by what Federal Reserve Chair Jerome Powell now calls a difficult correction.

For the longer term what we need is supply and demand to get better aligned so that housing prices go up at a reasonable level and at a reasonable pace and that people can afford houses again. We probably in the housing market have to go through a correction to get back to that place, Powell told reporters last week. This difficult correction should put the housing market back into better balance.

The bad news for mortgage brokers and builders? This housing correction is far from over.

In fact, the shock hitting the U.S. housing market continues to grow: On Monday, the average 30-year fixed mortgage rate jumped to 6.87%. That marks both the highest mortgage rate since 2002 and the biggest 12-month jump since 1981.

Mortgage Rate Predictions For September 2022

Rates for home loans are caught in a tug-of-war between rising inflation, which pushes rates higher, versus the Federal Reserveâs actions to maintain inflation, which indirectly moves mortgage rates lower.

The Federal Reserve began hiking its benchmark interest rate in March and then in July, it raised the rate by 75 basis pointsâthe largest increase since 1994.

âThe Federal Reserve has increased the target fed funds rate by 1.5 percentage points through the first half of 2022 and the markets have been pricing in more aggressive rate increases,â wrote Freddie Mac economists, in a July 20 forecast. âAs a result, mortgage rates have been volatile over the past few weeks.â

As a result of these market conditions and Fed actions, most housing-market experts think rates will essentially bob sideways for the rest of the year. Average rates for a 30-year, fixed-rate mortgage surged as high as 5.81% in late June, but have since leveled off at 5.55% as of August 25, according to Freddie Mac. Thatâs still nearly double the rate of 2.86% a year ago.

As of August 25, 2022, experts are forecasting that the 30-year, fixed-rate mortgage will vary from 5% to 6% throughout 2022:

Recommended Reading: How To Get A 500 000 Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Mortgage Rates Impact Your Wallet

Rates for a 30-year fixed mortgage the interest rate of which doesn’t change over the loan’s term have jumped more than two percentage points since the beginning of 2022.

Rates averaged 5.55% the week of June 23, according to data from Freddie Mac, another government-sponsored entity. That’s up significantly from 3.22% the first week of January though a slight decline from the 5.81% high point in June.

Even a seemingly small jump in mortgage costs can have a big impact on consumers, via higher monthly payments, more lifetime interest and a smaller overall loan.

Here’s an example, according to HSH data: At a 3.5% fixed rate, a homebuyer with a $300,000 mortgage would pay about $1,347 a month and $185,000 in total interest over 30 years. At a 5.5% rate, homeowners would pay $1,703 a month and pay over $313,000 in interest for the same loan amount.

Here’s another example, which assumes a buyer has an $80,000 pretax annual income and makes a $30,000 down payment. This buyer would qualify for a $295,000 mortgage if rates were 3.5%, about $50,000 more than the same buyer at a 5.5% rate, according to HSH data. That differential may put certain home out of reach.

You May Like: Is It Difficult To Refinance Your Mortgage

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

How Are Housing Market Predictions Made

Its probably no surprise that housing market predictions fluctuate based on what the greater economy is doing but experts also make their calls by analyzing cold, hard data.

The National Association of Realtors® reported in late July 2022 that the housing market continues to show signs of cooling, citing a consistent drop in home sales over the past five months. They have also shared that home buying is now about 80% more expensive as of June 2022 versus June 2019, pre-pandemic. Home prices have increased at a much faster rate than wages have, which means that many would-be buyers simply cant afford to make a purchase right now.

For added context, this HomeLight article from February 2022 included an economists prediction that the housing market should cool by the mid and later parts of 2022 due to an unsustainable growth in home prices. Sure enough and for better or worse homebuying has slowed down.

Recommended Reading: Can I Add My Daughter To My Mortgage

How High Will Mortgage Rates Go

Current predictions see 30-year home loans staying high through 2022. The Mortgage Bankers Association predicts 5 percent at the end of 2022 and then dropping gradually to 4.4 percent by 2024.

Lawrence Yun, the National Association of Realtors Chief Economist, told Forbes last week that he expects rates to stay above 5.5 percent for a few months, but doesnt see them breaking 6 percent. Most of the mortgage rate change from the expected Federal Reserve monetary policy change is already priced in. So future rate hikes by the Fed may have a less discernible impact on mortgage rates, he said.

If You Have A Variable Rate Loan Or Line Of Credit Interest Rate Changes Will Affect You

Variable interest rate loans can hold the most uncertainty for you in the event of rising interest rates, your payments can jump, too. A credit card balance or some types of student loans are subject to a variable interest rate, or one thats tied to a benchmark and can change with interest rates. Adjustable-rate mortgages, a lesser-used tool than in the past, are another example of a loan with an interest rate that changes.

Bottom line: Pay off variable interest rate debt as soon as possible. If you can, refinance loans such as adjustable-rate mortgages to lock in a set rate.

Read Also: What Documents Are Needed For A Mortgage Refinance

Forecasting Mortgage Interest Rates Explained

Mortgage interest rates are changing daily.

It used to be that banks would set the mortgage rates for the day, and then change them the next day, or week, or month, depending on the climate at the time.

Unfortunately, it doesnt work like that anymore. Wall Street is heavily involved in setting mortgage rates because people buy and sell mortgage-backed securities.

When these securities go up, the mortgage rates go down, and conversely, when the securities go down, mortgage rates go up.

The Fed steps in to help regulate this by buying a portion of the securities and helping to set the rates.

Current Mortgage Rates For Oct 4 202: Rates Go Up

A handful of important mortgage rates crept higher today. The average 15-year fixed and 30-year fixed mortgage rates both were higher. For variable rates, the 5/1 adjustable-rate mortgage also rose.

Mortgage rates have been increasing consistently since the start of 2022, following in the wake of a series of interest hikes by the Federal Reserve. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

If you’re looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates — and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Don’t Miss: How Is The Mortgage Industry Doing

How Forecasts Work

Forecasts are built on assumptions, so naturally, different assumptions about what will happen lead to different forecast results. That is why Mortgage Sandbox publishes the range of projections and the average of all the forecasted rates.

Apart from the economic assumptions, there is also guidance from the Bank of Canada. The Bank interferes in markets to push rates below the level that the free market would set. Often, Bank guidance is more important than the economic fundamentals when it comes to rates.

What To Do Next

The ability to remortgage and/or fix your mortgage has become a more difficult over recent years as the rules surrounding the affordability tests when applying for a mortgage were tightened leaving some borrowers stranded on their existing deals. It’s important to calculate the impact of an interest rate rise and seek advice from a mortgage expert ahead of time by following the steps below.

Whether you are on a tracker mortgage, variable rate mortgage or looking to remortgage your existing fixed rate deal that is coming to an end the steps below will take you a few seconds, but could prevent your mortgage repayments crippling your finances in the future and help you secure a low rate while they are still available.

Also Check: How Much Would Mortgage Be On A 500 000 House

Reviewing Your Budget With Your New Debt Payments

If interest rates rise and your debt payments increase, you may need to review and adjust your budget.

To prepare yourself, try the following:

- talk to your lenders to find out by how much your payments will increase

- look at how the higher payments will impact your budget and your ability to save for your goals

- if youre out of your comfort zone, see how you can reduce expenses or earn more money to pay off your debt faster

Use the Budget Planner to create or review your budget.

If after reviewing your budget if you expect challenges in making your payments, be proactive and dont wait to seek help. Talk to talk to your financial institution to discuss your options. They may be able to offer temporary accommodations such as making special payment arrangements, mortgage deferrals or allowing you to skip a payment on your loan.

% Say Rates Will Go Down

Les Parker

CMB, managing director,Transformational Mortgage Solutions,Jacksonville, Florida

Mortgage rates will go down. Here’s a parody based on Justin Timberlake’s 2016 happy song, Can’t Stop the Feeling: “Bucks can’t stop the feeling. So keep dancing. Euro makes it magical. Yen puts in air. Bonds give it blood. Turn dollars on. The battle between inflation and recession merged to both winning. But, with the dollar soaring, look for a near-term rate decline.

Loan agent,CrossCountry Mortgage,Alamo, CA

Trend: Lower. With rates having surged gigantically the day after Labor Day, we should expect more buying of mortgage-backed securities at these higher yields. Fixed income markets remain clueless about where CPI is going.

Also Check: When Does Mortgage Refinance Make Sense

Affordability Worsening Even As Prices Start To Fall

This rising rate environment is sending chills down the spines of many potential home buyers, even as home prices show signs of softening. Though year-over-year increases continue, as of August, the median existing home price has dropped for two months running, according to the National Association of Realtors. However, the additional interest financed buyers have to pay potentially wipes out any benefit from lower prices.

To borrow $300,000 at a 6% interest rate, a buyer would be looking at monthly principal and interest payments of almost $1,800. At the beginning of 2022, when interest rates were around 3.5%, monthly payments on a $300,000 mortgage would have been just under $1,350. The same loan would now cost roughly $450 more per month.

The rising cost of borrowing is pushing down demand, as the Fed had hoped, creating slightly less competition in some markets. There’s still a shortage of available homes. However, if these trends continue, we could see a housing market that favors buyers before the year ends, according to Black Knight, a mortgage and real estate analytics company.

A Look At Mortgage Rates During Past Recessions

The chart above shows the average 30-year fixed-rate mortgage based on Freddie Mac data, retrieved from FRED, Federal Reserve Bank of St. Louis. The shaded portions are U.S. recessions.

The most recent recession was the COVID-19 recession that lasted from February to April of 2020.

It was very short-lived, but during that time the 30-year fixed mortgage still fell from 3.45% to 3.23%, per Freddie Macs weekly survey.

Rates continued to fall after that and eventually hit record lows in January 2021.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

During the Great Recession, which spanned from December 2007 to June 2009, 30-year fixed mortgage rates started around 6.10% and fell to roughly 5.42%.

That recession was caused by the mortgage crisis, whereby loose home loan lending collapsed the global financial system.

In the early 2000s recession, from March 2001 to November 2001, mortgage rates began at 6.95% and fell to 6.66%.

In the early 1990s recession, from July 1990 to March 1991, mortgage rates fell from around 10% to 9.5%.

The prior recession, from July 1981 to November 1982, saw rates plummet from 16.83% to 13.82%.

And the 1980 recession from January 1980 to July 1980 saw rates move lower from 12.88% to 12.19%.

In all instances, mortgage rates went down during a recession. Of course, the decline ranged from as little as 0.22% to as large as about 3%.

Don’t Miss: What Is Apr Vs Mortgage Rate

What Is The Best Type Of Mortgage Loan

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage . The most popular ARM is called the 5/1 ARM, which has a fixed rate for the first five years of the loan and then switches to an adjustable rate for the remainder of the 30-year loan term. When the loan hits the adjustable-rate period, it typically adjusts annually.

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now.

Related: Current ARM Rates

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So its important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

Are Mortgage Interest Rates Going Up

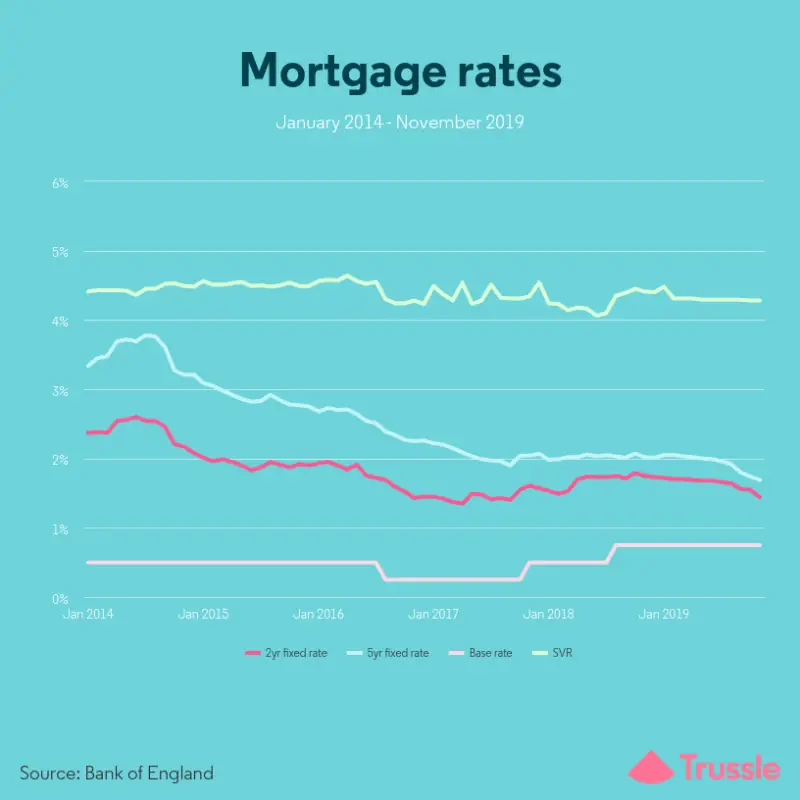

Interest rates declined throughout 2019 and when January 2020 rolled around, the average rate for a 30-year fixed was about 3.7%. Furthermore, when COVID-19 hit the United States, the Federal Reserve responded by dropping the federal funds rate to between 0% â 0.25%.

In 2021, mortgage interest rates were 2.98% on January 21 and by October 21, Freddie Mac reported an average mortgage rate of 3.09% for 30-year mortgages. Though mortgage rate forecasts predict a continual increase in mortgage rates, these interest rates will be lower than historical mortgage rates, according to Freddie Mac.

Read Also: Can You Repay A Reverse Mortgage