Is Your First Home A Starter Home Or A Forever Home

- Always think about how long youll stay in the property

- It might be possible to save money by choosing an ARM if you plan on moving soon

- Many first-time buyers move-up to larger properties within a few short years

- Your expected tenure is also a key consideration with regard to paying points

The first thing Id consider when buying a first home would be how long you plan to keep it. A lot of folks buy what are known as starter homes initially, then move up to larger homes within a few years.

For example, if you just got married and want to buy a home next, you might also be thinking about starting a family shortly after that.

This often results in outgrowing that first home, and requiring a new, larger property. Depending on your timeline, this could all happen within just a few years.

In that case, it could make sense to go with a hybrid adjustable-rate mortgage such as the 5/1 ARM or 7/1 ARM.

While fixed mortgage rates arent much more expensive than ARMs at the moment, this isnt always the case. Sometimes its significantly cheaper to go with an ARM.

And these hybrid ARMs offer a fixed-rate period for the first five or seven years before you even have to worry about an interest rate adjustment.

In other words, it operates exactly like a 30-year fixed-rate mortgage up until its first adjustment by then you could have already sold and moved on to a new property.

What Government Schemes Can Help First

A number of schemes have been introduced to make buying a home easier and more affordable for first-time buyers, these include:

- Help to Buy: Equity Loan – Used for newly built homes in England, this scheme can give you a loan of up to 20% to buy a home. Youll still need a 5% deposit and a 75% mortgage for the rest. The equity loan will be interest-free for the first five years.

- Help to Buy: Mortgage Guarantee – To help people who can afford mortgage repayments but not large deposits, this UK-wide scheme encourages lenders to provide 95% mortgages by providing them with a government-backed guarantee.

- Right to Buy – For council and housing association tenants in England, Right to Buy can provide a discount of up to £112,800 on these homes to help first-time buyers take their first step on the property ladder.

- – First-time buyers in England can buy a share of a housing association home, initially buying between 10% and 75% and paying rent on the rest. Youve got the option of increasing your share up to 100% when you can afford to.

Similar schemes to help first-time buyers are also available in Wales and Scotland, while Northern Ireland offers alternative low-cost homeownership options.

Who Is Eligible For An Fha Mortgage Loan

You must meet these requirements to get an FHA loan:

- Down payment of at least 3.5%

- MIP of 1.75% of the loan amount

- Debt-to-income ratio below 43%, which means you pay less than 43% of your income before taxes toward debt

- Proof of steady income and employment

In addition, the home must serve as your primary residence.

Read Also: How To Start Mortgage Process

How To Find The Best Mortgage Lender For Your Situation

NextAdvisor evaluated the best mortgage lenders for New York by looking at criteria including price transparency, accessibility of information, online conveniences, loan product variety, and customer satisfaction.

After looking at this criteria, narrowing your choice comes down to what is best for you and your personal circumstances. One lender could be a better fit than another, depending on your goals and needs as a borrower. As an example, first-time homebuyers with down payment challenges may choose a lender that offers down payment assistance programs. A different borrower with a low credit score could need a lender with a more flexible credit threshold.

Here is what else you can use to evaluate your decision:

Federal Housing Administration Loans

The Federal Housing Administration , part of the U.S. Department of Housing and Urban Development , provides various mortgage loan programs for Americans. An FHA loan has lower down payment requirements and is easier to qualify for than a conventional loan. FHA loans are excellent for first-time homebuyers because, in addition to lower up-front loan costs and less stringent credit requirements, you can make a down payment as low as 3.5%. FHA loans cannot exceed the statutory limits described above.

However, all FHA borrowers must pay a mortgage insurance premium, rolled into their mortgage payments. Mortgage insurance is an insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage.

You May Like: How Much Is A Mortgage On A 550k House

Are These Mortgage Lenders Trustworthy

The Better Business Bureau grades companies based on responses to customer complaints, honest advertising, and transparency about business practices. Here are the BBB grades for our top lenders:

| Lender | |

| Carrington Mortgage Services | A+ |

Most of the lenders have an A rating or better from the BBB. Guild Mortgage and Chase have an A rating due to government action. Navy Federal has an NR rating because it is responding to unresolved customer complaints. US Bank has a B+ due to government action. Better.com has a B rating due to complaints filed against the lender.

In 2020, Guild Mortgage paid the United States $24.9 million when it was accused of approving FHA mortgages for people who didn’t qualify, resulting in loan defaults.

Some of the other lenders on our list have recent public controversies, too, despite their strong BBB grades.

In 2020, the Department of Justice charged Bank of America for unfairly denying home loans to adults with disabilities, even though they qualified for loans. Bank of America paid around $300,000 total to people who were refused loans. In 2019, the Department of Labor required Bank of America to pay $4.2 million to people who claimed the bank discriminated against women, Black, and Hispanic applicants in the hiring process.

Better.com’s founder and CEO Vishal Garg has been accused of fostering a hostile workplace at Better.com and of engaging in fraud with some of his previous startups. He also laid off around 900 employees over Zoom in late 2021.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Don’t Miss: What Is The 30 Year Mortgage Rate Now

Are There Downsides To 0 Down Home Loans

You may want to keep these possible cons in mind when considering home loans with no down payment:

- Many 0 down mortgage programs have higher fees and interest rates

- Sellers may prefer offers with large down payments if youre buying in a competitive market

- The larger mortgage means youll pay more in interest over time

- You wont have equity in the home, which could become an issue if you need to sell

Fha Loans: 35% Down Payment

FHA loans are popular with borrowers who have smaller down payments or credit issues, which require extra underwriting flexibility. The biggest appeal of this loan is that buyers with below-average credit can get mortgage-approved.

FHA loans allow buyers with credit scores as low as 580 with 3.5% down, and 500 with 10% down. However, low credit scores must not be the result of recent bad credit history.

FHA mortgage rates are often lower than conforming mortgage rates. But because all FHA loans require mortgage insurance premiums , the overall cost of an FHA loan is sometimes higher.

FHA mortgage insurance costs:

- Upfront Mortgage Insurance Premium : 1.75% of the loan amount for recent FHA loans and refinances

- Annual Mortgage Insurance Premium : 0.85% of the loan amount most FHA loans and refinances

FHA mortgage insurance must be paid for the life of the loan. But borrowers can refinance into a new loan type to cancel those premiums down the road.

In addition, the home you buy using an FHA loan must be your primary residence. You cannot purchase a vacation home or investment property with this loan type. The same goes for other government-backed loan programs, including VA and USDA mortgages.

Recommended Reading: What Was The Mortgage Interest Rate In 2017

Who Qualifies As A First

Youll be considered a first-time buyer if you havent owned a home before – either in the UK or abroad.

As a first-time buyer, youll need to be planning to use the property youre buying as your main home, and not to rent it out or use it as a second home.

However, even if youve never owned a home before, youre unlikely to qualify as a first-time buyer if:

- Youre being bought your first home by someone whos already a homeowner

- Youve previously owned a share of a home, for example, if you were a joint tenant

- Youre buying a home with someone that either owns or previously owned a property

- Youve inherited a home, even if you never lived there and you sold it

Why Is My Credit Score Important

Your is not only important for qualifying for a mortgage, but its also the key to getting a lower interest rate. The better your credit score, the lower your interest rate will be, which can save you quite a lot of money.

Consider that a borrower with a $300,000, 30-year mortgage with a 3% interest rate will pay $29,635.90 less over the life of the loan than a borrower who has a 3.5% rate. On a monthly basis thats $82 in savings.

Don’t Miss: How Much Is A 280k Mortgage

What Is An Fha Mortgage Loan

An FHA home loan expands access to mortgages by offering flexible credit requirements, low closing costs, and low minimum down payments. These mortgages are backed by the Federal Housing Administration, so banks can lend to buyers who may not otherwise qualify.

To qualify for an FHA loan with a 3.5% down payment, you need a credit score of 580 or higher. In comparison, conventional mortgage lenders typically require a score of at least 660 to buy a home. You can even get an FHA mortgage with a 500 credit score if you have a down payment of at least 10%.

FHA loans have competitive fixed interest rates. You can select from either a 15-year or 30-year term to either pay off your mortgage faster or take advantage of lower monthly payments. Its important to note that unless you have a 20% down payment, your FHA loan will require both upfront and monthly mortgage insurance payments.

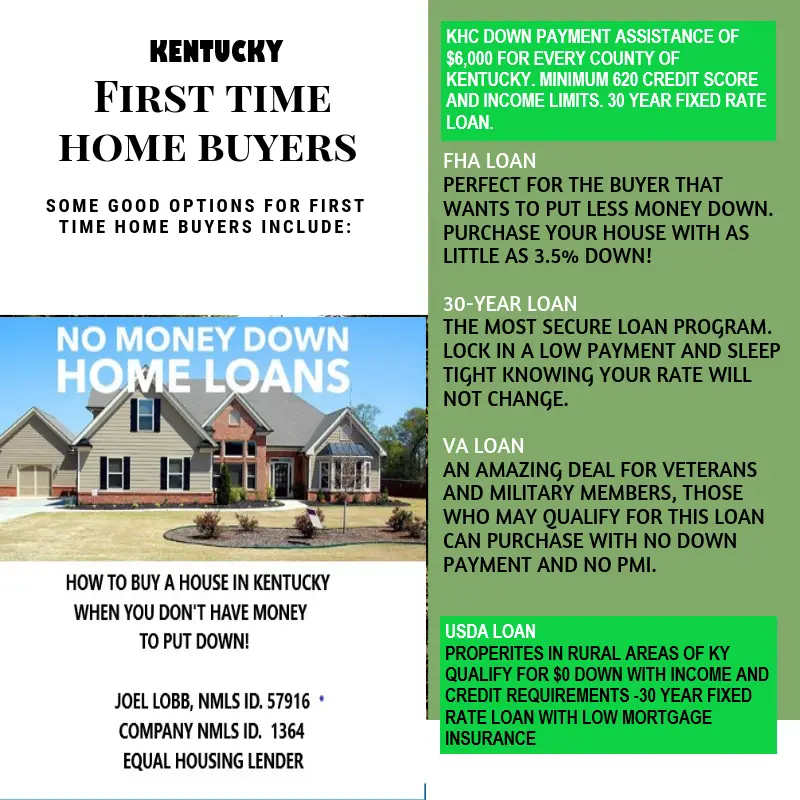

Best Programs For First

First-time homebuyer programs can offer assistance in several different ways. They commonly offer the following:

- Down payment assistance: These types of programs can help satisfy the minimum down payment required for a mortgage, and come in the form of a grant or an interest-free loan. Depending on the program, they may not require repayment as long as you agree to live in the home for several years or meet other requirements.

- Grants: Fees associated with obtaining a mortgage and buying a home can be significant. If you qualify for a grant, the funds can cover the down payment or closing costs.

- Tax benefits: Certain first-time homebuyer programs offer incentives to reduce your tax liability, helping you keep more money.

- Flexibility with mortgage eligibility requirements: Certain mortgage loans have more flexibility with underwriting criteria, making it easier to qualify for a loan. Examples include allowing for lower , higher debt-to-income ratios, and lower down payments.

Read Also: Who Gets The House In A Reverse Mortgage

What Programs Are Available For First

There are dozens, if not hundreds of programs available to help first-time home buyers save time, stress, and money.

First-timers can find assistance programs at three levels:

To be clear, you can still get a great deal on a mortgage without leveraging one of these programs. Theyre more geared towards providing assistance than providing a discount, if that makes sense. At the end of the day, the most important number is your rate plus closing costs.

How Much Down Payment For A House Do I Need

Conventional mortgage loans require a 20% down payment to avoid private mortgage insurance , an added monthly expense. You can usually get a conventional loan with a down payment as low as 5% with PMI.

If you dont qualify for home loans with no down payment, you can look for a low down payment mortgage. For example, you only need a 3.5% down payment for a home loan backed by the Federal Housing Administration . Other low down payment mortgage programs include:

- Conventional 97 from government-sponsored enterprises Fannie Mae and Freddie Mac, which offers a 3% down payment if you have at least a 620 credit score

- Home Possible from Freddie Mac, which has a 3% down payment

- HomeReady by Fannie Mae, also with a 3% down payment

- Good Neighbor Next Door, which provides discounted mortgages with $100 down payment for emergency medical technicians, members of law enforcement, firefighters and teachers who buy homes in designated areas

Read Also: What Happens With A Reverse Mortgage When Owner Dies

Home Loan Types To Consider If A First

- State Housing Finance Agency loan programs

- Also look for local and national grants for first-time home buyers and Mortgage Credit Certificates

Ive listed the most common loan types available to first-time home buyers, many of which are also an option for existing homeowners.

These generally dont require much in terms of down payment, which seems to be a chief need/want for first-time buyers that dont have the equity of move-up buyers.

Personally, I prefer to put down 20% on a home purchase to avoid costly mortgage insurance and obtain a lower mortgage rate, but I understand that isnt always realistic.

So for those lacking assets, the programs listed above are probably a good starting point.

Once you choose a loan type, you can decide on a specific loan program, such as a 30-year fixed, 15-year fixed, or an ARM.

While most first-time buyers will ultimately go with a 30-year fixed, lets discuss how the property itself could dictate your financing decision.

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the Moneysupermarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally binding MSE Editorial Code.

Don’t Miss: Can You Pay Off A Mortgage Early

Not Knowing Whether To Pay Discount Points

Mortgage discount points are fees you pay upfront to reduce your mortgage interest rate. Interest rate savings can add up to a lot of money over the life of a mortgage, and discount points are one way to gain those rate savings if youre in the right position to purchase them.

How to avoid this mistake: If making a minimal down payment is an accomplishment, the choice is simple: Don’t buy discount points. If you have enough cash on hand, the value of buying points depends on whether you plan to live in the home longer than the “break-even period.” That’s the time it takes for the upfront cost to be exceeded by the monthly savings you get from a lower interest rate.

» MORE:Calculate whether you should pay for discount points