More Mortgage Tools And Resources

You can use CNET’s mortgage calculator to help you determine how much house you can afford. CNET’s mortgage calculator takes into account things like your monthly income, expenses and debt payments to give you an idea of what you can manage financially. Your mortgage rate will depend in part on those income factors, as well as your credit score and the ZIP code where you’re looking to buy a house.

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

What The Forecast Means For You

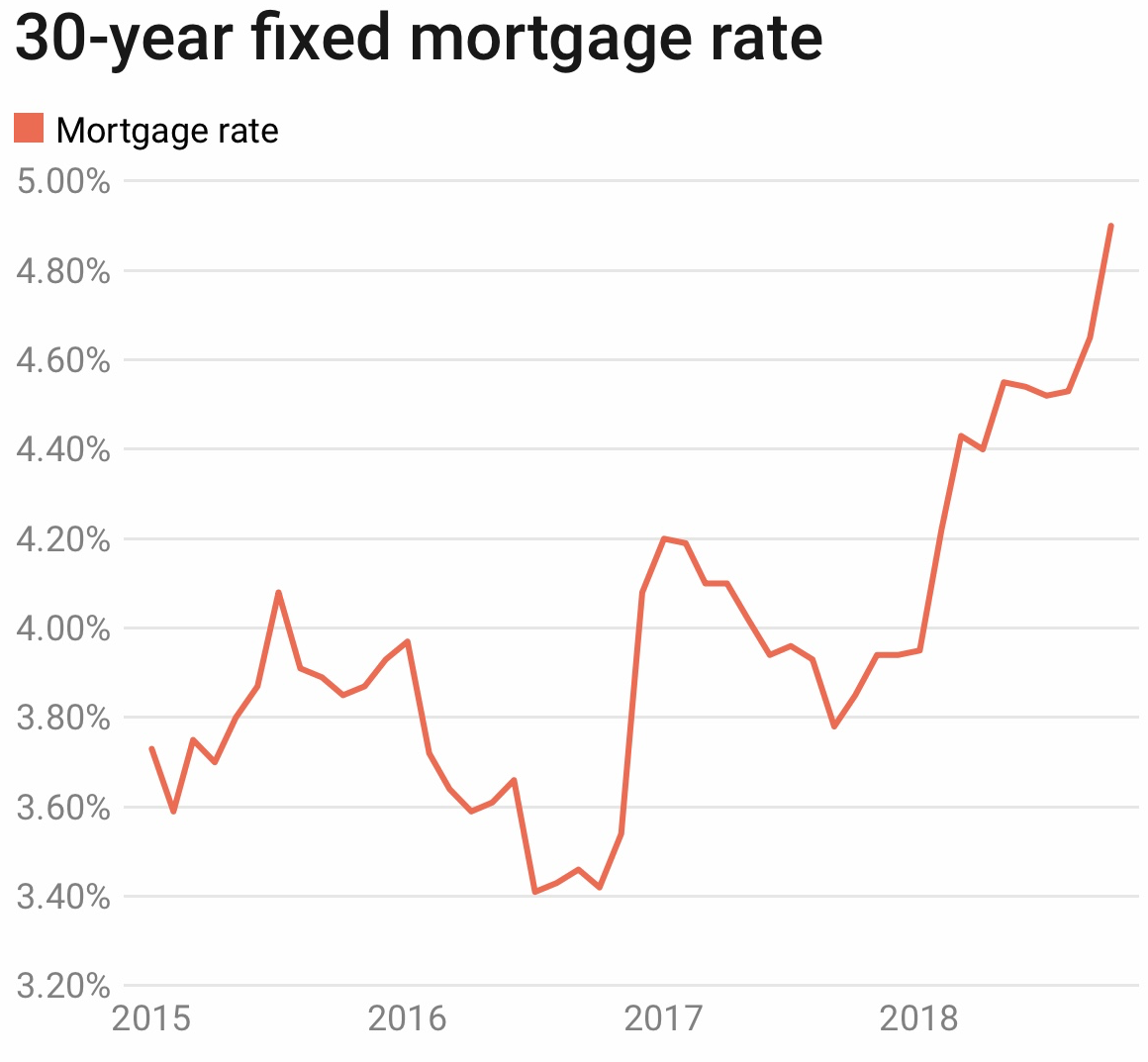

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

Don’t Miss: Can You Use A Mortgage To Buy Land

Increase Your Credit Score

Mortgage rates are highly influenced by a borrowers credit score. Lenders typically offer lower interest rates to borrowers with a higher credit score. The more you can work to increase it, the more likely youll be offered a lower rate. Some action steps to take include making on-time payments and refraining from applying for additional loans at the same time as your mortgage application.

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Read Also: How Much Is A Mortgage Point Worth

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates â personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

The Best Time To Get A 30

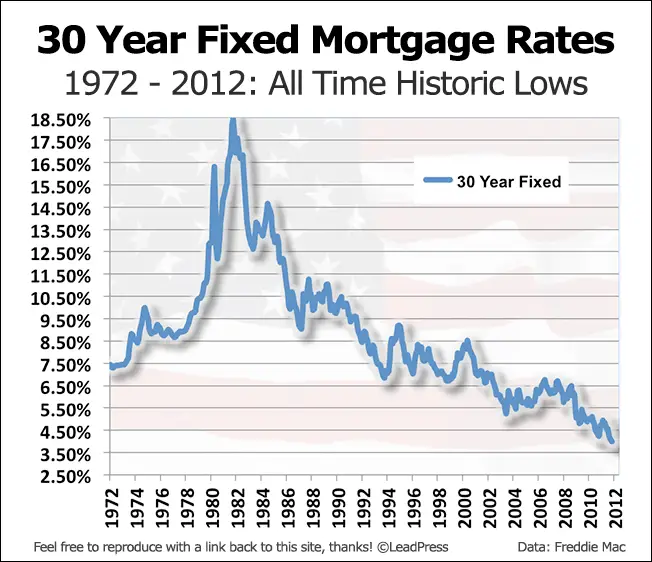

The best time to get a 30-year mortgage is when interest rates are low. Interest rates tend to fluctuate significantly over time. In late 2020 average 30-year rates were below 3%. Prior to the Great Recession rates were above 6% and were as high as 18.45% in October of 1981.

Rates depend on various economic factors, including the following:

Don’t Miss: Do Mortgage Lenders Match Rates

A Popular Choice Among Homeowners

The 30-year FRM is easily the most popular choice among both home buyers and people choosing to refinance their home loans into a lower rate.

If one looks at the market as a whole, people using 15-year FRM to refinance makes the overall market composition look a bit more even than it would without refis.

If one looks exclusively at purchases FRMs are about 90% of the market.

How To Get A Low 30

Getting the lowest possible mortgage rate for your 30-year fixed home loan is important if you want to keep your housing costs low. After all, as a homeowner youll be responsible for paying for property taxes, homeowners insurance, maintenance and repairs in addition to making a mortgage payment and paying interest.

To qualify for the lowest and best 30-year fixed mortgage rates, you need to have good credit. Most mortgage lenders look at FICO credit scores when assessing potential borrowers. Based on the FICO scoring model, a good credit score falls in the 670 to 739 range.

Different mortgage lenders have different standards regarding the credit scores that they expect borrowers to have. But in most cases, you wont be able to qualify for a conventional mortgage loan if your FICO credit score falls below 620. If your FICO score falls below that threshold, you do still have options. You can look into getting an FHA loan if you’re a first-time homebuyer or a USDA loan if youre planning on buying a home in a rural area.

Besides having a high credit score, you need to have a low debt-to-income ratio if you want to qualify for a low mortgage rate. Your DTI is the amount of debt youre paying off each month relative to your monthly gross income. Generally, you wont be eligible for a qualified mortgage if your debt-to-income ratio is higher than 43%.

You May Like: How To Lock In Mortgage Rate For 6 Months

How Do I Refinance A 30

Refinancing is when you replace your existing mortgage with a new home loan. When 30-year refinance rates are significantly lower than your existing mortgage rate, you may be able to save money with a refinance. Keep in mind that the potential savings will need to outweigh the upfront closing costs youll pay to refinance, which are typically 3% to 6% of the loan balance.

Another factor to consider when you refinance is, how many years have you been paying off your current mortgage? If youre 10 years into a 30-year loan, taking out a new 30-year mortgage adds those 10 years back onto your repayment term. Even though you may be lowering your monthly payment and rate in that scenario, you could end up paying more interest over the long term even if you have a lower rate.

For more information on how to refinance a mortgage, see NextAdvisors refinance page.

Rates Vary Based On Mortgage Type

There may be different rates depending on the type of mortgage you take out. There are mortgages that vary in the length of term with rates being lower for shorter terms. Adjustable rate mortgages also have different rates with their rates not being fixed for the entire loan term. For instance, ARMs tend to have a lower initial rate compared to fixed-rate loans, but after a predetermined amount of time itll go up according to the current market conditions.

Recommended Reading: What’s A Normal Mortgage Interest Rate

You Pay More Interest

Your interest rates on a 30-year fixed-rate loan will be higher, even though it will stay the same throughout the life of the loan. When you get a 30-year fixed-rate loan, your mortgage lenders risk of not getting paid back is spread over a longer period of time. For this reason, lenders charge higher interest rates on loans with longer terms.This may seem obvious, but its also something to consider: when you choose a 30-year mortgage loan term, you will pay more interest than if you were to choose a shorter loan term. Its that simple. Yes, a 30-year fixed-rate loan may offer you the lowest monthly payment, but thats because youre choosing to pay your loan amount back over the longest amount of time. As long as you owe money back to your lender for your loan, youll owe interest, meaning youll pay more total interest on a 30-year fixed-rate loan than you will on a 20- or 15-year fixed-rate loan.As previously before, you pay back your loan on an amortization schedule, which breaks down what you have to pay and when you owe it. Your lender will provide you that schedule. It also breaks down how much of each of your payments will go toward your principal balance and how much will go toward your interest.

Try using an amortization calculator, which you can find online. When you plug in some information about your loan , it will show you exactly how much interest you will pay based on your loans term.

Home Prices Are Falling Fastest In These 10 Us Cities Data Shows

Prospective homebuyers face a new chill after the average interest rate on the most popular home loan rose to its highest level since 2006, data from the Mortgage Bankers Association showed on Wednesday.

The average contract rate on a 30-year fixed-rate mortgage rose by 6 basis points to 6.81% for the week that ended Oct. 7, marking a 16-year high for the cost of a home loan.

The rise means that mortgage rates have now more than doubled since the beginning of the year, thanks to aggressive interest rate hikes from the Feds fight against inflation.

Those actions, designed to cool the economy sufficiently to curb price pressures, have weighed heavily on the interest-rate-sensitive housing sector as expectations for Fed tightening have led to a surge in Treasury yields. The yield on the 10-year note acts as a benchmark for mortgage rates.

With the likelihood of a weakening economy, which would lead to an increase in delinquencies,

there was a smaller appetite for lower credit score and high loan programs, along with a reduction in government streamline refinance programs, said Joel Kan, an MBA economist.

The historically high rates have hampered new applications for mortgages.

The MBAs measure for mortgage loan application volume, dubbed the Market Composite Index, shows the number of people applying for loans fell 2% last week, and is now down 69% from this time last year.

The index dropped 2.1% last week from the week prior, and is 39% lower than this time last year.

Recommended Reading: How Do You Remove Pmi From Your Mortgage

Thirty Years Is A Long Time

Another thing to consider before applying for a 30-year mortgage is that 30 years is a relatively long time. Its difficult to envision what your life will be like at the end of your mortgage term.

One thing to remember is just because your mortgage will be paid off in 30 years, it doesnt mean you need to keep the loan for that long. If you can afford to pay extra toward the mortgage, you are free to do so. You can also sell your home before the 30 years is up and use the proceeds from the sale to pay off the mortgage.

How Your Interest Rate Is Determined

In large part, mortgage rates are determined by the economy and overall interest rate market.

Mortgage rates move up or down depending on how much investors will pay for mortgage bonds in a secondary market. The economy is a big factor in that.

During scary economic times, interest rates tend to be low. But they go up when things are looking positive.

On top of that, lenders adjust your rate based on how risky you appear as a borrower.

Less risk to the lender means a lower interest rate for you. More risk, and your rates go up.

Mortgage lenders determine risk and set mortgage rates based on a wide range of factors, including your:

If youre very secure financially, you could be a top-tier borrower, meaning you qualify for the very lowest 30-year mortgage rates. The further away you are from that happy situation, the higher interest rate youre likely to pay.

Recommended Reading: How To Pay A Mortgage In 10 Years

Comparison To Other Mortgage Rates

When selecting a mortgage, there are many different mortgage products and terms to choose from, each of which has different interest rates. While 30-year fixed rates are near an all-time low, and were recently below 4%, they are still higher than other loan options with a shorter duration. 30-year rates can be compared to the following popular products:

15-year Fixed Rates

15-year fixed rates are normally lower than a 30-year and, depending on the lender, the interest rate variance ranges from 0.50% to 0.75%. These rates are often lower because having a shorter term provides significantly less risk to the lender. Although interest rates are lower, 15-year payments are higher than 30-year payments because the loan has to be paid off in half the time.

Adjustable Rate Mortgages

Interest Only Mortgages

While they are not as frequently offered today as in years past, many borrowers still opt for interest only mortgages. Since interest only loans do not require principal payment and do not amortize, the balance due never decreases. Because of this, lenders assume a lot more risk and often require a sizable down payment and charge higher interest rates. Interest only mortgage rates are commonly 1% higher than 30-year rates.

The following graph shows historical data from the Freddie Mac Primary Mortgage Market Survey. It shows historical rate data back to 1971 for the 30-year, along with 15-year data back to 1991 and 5/1 ARM data from 2005 onward.

Mortgage Rates Maintain Their Ascent

Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation. Not only are mortgage rates rising but the dispersion of rates has increased, suggesting that borrowers can meaningfully benefit from shopping around for a better rate. Our research indicates that borrowers could save an average of $1,500 over the life of a loan by getting one additional rate quote and an average of about $3,000 if they get five quotes.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Also Check: How Much Would Mortgage Be On A Million Dollar House

Historical Mortgage Rates In A Chart

This is a particularly fascinating time to be an interest-rate enthusiast. The Federal Reserve the U.S. central bank is raising rates in response to rising inflation.

The U.S. economy hasnt seen inflation like were currently experiencing since the 1970s. Many experts believe things could get worse because inflation has embedded itself so completely into the economys psyche.

These figures come from Freddie Mac, which began tracking 30-year fixed-rate mortgage rates in April 1971:

|

Mortgage Rates |

Where they were by the end of the decade |

|

1970s |

Thanks to Freddie Mac, theres solid data available for 30-year fixed-rate mortgage rates beginning in 1971.

Rates in 1971 were in the mid-7% range, and they moved up steadily until they were at 9.19% in 1974. They briefly dipped down into the mid- to high-8% range before climbing to 11.20% in 1979. This was during a period of high inflation that hit its peak early in the next decade.

How Big Of A 30

There are a few considerations to look into when determining how much of a mortgage you can afford. While lenders consider factors including your assets, liabilities, and income, your DTI will be the most significant factor in determining how much you can afford. The front-end DTI considers how much of your monthly income goes toward housing expenses. Lenders want to see this ratio at 28% or less.

You May Like: What Is Mortgage Insurance On A Home Loan

/1 Arm Moves Upward +005%

The average rate on a 5/1 adjustable rate mortgage is 5.38 percent, rising 5 basis points over the last 7 days.

Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. In other words, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These loan types are best for those who expect to refinance or sell before the first or second adjustment. Rates could be much higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 5.38 percent would cost about $554 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loans terms.