How We Determine Mortgage Interest Rates

To see where mortgage rates are going, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on mortgages where the borrower has a high credit score , a loan-to-value ratio of 80% or better, and lives in the home.

This table has current average rates based on information provided to Bankrate by lenders from across the nation:

Average mortgage interest ratesWhat Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

Don’t Miss: How To Become A Mortgage Closing Agent

What Determines My Mortgage Interest Rate

Your mortgage rate is influenced by a variety of factors that fit into two categories:

- The current economic climate: Factors like inflation and the Federal Reserves benchmark rate can have a big influence on current mortgage rates

- The specifics of your financial life: Within the context of the mortgage market, your personal finances help determine your precise interest rate

While you cant control the federal funds rate or other economic conditions, you can do things to improve your personal finances before applying for a mortgage loan.

Any change to one of the following seven things can directly impact the specific interest rate youll qualify for.

What Are Mortgage Rates

Mortgage rates are the rate of interest charged by a mortgage lender . The interest is charged by the lender as compensation for the money they have lent them in order to purchase a property.

Interest rates are determined by the lender in most cases, and can be either fixed or variable . Before you compare mortgages, you need to understand the different types. For more information see what type of mortgage should I get?

Also Check: Can I Get A Mortgage With A Fair Credit Score

Where Are Mortgage Refinance Rates Headed In 2023

If youâre thinking about refinancing, itâs worth noting that refinance rates are traditionally higher than purchase rates. Thatâs because lenders tend to view refinances as riskier.

For example, most housing experts predict the traditional 30-year, fixed-rate mortgage to average 5% to 6% in 2023, which means that refinance rate estimates may be a bit higher. Considering the exceedingly low mortgage rates that many homeowners locked in during the historical lows in previous years, mortgage refinance rates would need to take a significant dip in 2023 before many homeowners elect to refinance.

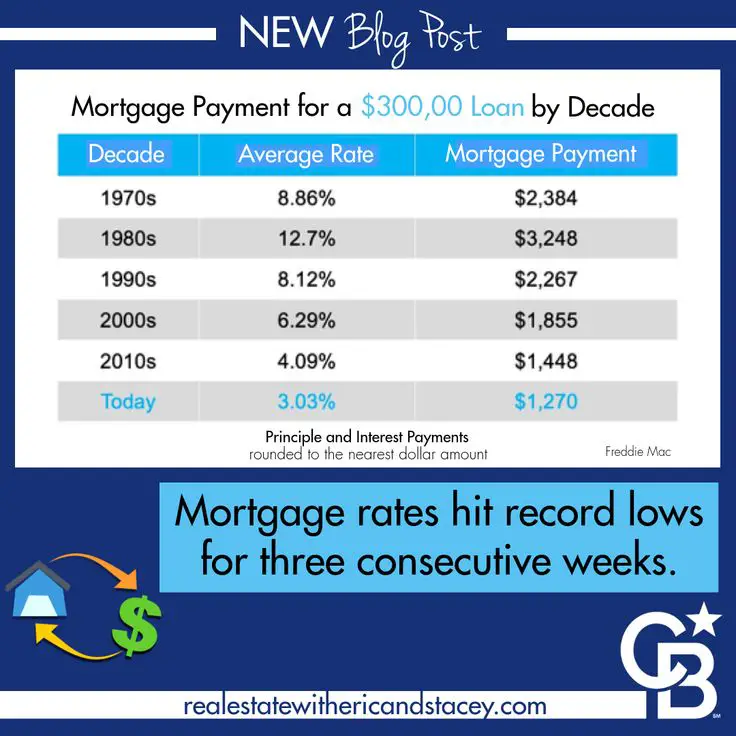

âIf we look at the stock of outstanding mortgages, about two out of three mortgages have a 4% or less interest rate,â said Len Kiefer, deputy chief economist at Freddie Mac, in a recent webinar. âA lot of those homeowners, if theyâre not forced to move, are probably going to stick in place for a while because theyâre not going to be willing to trade that 4% or 3% or 2% mortgage rate for a 7% mortgage rate.â

How Your Credit Score Affects Your Mortgage Rate

You dont need a high credit score to qualify for a home purchase or refinance, but your .

This is because credit history determines risk level.

Historically speaking, borrowers with higher credit scores are less likely to default on their mortgages, so they qualify for lower rates.

For the best rate, aim for a credit score of 720 or higher.

Mortgage programs that dont require a high score include:

- Conventional home loans minimum 620 credit score

- FHA loans minimum 500 credit score or 580

- VA loans no minimum credit score, but 620 is common

- USDA loans minimum 640 credit score

Ideally, you want to check your credit report and score at least 6 months before applying for a mortgage. This gives you time to sort out any errors and make sure your score is as high as possible.

If youre ready to apply now, its still worth checking so you have a good idea of what loan programs you might qualify for and how your score will affect your rate.

You can get your credit report from AnnualCreditReport.com and your score from MyFico.com.

Don’t Miss: Where Are 30 Year Mortgage Rates Headed

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youâll pay over time.

What Is A Good Mortgage Interest Rate

The best mortgage rate for you will depend on your financial situation. A home loan with a shorter term may have a lower interest rate but a higher monthly payment, while a home loan with an adjustable interest rate may have a lower interest rate at first but then change annually after a set period of time. For example, a 7-year ARM has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan , while a 30-year fixed-rate mortgage has a rate that stays the same over the loan term.

Recommended Reading: How To Recruit Mortgage Loan Officers

How Is My Mortgage Interest Rate Determined

Lenders determine your mortgage interest rate based on the type of loan you take out, your credit score, and the overall loan amount, as well as your down payment amount and the length of the loan.

- Loan Type: Government-backed loans are handled differently than conventional loans.

- : People with high credit scores generally receive lower interest rates. Although those with lower credit scores may still qualify, their mortgage terms may not be as favorable.

- Loan Amount: Your mortgage rate will be influenced by the total amount of money you need to borrow. Higher amounts tend to suggest higher interest rates.

- Down Payment Amount: A higher down payment can significantly lower your interest rate.

- Length of Loan: Long-term loans tend to bring lower monthly payments with higher interest rates, while short-term loans bring higher monthly payments and lower interest rates.

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserveâs monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

âThe pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year,â says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . âAdditionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.â

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : âMortgage rates are expected to end 2022 at 4.8%âand to decline gradually to 4.6%âby 2024 as spreads narrow.â

- NARâs Yun: âAll in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.â

- Matthew Speakman, senior economist at Zillow: âCompeting dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.â

Also Check: Do You Have To Pay Fees To Refinance A Mortgage

Are Fha Loans Fixed

Though the vast majority of FHA loans are 30-year, fixed-rate mortgages, other options are available, including both shorter-term fixed-rate mortgages and adjustable rate mortgages . In recent years, fixed-rate mortgages have been much more common, as home buyers have sought to lock in low interest rates. But if you dont plan to stay in the home long, an ARM may be worth a look.

The Advantages Of Being A First

There are 2 major advantages to being a first time home buyer: lower down payments and tax deductions on your mortgage payments.

Many first-time home buyers find that down payments are the biggest obstacle to purchasing a home. For a house that costs $250,000, most lenders expect borrowers to put at least 20% payment down on the homes purchase price. Most people simply dont have $50,000 or more lying around, though.

First-time home buyers can qualify for special first-time home buyer programs that offer down payments as low as 3%. For that same $250,000 home, youd only have to pay $7,500 down.

You can also qualify for first-time home buyer grants which are government-backed mortgages from the Federal Housing Administration if you have poor credit. These mortgages guarantee a down payment of 3.5% for first time home buyers with a credit score of at least 620 and a down payment of 10% for borrowers with a credit score of at least 580.

To qualify for an FHA loan, you must purchase private mortgage insurance. This protects your lender in the event that you default on a portion of your mortgage.

The other major benefit that first-time buyers receive is that certain mortgage expenses are tax deductible. For example, you can deduct the interest payments on your mortgage as long as your mortgage is secured by your home and is worth less than $1 million. You can also deduct up to $10,000 in state and local property taxes from your federal tax bill.

Also Check: How To See If You Qualify For A Mortgage

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youâll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loanâs interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

How Do I Apply For A Mortgage As A First

For your first mortgage, look for a lender that gives you personal attention, guides you through the process, and provides access to programs, such as state down payment assistance. Once you find a lender, you can apply for your first mortgage the same as any other borrower. Just be sure to tell your lender you may qualify for first-time home buyer programs.

Read Also: Are Home Equity Loan Rates Lower Than Mortgage Rates

Strategies To Get A Lower Interest Rate

Heres a recap of the best strategies to get a lower interest rate and save on your mortgage loan:

- Choose the type of mortgage that suits your needs best. Your loan officer can help you decide

- Shop around for the best deal. You could make huge savings

- Compare your mortgage Loan Estimates carefully. Pay close attention to the APR and the total youll pay in the first five years of your loan

- Negotiate. Dont be afraid to ask lenders for a better rate or lower fees

- Buy discount points if you can comfortably afford them

If you have extra time before you plan to buy or refinance, you can also:

- Boost your credit score before you apply

- Reduce your debts before you apply

- Save a bigger down payment. The higher your down payment, the lower your mortgage rate is likely to be

With those last three, theres only so much you can do. Few of us could save more at the same time were paying down debt.

But prioritize areas where you think you have the most room to grow as a borrower. And just do what you can. Because even a little can sometimes help a lot.

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580 to 620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers. Heres how to do that.

You May Like: Who Offers Interest Only Mortgage Loans

How To Navigate Current Mortgage Rates

The trick is getting rate estimates from multiple mortgage lenders and comparing them side by side to find your best rate. Its not a question of whats a good rate in general, but rather, whats a good rate for you personally.

Keep in mind that your mortgage interest rate depends on a number of factors, including:

Thats why experts say its so important to shop for your rate. Theres no way to know what a good mortgage rate looks like for you until youve compared your options.

Current Mortgage Rates: Are They Good For Buying A Home Right Now

The big increase in mortgage rates this year has taken a lot of potential homebuyers out of the market. That could present opportunities for you if you can afford the higher cost of borrowing money.

Homebuyers are facing less competition and prices are down compared to their all-time highs earlier this year, but theyre still high. If you can find a deal you can afford, it can still be a good opportunity. After all, nobody knows what mortgage rates and prices will be like next year, and buying a home is a lifestyle decision, not just a financial one.

If they find a house that they love, then they should absolutely pull the trigger, says Joe Allen, a senior mortgage lending officer at Quontic Bank, an online community development financial institution.

Don’t Miss: What Do You Need To Refinance Your Mortgage

Money’s Daily Mortgage Rates For December 1 2022

Almost all loan types inched higher yesterday, according to Money’s daily mortgage report.

The average rate on a 30-year fixed-rate mortgage increased by 0.026 percentage points to 7.826%. Rates on adjustable-rate loans also increased across the board. On the other hand, the rate on a 15-year fixed-rate loan moved down.

- The latest rate on a 30-year fixed-rate mortgage is 7.826%.

- The latest rate on a 15-year fixed-rate mortgage is 6.217%.

- The latest rate on a 5/6 ARM is 7.215%.

- The latest rate on a 7/6 ARM is 7.281%.

- The latest rate on a 10/6 ARM is 7.242%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on mortgage application data submitted to Freddie Mac by thousands of lenders across the country. The weekly rate averages are based on applications for conventional, conforming loans for borrowers with excellent credit who made a 20% down payment and no longer include discounts for points/fees paid.