How Much Money Should I Save For A House

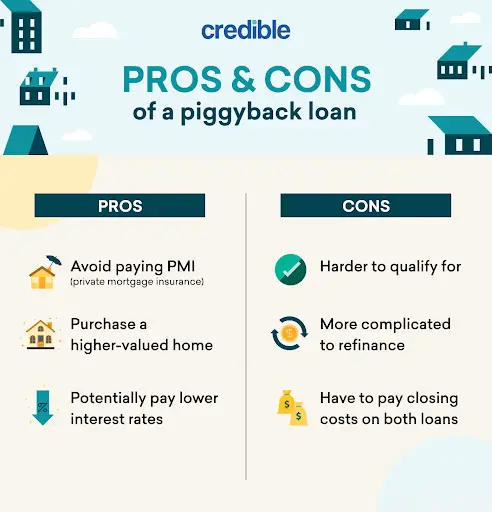

The more you can afford to put down on a house the less capital will accumulate interest. Further, outside of saving on interest payments, there is another benefit for putting down at least 20%.

For a standard conforming mortgage, it is ideal to put at least 20% down on the loan. Loans which have less than 20% down-payment have a loan-to-value above 80% & are required to carry property mortgage insurance , which is an additional expense paid by the home buyer to insure the lender will get paid in case the homeowner can not make payments. These insurance payments must be made until the LTV falls below 80% & are automatically removed when the LTV falls to 78%.

PMI ranges from 0.3% to 1.5% of the initial loan amount, with the consumer’s credit score & the down-payment amount factoring into the rate.

Whats The Minimum Down Payment For A Conventional Loan

If the title of this article didnt give it away, the minimum down payment you can make for a conventional loan is 3%. Most lenders add private mortgage insurance fees to your monthly mortgage payments when your down payment is less than 20%, but that hasnt deterred most Americans. In fact, 75% of first-time homebuyers put less than 20% down.

Example Of A Down Payment

The mechanics behind making a down payment are fairly straightforward. Imagine you find a house for sale, and you have an accepted offer to buy it for $500,000 with a 20% down payment. The down payment amount would be $100,000 = . This sum of money must be deposited in a timely manner into an escrow account that will be held until closing. At closing, it will be credited toward the final amount due.

Read Also: What Should My Mortgage Payment Be Based On Income

Down Payment Assistance Programs

Not everyone qualifies for a zero-down mortgage. Most borrowers need at least 3% down for a conventional mortgage or 3.5% down for an FHA loan. But what if you cant quite afford the minimum down payment? Three percent down on a $300,000 home is still $9,000 a considerable amount of money.

Luckily, there are grants and loan programs that can help.

For example, every state has multiple down payment assistance programs . These programs often funded by state and local governments and nonprofits offer money to make homeownership more accessible for lower-income or disadvantaged home buyers.

DPA funds can come in the form of a grant or loan, and the loans are often forgiven if you live in the home for a certain period of time. To find out whether youre eligible for assistance, ask your Realtor or lender to help you find and apply for programs in your area.

Why A 3% Down Conventional Loan Can Be A Smart Choice

- First-time homebuyersand people who havent owned a home in the last 3 yearscan enter the housing market sooner

- Instead of building your landlords home equity, you can start building yours

- You can buy a primary residence before rising property values price you out of the market

With a 3% down payment, first-time homebuyers can qualify for fixed-rate mortgages up to $625,000 for single-family homes, condos, townhouses, and planned unit developments . As the down payment is less than 20%, youll likely need to pay PMI until your home equity reaches at least 20%.

Also Check: How Much Would A Mortgage Be For 250 000

In This Situation Your Housing Needs Are About To Overwhelm Your Finances

You need more space immediately, but you dont have time to accumulate a larger down payment. A minimum down payment is the only way youll be able to afford to buy a house.

If your finances can accommodate it, you may need to buy a house with the smallest down payment. Naturally, it will go better for you if youre buying less house than you can afford. And it will be even better if you have rich relatives to turn to if things turn sour.

How Much House Can I Afford

Everyones budget and financial goals vary. How much house you can afford comes down to a number of factors, including what you earn and what you owe. Youll also want to consider how much you want to save for retirement, school and other expenses down the road.

Here are a few basic factors that go into what you can afford:

Also Check: What Do You Need For Pre Qualifying Mortgage

Dont Give Up Your Dream Of Homeownership

If you havent explored your options or spoken with someone with experience in finance or real estate, you could be selling yourself short, says Fuller. I once had a client literally shaking in my office because she was so concerned about her , and three months later, we closed the loan on her first home.

Fuller recommends signing up for homebuying counseling programs in your community.

If you dont know whats holding you back, youre already a step behind, says Fuller. Speaking with an expert is the best way to figure out what to do next.

How Do Fed Rate Hikes Affect Mortgages

The Federal Reserve has been increasing the federal funds rate to try to slow economic growth and get inflation under control. So far, inflation has slowed somewhat, but it’s still well above the Fed’s 2% target rate.

Mortgage rates aren’t directly impacted by changes to the federal funds rate, but they often trend up or down ahead of Fed policy moves. This is because mortgage rates change based on investor demand for mortgage-backed securities, and this demand is often impacted by how investors expect Fed hikes to affect the broader economy.

As inflation starts to come down, mortgage rates should, too. But the Fed has indicated that it’s watching for sustained signs of slowing inflation, and it’s not going to stop hiking rates any time soon though it may start opting for smaller hikes at its next couple of meetings.

You May Like: Are Mortgage Origination Fees Negotiable

Should I Put 5% Or 10% Down On My Home

Our clients live exciting lives that we like to live vicariously through. Weâve had quite a few of you start the process of purchasing a home this year! Planning around a home purchase is a big part of our service offering for clients. Questions that come to mind are⦠How much should our down payment be? Whatâs the advantage of putting 5% down versus 10% down? Does anyone put down 20% anymore? Letâs dive in.

â«â«â«

Should You Put 20% Down

Putting 20% down to avoid PMI is a smart move if you can easily afford it. But the idea that you should always put 20% down on a house is a myth.

In reality, most people put down a lot less.

The average buyer puts just 13% down on a house. That figure drops to 8% for buyers below the age of 30. And some mortgage loan programs allow as little as 3% or even zero down.

If a 20% down payment would leave you house poor, paying less could absolutely be the right move.

In this article

> Related:How to buy a house with $0 down: First-time home buyer

You May Like: What Are The Repayments On A 150k Mortgage

Why You Don’t Have To Spend 20%

The 20% rule is a middle-ground number for most potential homeowners. You don’t have to settle with a high percentage of the cost of your home. Instead, you can find a way to pay between 3-10%, or even less.

As stated earlier, your lender will be a deciding factor between you and cheaper down payments. Before you try negotiating a lower fraction of the total cost, try looking at your credit history and current income. This is likely to sway your lender to allow a lower down payment. If you can quickly increase your credit score then the loan should automatically become cheaper.

Comparing Different Mortgage Terms

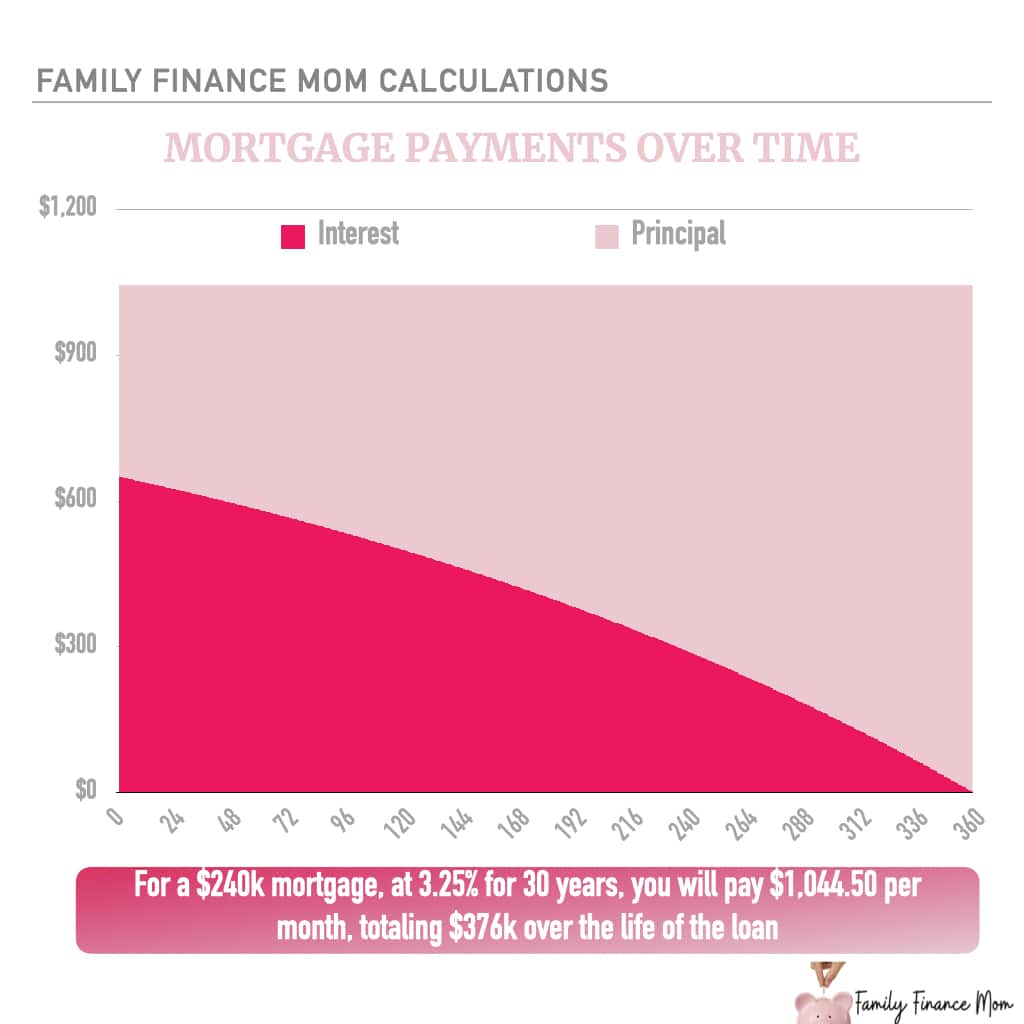

The 30-year fixed mortgage is the most popular loan for homeowners. This type of loan has a number of advantages, including:

- Lower monthly payment: Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower payments spread over time.

- Stability: With a 30-year mortgage, you lock in a consistent principal and interest payment. Because of the predictability, you can plan your housing expenses for the long term. Remember: Your monthly housing payment can change if your homeowners insurance and property taxes go up or, less likely, down.

- Buying power: With lower payments, you can qualify for a larger loan amount and a more expensive home.

- Flexibility: Lower monthly payments can free up some of your monthly budget for other goals, like saving for emergencies, retirement, college tuition or home repairs and maintenance.

- Strategic use of debt: Some argue that Americans focus too much on paying down their mortgages rather than adding to their retirement accounts. A 30-year fixed mortgage with a smaller monthly payment can allow you to save more for retirement.

That said, shorter-term loans have gained popularity as rates have been historically low. Although they have higher monthly payments compared to 30-year mortgages, there are some big benefits if you can afford the upfront costs. Shorter-term loans can help you achieve:

You May Like: How To Market Yourself As A Mortgage Loan Officer

Should You Strive To Put Down 20%

A 20% down payment is a significant amount of money for most people. According to Opendoors report, 82% of Gen Xers and 93% of millennials say theyd need to save up for a down payment. For some people, it can make more sense to put down less and accept a higher interest rate and monthly payment if it means building equity in a home instead of paying rent elsewhere.

But putting down 20% or more is an important goal for those who want to spend less overall on their mortgage. It can make the home more affordable by helping you save money over time with lower interest rates and monthly payments, says Aziz.

So while making a 20% down payment isnt a hard-and-fast requirement when it comes to buying a home, its a good idea if you can pull it off. But dont assume that youll be locked out of the homebuying market just because you dont have a lot of cash. Instead, look at your options and consider whether making a down payment of less than 20% makes sense for you.

What Are The Advantages Of Putting 20% Down

Obviously, the biggest advantage of not making a 20% down payment is that you dont have to come up with as much cash to buy a home. But what are the advantages of putting 20% down?

Recommended Reading: How Much Income For 500k Mortgage

Where Mortgage Insurance Comes Into The Picture

If you put 5% down on a home purchase in Seattle, Washington, you might be required to pay for mortgage insurance. These policies are usually required when the loan-to-value ratio rises above 80%, which is what happens when you put down less than 20%.

In the grand scheme of things, mortgage insurance is not particularly expensive. But it does increase the size of your monthly payments, so its something to consider.

For many Seattle-area home buyers, the ability to make a smaller down payment more than makes up for the slight increase in payments brought on by mortgage insurance.

How Credible Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

You May Like: Does Freedom Mortgage Accept Credit Card Payments

How Little Can A Down Payment Be

Well, $3,000 is not enough for a down payment on most houses, says Jill Gonzalez, an analyst with WalletHub. The lowest percentage of down payment required is 3.5% for an FHA loan. So $3,000 would be enough for an approximately $85,000 loan, although thats way below todays median home price of $300,000.

Suppose you do find a home for $85,000, congratulations! But lets say you have a few thousand dollars saved and find a more expensive home that would have you putting down less than 20% of the purchase price. In that case, keep in mind that borrowers who pay less than 20% typically have to pay private mortgage insurance, or PMI. The PMI is in addition to a monthly house payment, and typically ranges from 0.5% to 1% of your loan amount each year.

These Are The Latest Mortgage Rates And They Dropped From This Time Last Week

Mortgage rates in the U.S. for Tuesday, Jan. 10, increased day over day and were down from the same time last week, according to data from Bankrate.

30-year fixed-rate loans

The average daily rate for 30-year, fixed-rate mortgages was 6.65%, up 14 basis points from 6.51% the previous day and down 18 basis points from a week ago.

The refinance rate for 30-year, fixed-rate loans was 6.69%, rising 18 basis points from the previous day and a decrease of 8 basis points from the same day last week.

15-year fixed-rate loans

A 15-year, fixed-rate mortgage averaged 5.91%, rising 2 basis points from the prior day and down 2 basis points from the prior week.

Jumbo mortgages

For jumbo loans, which cover properties that are more expensive than those under a conventional conforming loan , the rate was 6.65%, an increase of 17 basis points from the previous day and down 23 basis points from the last week.

ARMs

As for 5/1 adjustable-rate mortgages, which carry a fixed rate for five years that can then rise or fall each year after, the average was 5.50%, declining 1 basis point from the prior day and flat from last week.

FHA and VA loans

The rate for 30-year, Federal Housing Administration-insured mortgages was 6.02%, up 12 basis points from the previous day and down 13 basis points from seven days prior. Mortgages backed by the Department of Veterans Affairs reached a rate of 6.04%, rising 15 basis points from the previous day and up 6 basis points from the previous week.

Also Check: Can You Shop Around For Mortgage Insurance

What Are The Zero

For most zero-down payment home loans, there are certain criteria buyers have to meet, and many people dont qualify. Certain groups like health care workers, educators, protectors, veterans and households with disabled members can qualify for specific programs. Requirements vary, but many of these programs are available to first-time buyers or those who havent owned a home for at least the past three years. The home theyre buying usually has to be their primary residence, too.

Down Payment Assistance programs: These programs are often offered by state, county, or city governments that provide DPA support in the form of a grant or a second mortgage to cover the cost of their down payment, sometimes with benefits such as zero percent interest and deferred payments. These programs are usually run by government agencies or nonprofits, although there are lenders out there that do offer DPA loan programs.

Below-market first mortgages: Also known as first-time home buyer programs, these are below-market interest rates with reduced closing costs or fees. Theyre typically funded by state housing finance agencies as a way to help lower upfront and ongoing costs for some first-time buyers.

Tax credit or mortgage credit certificate : The MCC is a tax credit that allows certain first-time home buyers to offset a portion of their mortgage interest, up to $2,000 per year, which also helps buyers qualify for a loan because it counts toward monthly income.

How Much Is A Down Payment On A House

How much youre required to put down on a house is determined by the type of loan you get, but it generally ranges from 3% to 20% of the purchase price of the home. Beyond lender requirements, it can be financially beneficial to increase your down payment to reduce the amount of your monthly mortgage payment. Offers with larger down payments can be more appealing to home sellers who are looking for buyers with a low risk of financing issues that could delay the sale or worse, have it fall through.

Also Check: Is Pmi And Mortgage Insurance The Same Thing