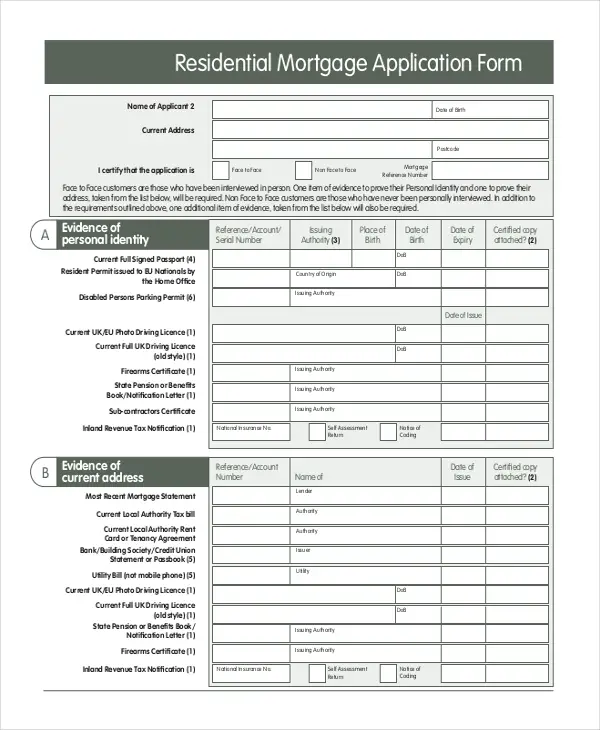

Add Your Form To Your Website

Now that youve built your online mortgage application using the template, you can add it to your WordPress website. WPForms lets you add your forms to other locations on your site, including your blog posts, pages, and even sidebar widgets.

To begin, create a new page or post in WordPress, or simply update an existing one for your simple loan application form. After that, add a new block and select the WPForms icon.

The easy-to-use WPForms widget will appear inside your block. Click on the WPForms dropdown and pick the form you want to insert into your page.

Now, click Preview, and youll see your mortgage application form as itll appear on your website.

If youre satisfied with the way your mortgage form looks, hit Publish, and your form will go live on the Internet.

To view mortgage application form entries after theyre submitted, check out this complete guide to form entries.

For example, you can view, search for, filter, print, and delete any mortgage application entries, making the pre-qualification process that much easier.

When Should I Apply For A Mortgage

The general advice is to begin the mortgage application process before you start house hunting. Having financing in place early on will put you at an advantage to other buyers and will reduce the chances of delays once youve found a house. Applying early also means youll have a more accurate picture of how much you can spend.

What Do You Need To Bring With You

- Several pieces of government-issued identification, preferably those including a photo.

- Your current address and at least two previous addresses .

- If youre renting, a letter from your landlord confirming your rent history.

- The name and address of your current employer and past employers .

- Proof of employment, including pay stubs or other proof of income , your position with your current employer and past employers depending on how long youve been working there. Other useful documents include a T4 or, if you are self-employed, Notices of Assessment for the previous two years.

- Proof of a down payment and where your down payment will come from . If a family member will be paying for a portion of your down payment, you will also need a signed letter from them acknowledging the purpose of the gift, and that it is non-repayable.

- Recent financial statements for the past several months to show your down payment as well as the contact information for your bank.

- Your current debts and other financial obligations .

- Information about the property you are looking to purchase, including a copy of the MLS listing, a signed Offer to Purchase, cancelled deposit checks, copies of previous appraisals, building specifications, current property tax statements, heating costs and condominium fees once you have made an offer on a home.

Read Also: Why Is My Mortgage So High

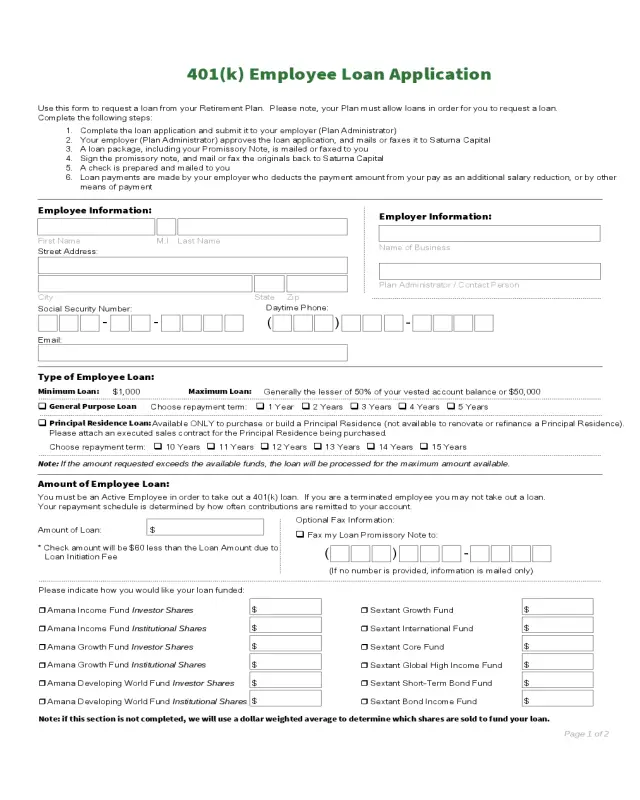

Type Of Mortgage And Terms Of The Loan

- Loan Type : Most, if not all, investment property loans are conventional or jumbo, which falls into the other category.

- Lien Position : Most loans on investment property are first liens. There are 2nds, but theyre much harder to find these days.

- Amortization Type : Most people prefer fixed loans, but ARMs are an excellent tool to increase cash flows because of lower interest rates on investment property.

- Purchase Price: The contract price. Not applicable for refinance transactions.

- Loan Amount: How much money you are borrowing after your down payment?

- Interest Rate: This is the actual note rate, not the annual percentage rate which varies based on closing costs.

- Loan Term : For example, a 30-year fixed loan would have a loan term of 360 months.

Avoid Applying For New Credit

Once you start contacting lenders, it’s a good idea to avoid applying for any new credit. Doing so can throw a wrench in the mortgage application process. Your lender may require you to write a letter outlining why you applied for the new credit, for example, and that can hold up the mortgage application process.

Recommended Reading: What Is The Mortgage Rate In Florida

Buying A House With Bad Credit

One potential barrier for getting a mortgage can be your credit history, particularly if you have a history of missed payments, defaults or insolvency. Checking your credit report thoroughly before you even apply can help ensure you are aware of any errors or problems that might concern a lender. If you do have issues, you can find more information in this article on helping improve your credit history.

If you are interested in checking details of your credit history and getting an indication of how creditworthy a lender may find you, you can get online access to your credit report with your Equifax Credit Report & Score. It’s free for 30 days and £7.95 a month thereafter.

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your likelihood of being approved by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

Also Check: What Does It Mean Refinance Mortgage

What If You Have Private Student Loans

Unfortunately, private student loans are not eligible for forgiveness. If you do have private student loans and want to save, it may worth looking into refinancing, which can qualify you for better repayment terms, including a lower interest rate.

Note that if you have federal student loans and want to refinance them to get a lower rate, you’ll also lose any federal protections. Select ranked the following as some of the best student loan refinancing companies:

-

No origination fees to refinance

-

Eligible loans

Federal, private, graduate and undergraduate loans, Parent PLUS loans, medical and dental residency/fellowship loans, plus special pricing and reduced rates for health-care professionals

-

Fixed rates

From 3.99%

-

Loan terms

5, 7, 10, 15, 20 years

-

Loan amounts

For bachelor’s degrees and higher, minimum $5,000 for eligible associate degrees in the health-care field, up to $50,000 in loans for non-ParentPlus refinance loans

-

Minimum credit score

-

No origination fees to refinance

-

Eligible loans

Federal, private, graduate and undergraduate loans, Parent PLUS loans, medical and dental residency loans

-

Fixed rates

From 3.99%

-

Loan terms

5, 7, 10, 15, 20 years

-

Loan amounts

From $5,000 over $10,000 for medical/dental residency loans

-

Minimum credit score

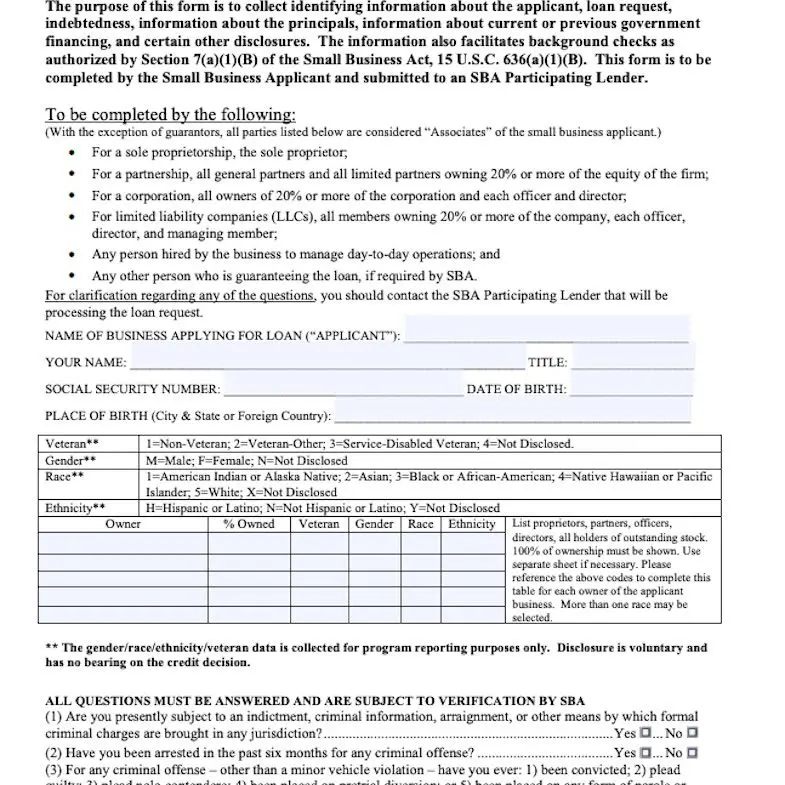

What Is The Most Common Loan Application Form

The 1003 mortgage application, also known as the Uniform Residential Loan Application, is the standard form used by nearly all mortgage lenders in the United States.

When filling out a bank loan application form you will be asked?

Here are some of the key questions you should ask before starting an application:

What is the best reason to put on a personal loan application?

Here are the top nine reasons to get a personal loan.

- Debt consolidation. Debt consolidation is one of the most common reasons for taking out a personal loan.

- Alternative to payday loan.

Read Also: Can A Mortgage Loan Be Used For Renovations

A Complete Instructions In Editing Fill In Mortgage Application On G Suite

Intergating G Suite with PDF services is marvellous progess in technology, able to streamline your PDF editing process, making it quicker and more cost-effective. Make use of CocoDoc’s G Suite integration now.

Editing PDF on G Suite is as easy as it can be

- Visit Google WorkPlace Marketplace and get CocoDoc

- install the CocoDoc add-on into your Google account. Now you are all set to edit documents.

- Select a file desired by hitting the tab Choose File and start editing.

- After making all necessary edits, download it into your device.

Before You Begin: Basic Documentation Required For A Mortgage

The mortgage application process involves a lot of paperwork, so its best to gather as much as you can before you begin house hunting. While the exact documents youll need may vary, heres what you can expect the lender will ask:

- Social Security number

- Pay stubs from the last 30 days

- Bank statements from the last 60 days

- W-2s or I-9s from the past two years

- Proof of any other assets and sources of income

- Information and documentation on any current debts

Depending on your situation, the lender may request additional documents. For instance, if youve been renting, you may need to provide records proving your rental history for the past two years. Or, if youre divorced, the lender may ask for a copy of your divorce decree showing whether you have to pay alimony or child support.

Also Check: Who Qualifies For A Jumbo Mortgage

Employment And Income History

When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. Thats why lenders request two years worth of W-2 tax forms and contact information for your employer. Essentially, lenders want to ensure that you can handle the added financial burden of a new mortgage.

Youll also be asked to provide salary information, so a lender has evidence that you earn enough money to afford a mortgage payment and related monthly housing expenses. Youll also have to provide 60 days of bank statements to show that you have enough cash in hand for a down payment and closing costs.

What Can You Do If Your Mortgage Application Is Refused

If your mortgage application is declined, there may be a few different reasons the lender has made this decision. Firstly, it might be a good idea to check that all the information you provided is correct, its not impossible for either a borrower or a lender to make a mistake, so review everything carefully.

If you are not earning enough, or you are spending too much, the lender might have decided that you would not be able to afford your repayments. In this case, it might be wise to rethink the size of the mortgage you are able to get and to also think about how to better budget your spending. It is also possible to get something called a guarantor mortgage, this is when another person, usually a relative or close friend, agrees to accept responsibility for the debt, in the event that you are unable to keep up repayments.

Don’t Miss: How To Get A Conventional Mortgage

Get An Agreement In Principle

An agreement in principle also known as a decision in principle or mortgage in principle is a statement from a lender outlining how much theyre prepared to lend you, before you formally apply for a mortgage. While its not a guarantee, it gives you a pretty good idea of how much youll be able to borrow so is very helpful when it comes to budgeting.

Things To Know About Homeowners Insurance

Also Check: What Is The Mortgage Payment For A 150k House

What Is A Mortgage Application

A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrowers financial situation and employment history, and more. Lenders use the information in a mortgage application to decide whether or not to approve the loan.

Configure Your Mortgage Form Notifications

Notifications are a superb way to email others when a mortgage application form is submitted on your website.

Unless you disable this feature, whenever someone submits a mortgage application form on your site, youll get a notification about it.

If you use Smart Tags, you can also send a notification to the site visitor when they fill out a mortgage application, letting them know you received their application, and youll be in contact. This assures your clients that are applying for a mortgage that their form has gone through.

For help with this step, check out our documentation on how to set up form notifications in WordPress.

WPForms also lets you notify others when a mortgage application form is submitted. For instance, you can send a notification to yourself, the person submitting the request, and your:

- Mortgage Loan Officer

For help doing this, check out our step-by-step tutorial on how to send multiple form notifications in WordPress.

Last, if you want to keep branding across your emails consistent for your financial institution, you can check out this guide on adding a custom header to your email template.

You May Like: What Happens To My Mortgage If I Die

What Are The 6 Pieces Of Information Mortgage Application

When filling out the app, here are the six main pieces of information your loan officer will ask:

Once the above is complete your file will move through the processing department to verify everything and then onto underwriting. If youre purchasing a home, add to that list a signed sales contract.

Avoid Falling Behind On Paid Debts

If you want to get a new loan, you should make sure you dont fall behind on any of the payments you already owe. If you dont pay on time, your credit score could go down, you could get in trouble with the law, and your wages could be taken. These are some probable negative repercussions.

You can avoid these problems by making sure all of your payments are up to date and by making a budget for your money that gives you enough money to pay your monthly bills. If your expenses exceed your expectation, then you can apply for guaranteed installment loans direct lenders only.

You need to have a conversation with your lender if you are having problems paying your payments on time, and you should ask for assistance. Its possible that theyll be able to locate a solution thats inside your price range by working with you.

Also Check: What Is Your Mortgage Rate

Stated Income Or Stated Asset Mortgage

This type of mortgage is based on the income that you report to the lender without formal verification. Stated income loans are sometimes also called low-documentation loans because lenders will verify the sources of your income rather than the actual amount.

Self-employed people should be prepared to provide a list of their recent clients and any other sources of cash flow, such as income-producing investments. The bank may also want a copy of Internal Revenue Service Form 4506 or 8821.

Form 4506 is used to request a copy of your tax return directly from the Internal Revenue Service , thus preventing you from submitting falsified returns to the lender. It costs $43 per return, but you may be able to request Form 4506-T for free. Form 8821 authorizes your lender to go to an IRS office and examine the forms you designate for the years you specify, free of charge.

How Much Does Applying For A Mortgage Affect Your Credit Score

Applying for a mortgage generally only lowers your score by around five points or less and the effect is only temporary, lasting around a year. If you complete all of your rate shopping within 14 days, it will be recorded as a single inquiry on your credit report, limiting the hit to your credit score.

Recommended Reading: Can I Refinance My Mortgage If I Have Bad Credit