How Do I Get The Best Mortgage Rate

To get the best mortgage interest rate for your situation, its best to shop around with multiple lenders.

According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings.

Interest rates help determine your monthly mortgage payment as well as the total amount of interest youll pay over the life of the loan. While it may not seem like much, even a half of a percentage point increase can amount to a significant amount of money.

Comparing quotes from three to four lenders ensures that youre getting the most competitive mortgage rate for you. And, if lenders know youre shopping around, they may even be more willing to waive certain fees or offer better terms for some buyers. Either way, you reap the benefits.

How Much House Can I Afford

Income is the most obvious factor in how much house you can buy: The more you make, the more house you can afford.

However, it also depends on how much of your income is already spoken for through debt payments as well as your credit score and history. The more debt you have, the less likely you will be approved for a mortgage or one at a lower interest rate. Your credit score also plays a role in that the higher your score, the better loan rate and terms you will receive.

And of course, if you have a larger down payment, it will help you in all these factors for affording a home.

How Do I Get The Best Mortgage Interest Rate

The right deal for you will depend on your circumstances and what you want from a mortgage. In most cases you’ll need to meet certain conditions to qualify for the most competitive rates on offer.

Follow these steps to increase your chances of getting a great deal:

- Have a good credit record. Lenders are very thorough in checking your credit history when assessing your application – they want to know that you are good at repaying debt, so the better your credit score, the better your chances of being approved. Find out more in our guide to how to improve your credit score.

- Build a bigger deposit. The best rates are reserved for people borrowing at a lower loan to value ratio – i.e. borrowing a relatively small percentage of the property price. You can achieve this by saving a bigger deposit, or, if you already own a property, increasing your equity by paying down your mortgage each month.

- Shop around. There are dozens of different mortgage lenders, from the big, high-street names you are familiar with to challenger brands that are exclusively online. Each will have a range of different products on offer, and it pays to take time working out the most suitable deal for you.

- Use an independent, whole-of-market mortgage broker. Not only are mortgage brokers familiar with the different products on offer and able to advise on the lenders most likely to accept you, but they have access to mortgage deals which you can’t get by applying directly.

Also Check: How Are Points Calculated On A Mortgage

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Get Help Paying Off Your Credit Card Balance For Good

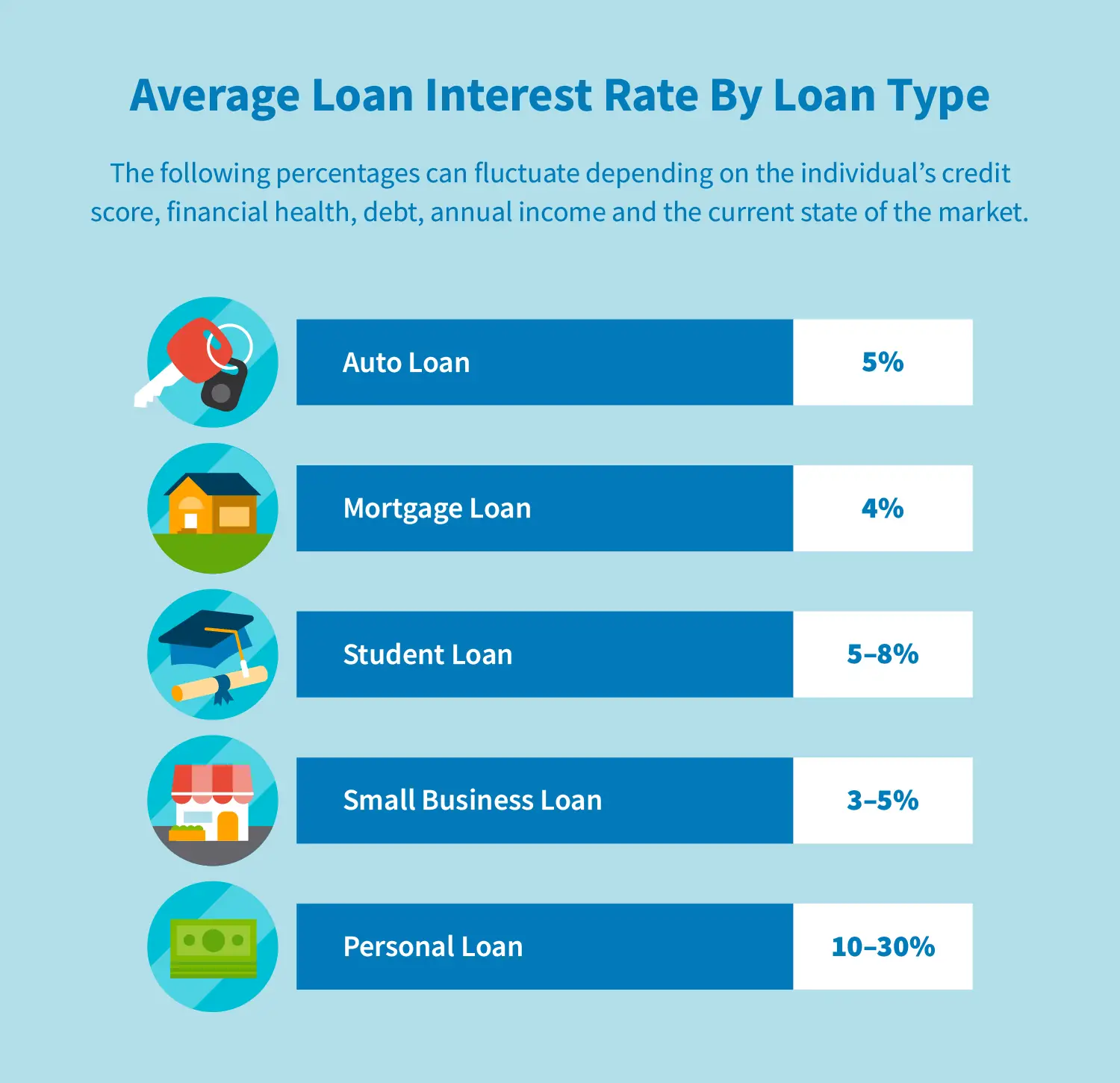

While borrowing money to finance college or a first home is generally seen as a financially sound move, carrying a balance on a credit card is a big no-no thanks to their high, double-digit interest rates.

Balance transfer cards let you transfer your existing credit card debt to a new card with an introductory 0% APR period so you can pay off your outstanding credit card debt in a set timeframe and don’t have to worry about accruing additional, costly interest charges.

For example, the U.S. Bank Visa® Platinum Card offers an introductory 0% interest for the first 18 billing cycles on both balance transfers and new purchases . That’s a long period of time that you can chip away at your credit card debt without it growing month over month . The 0% introductory APR applies to balance transfers made within 60 days of account

Recommended Reading: How Does Rental Income Count For Mortgage

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates â personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

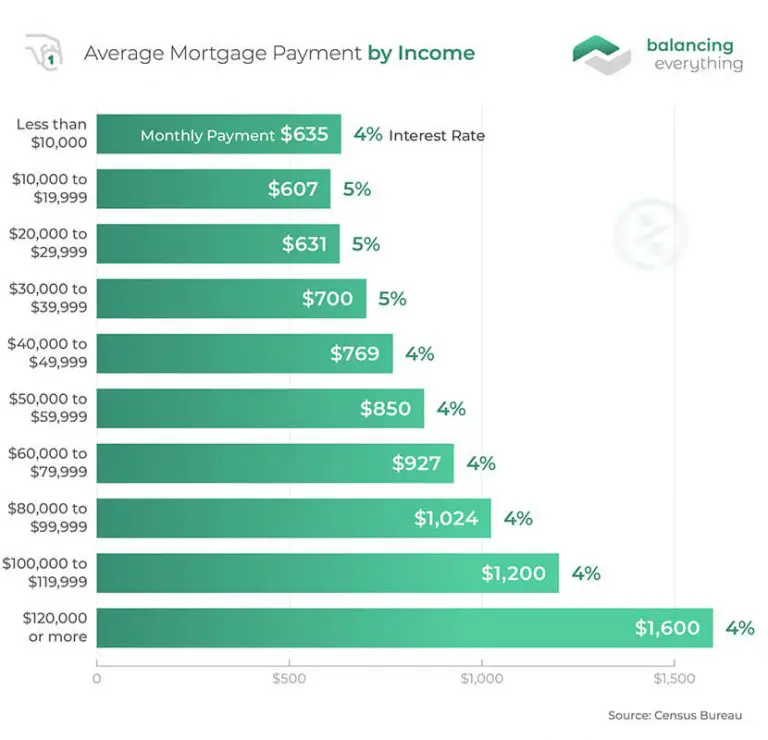

Mortgage Payments By Income

Just like the average mortgage payment in Utah is different from payments elsewhere, this segment varies by income, as well. According to the data provided by the US Census Bureau, Americans making the most money have the highest average house payments per month. People from this income group, interestingly, dont have the highest median interest rate.

The highest mortgage interest rates are reserved for Americans making between $10,000 and $39,999. Those from the $10,000-19,999 income group are among the consumers paying the highest interest rate. Yet, they boast the lowest typical mortgage payment per month.

As you can see in the table above, households making $120,000 or more pay the highest median mortgage of about $1,600. Those making $10,000-19,999 meanwhile pay the lowest median mortgage payment per month of $607.

The difference between the highest and lowest median payments is an impressive $993. The first group gets better median rates of 4%, while the latters median mortgage rate is 5%.

Don’t Miss: How Many Tax Returns For Mortgage

Mortgage Rates Soared This Week With The Average Rate For A 30

Mortgage rates soared this week with the average rate for a 30-year fixed-rate mortgage climbing to 3.69%. Thats a 0.14 percentage point jump compared to last week and the highest the 30-year rate has been in nearly two years.

Rates for other loan categories in Freddie Macs weekly report are also higher. The 15-year fixed-rate mortgage is averaging 2.93% while the average rate for a 5/1 adjustable-rate mortgage is up to 2.80%. All rates are for on borrowers with the strongest credit scores.

Key Mortgage Terms Explained

We know that when it comes to choosing a mortgage, there’s a lot of jargon to get your head around. That’s why we’ve listed some common mortgage terms here.

Loan-to-value

This represents the percentage of the property value you want to borrow. For example, a £100,000 property with an £80,000 mortgage would be an 80% LTV. The maximum LTV we’ll lend you depends on your individual situation, the property, the loan you choose and the amount you borrow.

Initial interest rate This is the initial percentage rate at which we calculate the interest on the mortgage.

Variable rateWhen your initial mortgage rate ends, the interest on your mortgage will be calculated using the HSBC Standard Variable Rate or HSBC Buy to Let Variable rate. This will vary over the term of the loan and is set internally. HSBC Standard Variable Rate and HSBC Buy to Let Variable Rate do not track the Bank of England base rate.

Initial interest rate period This is the period during which the fixed or tracker rate applies. For fixed and tracker rate mortgages, when the specified period expires, the rate will revert to the HSBC Standard Variable Rate/Buy-to-let Variable Rate.

Annual Percentage Rate of Charge The APRC represents the overall cost for comparison and can be used to compare mortgages.

Booking feeA fee charged on some mortgages to secure a particular mortgage deal.

Annual overpayment allowance

Recommended Reading: Can You Pay Off Mortgage Early Without Penalty

Should Brits Take A Mortgage Holiday

Our analysis looks at what repayment holidays might mean in the long term for mortgage holders in three different scenarios:

- Scenario 1: First-time buyer, 1 year into their 30-year mortgage of £170,000.

- Scenario 2: Mid-late 30s with a family, with a 20-year mortgage worth £220,000.

- Scenario 3: Older homeowner, with 7 years left to pay their remaining mortgage balance of £55,000.

| £788.72 |

Matthew Boyle, mortgage specialist, reflects on the the housing market through the pandemic

“The UK’s coronavirus lockdown saw the housing market and the mortgage market effectively paused during spring 2020. Many lenders cut the number of products they had on offer, particularly at higher LTVs, as they concentrated on their existing mortgage customers and dealing with mortgage holiday requests.

However, as property viewings and sale completions started to return post-lockdown, the housing market has shown to be surprisingly robust in terms of asking prices. In turn, we are beginning to see a larger number of mortgage deals become available to home buyers again. Despite a flat few years in the country’s house-selling sector, the size of the UK’s mortgage market has remained steady. In the third quarter of 2019, the outstanding value of all residential mortgage loans stood at £1.49 trillion 3.9% higher than it was a year earlier.

What is the size of the mortgage market?

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

Recommended Reading: Where To Find Lowest Mortgage Rates

How Rate Changes Could Affect Your Mortgage Payments

If you have a fixed-rate mortgage, youll continue to pay the same amount each month during your fixed-rate period. You can book a new fixed rate up to 120 days before this period ends. That way, you avoid spending time on our Standard Variable Rate after your rate has expired and, as long as you dont want to leave your existing fixed rate early, you won’t incur early repayment charges.

If you have a tracker rate mortgage or a variable rate mortgage linked to the Bank of England base rate, the amount you pay may change when there are changes to the base rate.

If your mortgage is on our Standard Variable Rate, the amount you pay may change when this rate changes.

Well let you know if your interest rate changes and what effect that change will have on your monthly payments.

You can switch to a new rate if youre on:

Median Household Income Vs Monthly Household Expenses

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-brian-oneill-exp.jpeg)

If we take the figures above at face value, this means that in 2021, a four-person household spent nearly $8,000 each month. This is compared against the median household income of $9,520.

As you’d notice, this leaves barely any headroom in the household budget for savings, investments, insurance and other important financial needs.

Perhaps this is why Singaporeans are often ranked as the most stressed out in the world?

Recommended Reading: What Is The Minimum Down Payment Required For A Mortgage

You Might Buy More Home Than Youre Comfortable With

Another thing to consider when getting a 30-year mortgage is that you might end up buying more house than you can take care of or manage. Bigger houses tend to have higher upkeep costs. They also tend to require more care and attention compared to smaller, less expensive homes. For example, if you buy a home with a large yard, someone will need to take care of the yard.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Recommended Reading: How Much Will I Save If I Refinance My Mortgage

How Much Is The Average Mortgage Payment

HomeMortgagesMortgage GuidesHow Much is the Average Mortgage Payment?

While looking at indicative mortgage rates online is not complex, understanding exactly what that mortgage product will cost you is! There are thousands of different types of mortgages, repayment options, product terms, and interest rate calculations to get to grips with.

If you have ever spent hours nurturing a headache on a price comparison site, you will appreciate that the numerous variables, and potential for additional application fees, can make it pretty impossible to make a clear judgement about which mortgage products are the most affordable.

In this guide, Think Plutus breaks down mortgage costs into manageable chunks, explaining the factors influencing your overall mortgage payment and how much you might anticipate budgeting per month for repayments.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

You May Like: How To Become A Mortgage Broker In Fl

Average Monthly Payments On A Mortgage

How much should you pay on a mortgage each week or month? Of course, it depends on the size of the mortgage, your deposit, the house value and your own incomings and outgoings.

Its really important to make sure you budget, and check you can afford your own repayments our mortgage affordability calculator can help you out.

The Bottom Line: Medians And Averages Are Just A Guide

Information is power and when youre considering making a substantial purchase like a property, its important to take advantage of all the information available to determine if youre financially ready to buy a house. But remember that these medians and averages are just a guide, and the specific details of your loan will depend on the home price, the size of your down payment, the number of extra payments you make and your interest rates.

If youre looking for more ways to be financially frugal, learn more about how to lower your mortgage payment!

Protect yourself from rising rates for 90 days.

Lock in today’s rate with RateShield®.1

Recommended Reading: When Can I Remove The Pmi From My Mortgage

Where Can I Compare Mortgage Interest Rates

There are many price comparison sites that allow you to compare mortgage interest rates, based on your own personal criteria.

It’s important, however, to not focus solely on the rate that a lender offers, but the total cost of the mortgage across the term of the deal. This way, you’ll factor in any fees and cashback associated with the deal as well as the interest being charged.

This is where the APRC can help.

What Was The Average Mortgage Rate In 1920

While its hard to get an apples-to-apples comparison of mortgage rates before the advent of the 30-year fixed, the National Bureau of Economic Research does have a chart detailing rates from 1920 to 1956. From about 1920 until 1934, conventional mortgage rates averaged close to 6%, and then began to decline to a low point of just under 4.5%.

What was the interest rate for a mortgage in 1964?

Mortgage Rates from 1964. This is based on Reserve Bank data and shows that interest rates have never been lower since records began in 1964. This is only to February. The latest drop is not factored in. You can in fact get many mortgages for under 5% now.

Recommended Reading: How Is Debt To Income Ratio Calculated For A Mortgage