Calculating Principal And Interest

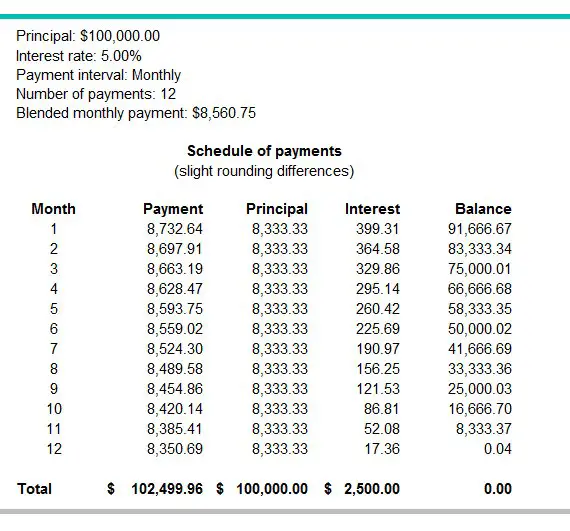

Once you have determined the logistics of your mortgage, including the duration of your repayment, the amount borrowed and your interest rate, your bank will disclose what your monthly payment will be. This figure will take into account both your mortgage principal and the interest accruing on the principal. In the early stages of your mortgage, you should plan on paying back much more interest than principal. The reason for this can be explained as follows. If, for example, you have taken out a $417,000 mortgage to pay for your property in the Bay Area at a 5 percent interest rate, your monthly payments will be $2,239. In order to determine what proportion of this payment is interest and principal, do the following.

First, convert your annual interest rate from a percentage into a decimal format by diving the figure by 100. So, 5/ 100 = 0.05. Next, divide this number by 12 to compute your monthly interest rate. Following this formula, your monthly interest will be 0.00416. Now, multiple this number by the total principal : $417,000 * 0.00416 = $1,734.72.

Therefore, $1,734.72 of your first months payment will be interest. Subtract this figure from your monthly payment to determine what amount of your payment is reducing your principal balance: $2,239 – $1,734.72 = $504.28.

You can use this formula on a monthly basis by reducing the principal balance by the amount of total principal you have already paid.

References

Mortgage Principal Reduction From Citi

Citi, another major lender, has streamlined and improved its existing loan modification program, as well as increased the number of mortgages and home loans with PR. They attempted to replicate the FDIC/IndyMac model, which is an aggressive approach to reworking delinquent loans and assisting struggling homeowners. Furthermore, the majority of the assistance they are providing is part of the Citi Homeowner Assistance program.

The mortgage principal reduction program employs a simple and effective formula to calculate an affordable payment for the homeowner based on a percentage of the borrowers gross income. Citi will then reduce the monthly payment on that mortgage to that amount once they have that amount. And, increasingly, these reductions include principal forgiveness in addition to interest rate reductions.

How Many Mortgage Principals Have Been Reduced

The federal government does provide data, and they report on it. Loan modifications that included mortgage principal reductions or write-offs as part of the process increased from 3.1 percent in the first quarter of 2009 to more than 10 percent in the second quarter of last year, according to data from the Office of the Comptroller of the Currency. From there, the percentage has risen steadily. Also, the percentage of loan and mortgage modifications involving principal reduction increased to nearly 13 percent in the third quarter of last year. You may wonder why a bank would provide this service. Not only does data show that providing this type of assistance will reduce the number of foreclosures, but another important reason is psychological.

Also Check: What Is P& i In Mortgage

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

Also Check: What Is Rocket Mortgage Fieldhouse

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

What Is Principal And Interest On A Mortgage Payment

Calculate principal and interest | Mortgage payment breakdown | FAQs

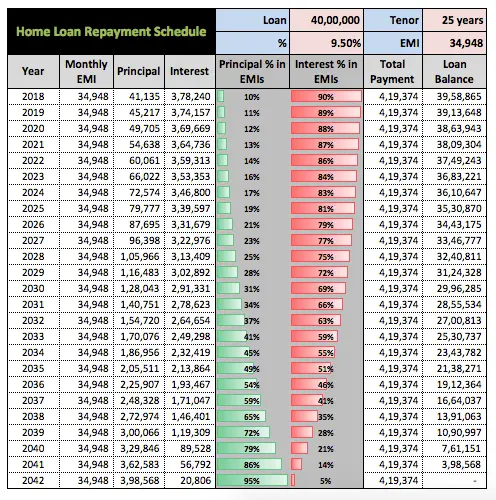

Your mortgage payments consist of two elements: the mortgage principal amount and the interest on the loan principal balance. When you take out a mortgage,your lender calculates your monthly payment using the original loan amount, interest rate, and loan term .

You can reduce how much you’ll pay in total interest significantly by paying down your principal faster. Doing sowill also help you pay off your loan earlier.

| ð¡ Need a realtor? Try Clever Real Estateâs free agent matching service. Match with top local buyerâs agents nationwide, qualify for cash back after closing! Learn more. |

Read Also: Can You Refinance A 30 Year Mortgage

Principal + Interest Payments

In a principal + interest loan, the principal is divided into equal monthly amounts, and the interest is calculated on the outstanding principal balance each month.

This means the monthly interest amount declines over time as the outstanding principal declines. As a result, a principal + interest loan results in less interest than a blended payment loan.

How Taxes And Insurance Factor Into Your Mortgage Payment

Property taxes and homeowners insurance might be included in your mortgage payment if your lender requires you to escrow these payments. Your lender might require a mortgage escrow account if you put down less than 20%, and itâs required if you get an FHA or USDA loan.

Letâs say your property taxes are $2,500 per year and your homeowners insurance is $1,000 per year. Your lender will divide each amount by 12 so that you pay your taxes and insurance gradually over the year.

The lender holds this money in your escrow account, then sends the money to your local tax collector and your insurer when the payments are due. Your monthly mortgage payment would be $1,134.67 after adding the $291.67 per month for taxes and insurance to your $843 principal and interest payment.

If you are required to pay for private mortgage insurance or flood insurance, your lender will escrow these amounts as well.

Recommended Reading: Can A Reverse Mortgage Be Refinanced

How We Calculate Our Mortgage Rates

We use Bankrates daily mortgage interest rate data for our mortgage rate trends. These overnight rates are based on a specific personal profile, which only includes loans for primary residences where the borrower has a FICO score of 740+. Bankrate is part of the same parent company as NextAdvisor.

The table below compares todays average rates to what they were a week ago, and is based on information provided to Bankrate by lenders nationwide:

Average mortgage interest ratesAdd A Free Mortgage Principal Calculator Widget To Your Site

You can get a free online mortgage principal calculator for your website and you don’t even have to download the mortgage principal calculator – you can just copy and paste! The mortgage principal calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

Also Check: When Is A Reverse Mortgage Good

Other Things That You Might Have To Pay For Monthly

Your mortgage payment consists of principal and interest . But you may have other monthly expenses. Consider all these additional costs in your monthly budget when deciding whether you can afford extra payments to pay down your mortgage principaland how much to pay.

PITI

The most common additional payments are taxes and insurance . Together, the payment is commonly called PITI.

Your lender will apply the principal and interest to your home loan and put the taxes and insurance payments in an escrow account. Then, your lender pays the tax bill and annual insurance premium out of escrow when they come due each year.

PMI

You need to budget private mortgage insurance if your down payment is less than 20% of the home price.

HOA fees

Homeowners association fees are also common monthly expenses for communities like condos or subdivisions.

Paying More Principal Less Interest Over Time

In month 2, you owe your lender $199,657 . At 0.0025% monthly interest, $499.14 of your next mortgage payment will go toward interest, and $343.86 will go toward principal.

And for each month going forward until you pay off your loan, two things will happen:

- The amount of your payment that goes toward principal will increase slightly.

- The amount of your payment that goes toward interest will decrease slightly.

As you pay down your mortgage principal, you have a smaller balance to accumulate interest. Since your monthly payment stays the same each month, the lender puts more of your payment toward principal because you donât owe as much interest.

In this way, youâll be able to pay down your mortgage steadily over 30 years. Your 359th payment will be allocated as $838.50 toward principal and $4.50 toward interest. Your 360th payment will be a bit larger, at $964.28, to kill off the remaining balance $961.88 will go toward principal, and $2.40 will go toward interest.

Also Check: What Is An Apr Fee On A Mortgage

What Else Is Included In Your Monthly Payment

Principal and interest make up the bulk of your mortgage payment. On some loans youll only need to pay principal and interest to your lender each month, but your loan might also involve taxes and insurance. You should note that regardless of whether taxes and insurance are included in your loan, lenders typically combine principal, interest, taxes and insurance when determining how much house they will approve you for.

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

Also Check: How To Get A Mortgage If Self Employed

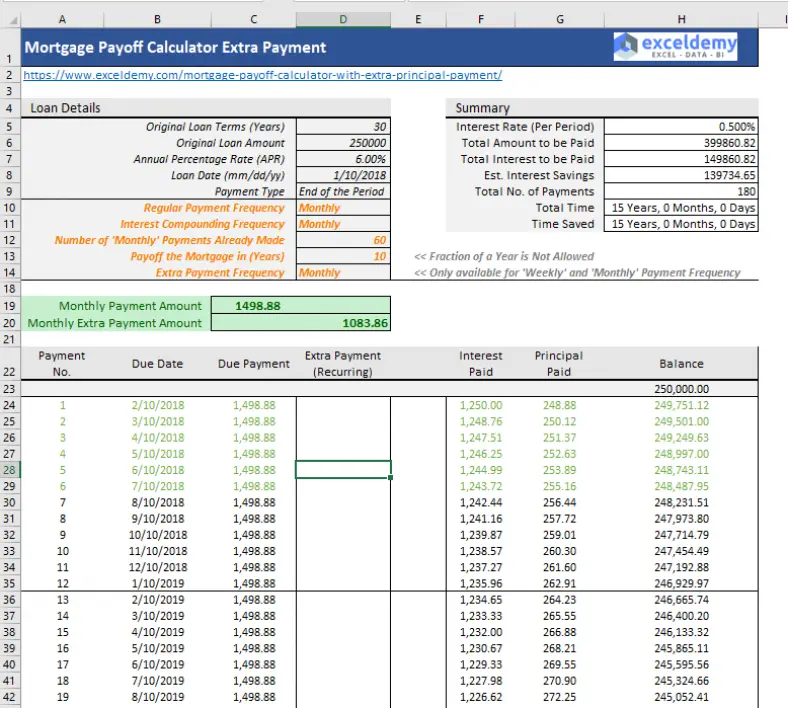

How Do You Calculate Mortgage Amortization

Mortgage amortization is calculated using a fairly complicated formula that takes into account your loan balance, the length of the loan term, and your interest rate.

Luckily, you dont have to do the math yourself. Plenty of mortgage amortization calculators are available online that you can use to determine the breakdown of your payments. You can try this one from Freddie Mac to get you started.

With Credible, you can compare rates, research how much home you can afford, and generate a streamlined pre-approval letter in minutes.

How To Add A Principal Reduction At Closing

To access the closing disclosure, go to the closing disclosure screen or the variance screen and click on the CD details button:

- Select Payoffs/Payments from the dropdown menu when you click on the CD Details button:

- Choose Miscellaneous as the type and then click the green checkmark button.

- In the description field, type Principal Reduction.

- Fill in the amount field with the amount of the principal reduction.

- Select Yes to the save prompt by clicking the green checkmark button.

- To save, click the blue floppy disc icon.

- To exit the screen, press the red X.

The Principal Reduction will appear in this format on the Closing Disclosure.

Read Also: Can I Get A Mortgage Without A Credit Score

How To Manually Calculate Mortgage

When you begin paying a mortgage, you’re usually paying a fairly big portion in interest payments. Later in the life of the loan, you’ll usually pay a smaller amount in interest, since there will be less loan balance to incur those interest charges. You can calculate the portion of mortgage principal and interest by knowing your monthly interest rate and the balance on the loan.

TL DR

Multiply your outstanding mortgage balance by your monthly interest rate to see how much interest you are paying that month. The rest of your monthly payment is principal.

The Subprime Mortgage Crisis Vs Principal Reductions

Principal reductions resulted from the 2008-2009 financial crisis, which was largely caused by the subprime mortgage housing bubble. These mortgages were dubbed subprime because they were made available to borrowers with poor credit. As a result, many people found themselves in over their heads in homes they couldnt afford.

The growing real estate bubble burst as people began to default on their mortgages. Housing prices have plummeted, leaving many people in negative equity. In response, the United States government established the Home Affordable Modification Program , as well as other PR programs.

Also Check: When Can I Drop My Mortgage Insurance

What Is Your Interest Payment

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate and determine your mortgage rate in terms of an annual percentage rate . is the actual amount of interest that you pay on your loan per year . For example, if you borrow $100,000 at an APR of 5%, youd pay a total of $5,000 per year in interest. At the beginning of your loan , most of your monthly payment goes toward paying off interest.

Just a few percentage points of interest can make a huge difference in how much you eventually end up paying for your loan. For example, lets say you borrow $150,000 at a 4% interest on a 30-year loan. With this loan, your monthly payment would be $716.12. If you take the same loan with a 6% interest rate, youd pay $899.33 each month.

The interest rate on your loan depends upon a number of factors. Your credit score, income, down payment, and the location of your home can all influence how much you pay in interest. If you know your credit history isnt that great, you may want to take some time to raise your credit score so you can save thousands of dollars in interest over time. Lets take a look at an example.

Say you have a choice between two lenders. One offers you $150,000 for a 30-year loan with 4% interest. The other lender offers you the same $150,000 for a 30-year loan, but with a 6% interest rate.

Understanding Mortgage Principal And Interest

When you take out a mortgage loan to buy a home or pretty much any other type of commercial loan, the financial institution you’re borrowing from isn’t lending to you out of the goodness of its heart. The bank or other institution is looking to make money, and that comes from charging you interest, which is almost always proportional to how much you have outstanding on the loan.

The initial loan amount is called the principal of the loan, and each monthly payment you make on your mortgage will include a portion paying interest and a portion paying principal. Generally with a fixed-rate mortgage, you will pay the same payment amount over the course of the loan.

Early on after you take out the mortgage, a large portion of your payments each month will be interest because there is still a lot of principal remaining on the loan to incur interest. As you gradually pay off the loan, a greater portion of each month’s payment will be principal.

Don’t Miss: How Do I File A Complaint Against A Mortgage Company