Things That Could Change Your Home Affordability Calculator Results

-

Your credit score

Your measures your current and past history of managing credit. A credit score above 740 usually helps you snag the lowest rate and monthly payment, which means you can potentially afford a more expensive home.

-

Your monthly income

Lenders look for a stable monthly income, which means a salary or hourly wage will give you a home affordability number you can count on. If youre self-employed or receive variable commission income, youll need to average out your income based on your tax returns for the past two years.

-

Your total monthly debt

Lenders take a look at how much debt you have now, and how much youll have with your new mortgage payment. They take both of these sums and divide them by your gross monthly income to determine two types of DTI ratios:

- Your front-end DTI ratio. This figure divides your new house payment by your income, and most lenders prefer that it doesnt exceed 28%.

- Your back-end DTI ratio. Lenders add all your debt to your new house payment and then divide it by your income, and most prefer a DTI ratio of about 43%.

Your loan term

Youll be able to afford a bigger home with a longer repayment term, such as 30 years. However, a shorter term can save you thousands in interest charges, if the higher payment doesnt strain your monthly budget.

Its Not What You Can Borrow Its What You Can Afford

In some respects, the mortgage lending industry is working against your best interest. If you are deemed a qualified borrower, a lender is prone to approve you for the maximum it believes you can afford. But in some cases, that amount may be too generous.

Buying a home always means dealing with big numbers. And the impact to your budget may seem to be a stretch, particularly in the beginning. The challenge is buying a home that meets your current and future needs, without feeling like all of your money is in your home leaving you without the financial freedom to travel, save for other priorities and have a cash flow cushion.

Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power, you may want to gut-check the number by:

-

Run affordability scenarios. You can get another view of your home-buying budget by running some what-ifs through the NerdWallet home affordability calculator.

-

Talk to more than one lender. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for.

-

Consider all homeownership expenses. Its not just whats built into your monthly payment such as insurance, taxes and the rest but the other having-a-home expenses, like structural upkeep, new furniture, maybe even yard maintenance equipment.

Rbc Royal Bank Mortgage Affordability

Before you get a mortgage from RBC, it is important to know how RBC calculates your mortgage affordability. RBC takes into account the following factors:

- Your household income

- Your down payment

- Your monthly debt payments to loans and lines of credit including credit cards,car loans, student loans, and leases.

If your down payment is less than 20%, RBC’s mortgage affordability calculator also considers your mortgage insurance premiums. Unlike some other mortgage affordability calculators, RBC’s mortgage affordability calculator does not take into account your location for property taxes and utility costs.

RBC calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 32% and a maximum total debt service ratio of 40%. These ratios are more strict than CMHC regulations, but you may still be able to get a mortgage with RBC even if you exceed these limits.

Another factor in determining your mortgage affordability is your down payment. According to RBC, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Recommended Reading: Can I Apply For Mortgage With Multiple Lenders

How Much Can I Afford

How much you can afford to spend on a home in Canada is primarily determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation.

I Failed An Affordability Assessment Now What

First things first, while your lender may be unwilling to loan you the amount youâve requested, they may still be able to offer a lower amount or a longer repayment term.

If this wonât cut it – for example, if the amount is too low – there are other steps you can take. In fact, itâs a good idea to take these measures before you even apply for a mortgage. That way, youâll be in the best position to get a great deal.

Pay off your debts

could help to improve your credit score, which in turn will help you chances at getting a better mortgage deal.

Take control of your spending

Reining in your spending hits two birds with one stone: it reduces your expenses and shows lenders youâre financially responsible. It also saves you money.

Cancel any services or subscriptions you donât use. The gym you havenât been to in months or that magazine you never read might seem like minor expenses, but youâd be surprised at how much it can all add up.

More importantly, consider whether you could reduce some of your regular expenses. Try looking for cheaper car insurance, or a better deal on your utilities.

Budget carefully

Don’t Miss: How Fast Can You Get Preapproved For A Mortgage

How Much Savings Should I Have Before Buying A House

This depends on how much you intend to put up as a down payment. If you pay less than 20% of the sales price, you will have to pay PMI as part of your monthly repayments. You will also need to pay for mortgage closing costs. Its a good idea to have at least $3,000 to $10,000 saved up to cover these costs or unexpected expenses along the way.

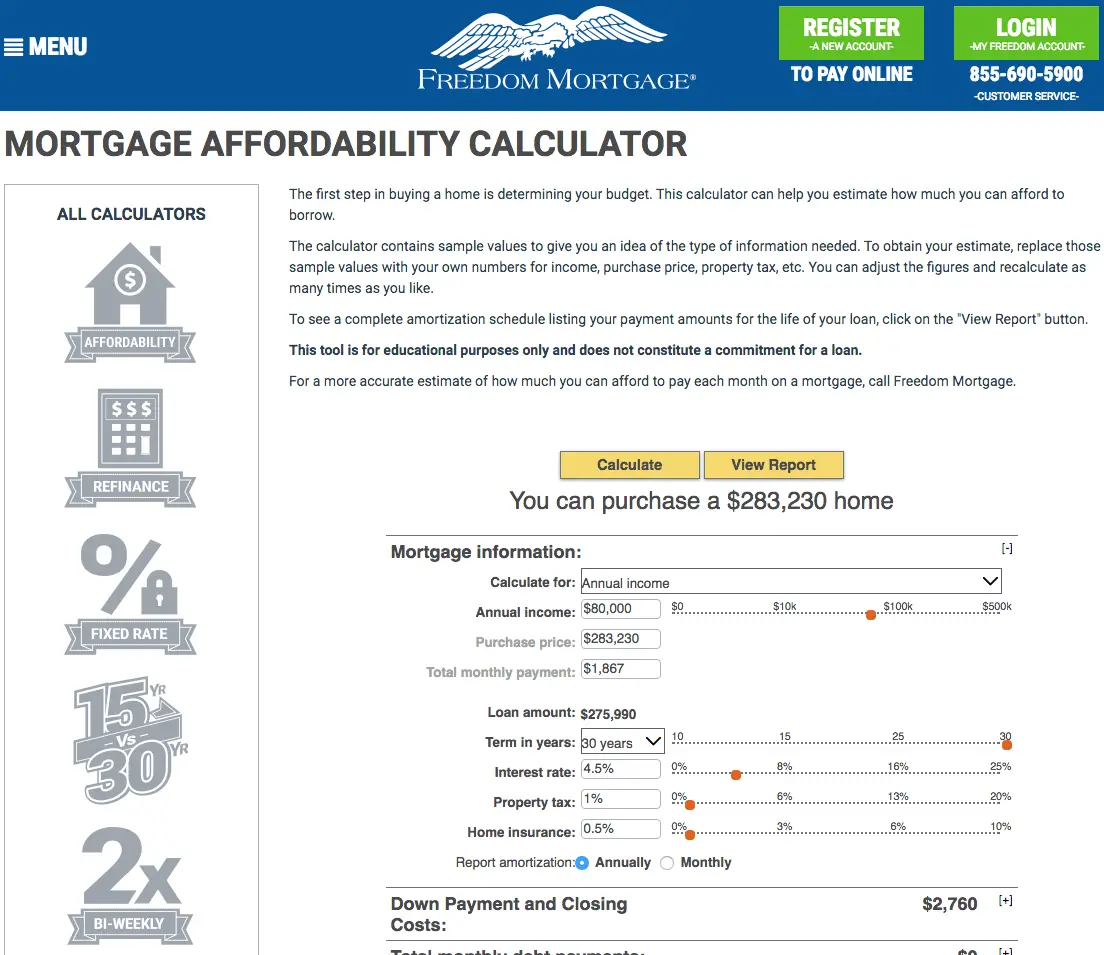

Why Should You Use A Mortgage Affordability Calculator

Using a mortgage affordability calculator is an important first step towards determining how much you can spend on a home. These calculators take your gross income, debts and other living expenses to calculate the maximum amount you can borrow as a mortgage. Together, your down payment and mortgage amount will give you an estimate of the maximum you can spend on a home. This, in turn, can help you decide if buying real estate makes sense financially. It can also help to narrow the search for your perfect home.

With a mortgage affordability calculator, you can play with the inputs to see the impact they have on your maximum affordability. For example, by paying down debt , you should be able to obtain a larger mortgage. Similarly, a jump in household income will allow you to borrow more money, too.

Since these calculations are based on averages, its good practice to confirm what you can afford on a mortgage with a mortgage lender, who will take the nuances of your financial situation into account. For example, if you have a credit score of under 600, you may have difficulty qualifying for a mortgage from a top-tier lender and may need to consult alternative lenders, which a mortgage broker can help with.

Recommended Reading: How Do I Know If I Have Mortgage Insurance

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

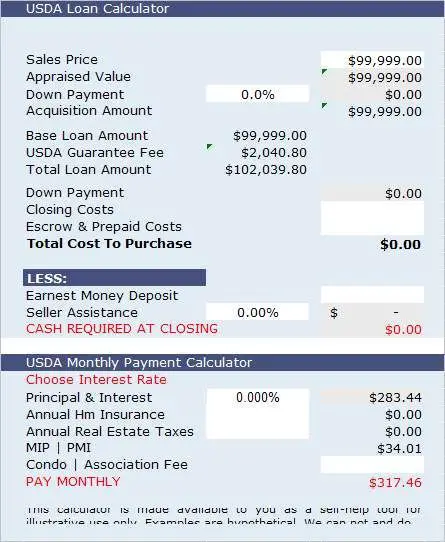

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

How To Lower Your Mortgage Payments

To ensure mortgage payments fit comfortably within your budget, you can also work to lower your monthly payments on the same mortgage amount.

- Increase your amortization period:Stretching out paying back your mortgage over a longer period will decrease your monthly costs. In some cases, you may be eligible for a 30-year mortgage. However, you will pay more in interest in the long run.

- Find a lower mortgage rate: To bring down your monthly payments, compare offers from multiple lenders and find the one willing to give you the most competitive interest rate. You may also want to consider using a mortgage broker, who can help find you the best rate.

This article was originally published on Jan. 12, 2022. It was last updated on March 11, 2022.

Read Also: What Should My Mortgage Be

How Many Times My Salary Should I Borrow For A Mortgage

A common financial rule of thumb for how much house payment you can afford based on your income is to multiply your monthly gross income by 28%. As an example, if you earn $10,000 every month pre-tax, multiply $10,000 by 0.28, a $2,800 mortgage is what you are suppose to be able to afford based on your salary. This means that a $2,800 monthly mortgage payment should be the most you can afford regardless of whether you get a 15-year or 30-year mortgage.

Mortgage Affordability And Regulation

Since mortgages are regulated products, the Financial Conduct Authority needs to be comfortable with how each mortgage lender assesses mortgage affordability.

Therefore, each mortgage lender has made a submission to the Regulator outlining how they will assess mortgage affordability. For this reason a mortgage lender is not is a position to make individual adjustments or allowances on a particular case.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If youre hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

Recommended Reading: How Much Mortgage Can I Afford With 100k Salary

How Do Lenders Work Out How Much I Can Afford

If youre looking to buy a new home, you may well be wondering how much you could borrow for a mortgage.

The mortgage amount, added to your deposit, will determine the maximum property price you can afford.

When you apply, your chosen lender will conduct an affordability check to calculate how much they can lend you. This involves examining your income and outgoings the more money you spend each month, the less you might be able to borrow.

As part of their affordability assessment, lenders will consider criteria such as your:

- Employment status

- Total gross income

- Childcare costs

Traditionally, they would also calculate whether you would still be able to afford your mortgage if interest rates climbed to 3%.

If you are wondering, what kind of mortgage could I get?, check out our guide to the different types of mortgage.

How Much Deposit Do I Need To Get A Single

Single-person mortgage applications can be stronger than joint applications, and you can even qualify for a 5% deposit. Generally, you can get a mortgage worth up to 95% of the property value in the UK. Its wise to save up as much deposit as possible because you have more and better options among lenders with a higher deposit.

Also Check: Is It Better To Get A 15 Year Mortgage

Understand Your Mortgage Options

The type of mortgage loan you choose to apply for can affect how much house youre able to afford. As such, its important to have a clear sense of what each loan option will entail as you begin your home buying journey.

All three government-backed loans have mortgage limits, which is a handy way to help you stay in a healthy debt-budget range. At this time, Rocket Mortgage doesnt offer USDA loans.

Use A Mortgage Affordability Calculator As A Starting Point

- Before you start perusing real estate listings

- Use an affordability calculator to determine if homeownership

- Makes sense financially and is within reach

- Then you can look into a pre-qual or pre-approval to fine-tune the numbers and make sure all red flags are addressed

The mortgage affordability calculator below can give you a head start in front of other prospective home buyers competing for the same property.

Recommended Reading: Does Rocket Mortgage Affect Credit

How Does It Work

To use the mortgage affordability calculator, youll need to gather the following information:

- Your co-applicants income

- Your monthly debt payments, including credit cards, car payments and other loan expenses

- Your expected monthly living costs in your new home, including property tax, condo fees and heating costs, as applicable

These factors are used by lenders to calculate two ratios that serve as guidelines in determining how much you can afford. They are called the gross debt service ratio and the total debt service ratio.

Bringing It All Together

As you can see, there are a number of factors that determine how large of a mortgage you can get. If you get access to your FICO score and crunch some numbers, you can get a rough idea of your borrowing capacity. You can also seek assistance from your bank or a mortgage broker.

All of this, however, still leaves one important question.

Don’t Miss: How Long Until Refinance Mortgage

What Does ‘ltv’ Mean

The deals you’re offered when applying for a mortgage will usually be affected by the loan-to-value ratio or ‘LTV’ – ie the percentage of the price that you’re borrowing compared to how much you’re putting in yourself.

This means that if you have a 10% deposit, your LTV will be 90% as your mortgage will need to cover 90% of the property price. With a 15% deposit, your LTV will be 85%, and so on.

Lenders will set a maximum LTV for each deal they offer – for example, a particular interest rate may only be available to those with an LTV of 75% or below.

In general, the lower your LTV , the lower the mortgage rate, and the cheaper the overall deal.

How Can I Determine My Mortgage Payment

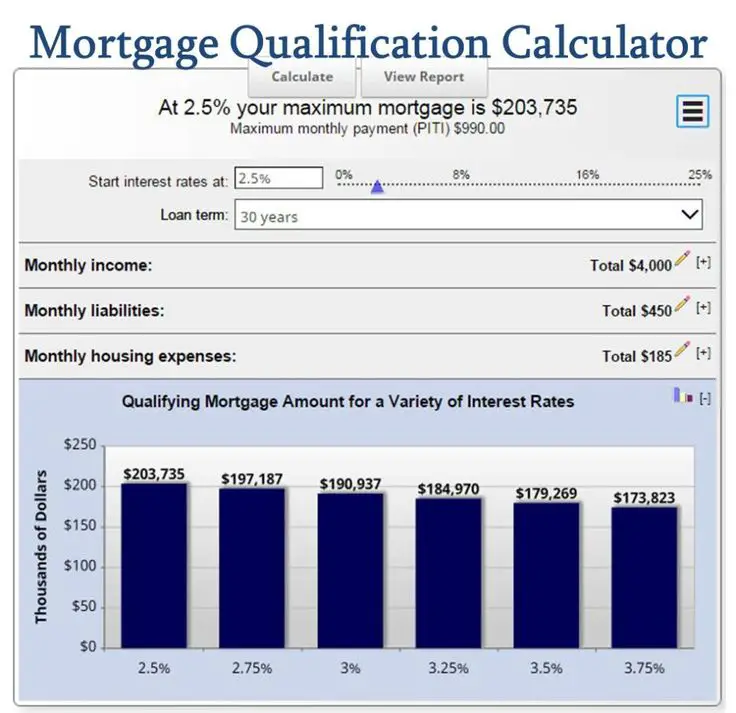

The Mortgage Payment Calculator helps you generate mortgage payment scenarios to see how different homes impact your budget. Before estimating your affordability, compare mortgage rates and see how they affect your payment. Just remember, lenders, base your debt ratios on a stress-tested payment. That means they simulate a higher payment based on rates that are at least two percentage points above typical rates. They do this to ensure you can afford higher rates in the future. This simulated payment is then used as a key input in lenders debt-ratio formulas.

Check out our Mortgage Guide for more information on how to apply for a mortgage.

You May Like: Is It Better To Get Mortgage From Credit Union

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, andinsurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans,student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of39% and a maximum total debt service ratio of44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Don’t Miss: How To Get A Mortgage Loan Without Proof Of Income