How Much Are The Closing Costs

You also need to factor in how much those closing costs are and what your monthly payment will be with them rolled in. If you’re not careful, they could put you above your lender’s loan-to-value or debt-to-income thresholds, which might mean paying for private mortgage insurance or, in some cases, getting stuck with a higher interest rate. Both of these equal extra costs and a slimmer profit margin to boot.

How To Reduce Or Avoid Closing Costs

When youâve spent months or even years saving for a down payment, searching for a property, negotiating a purchase price, going through due diligence and securing financing, paying closing costs can be an unwanted surpriseâand they can make it that much harder to afford your new property.

With that in mind, a lot of people want to try to reduce or avoid closing costs. While itâs impossible to eliminate closing costs entirely, there are some things you can do to reduce your expenses, including:

Additionally, certain closing costs can sometimes be added to a buyerâs loan amount, rather than paying it in cash at closing. What costs can be rolled into your loan vary by lender, but may include origination fees, appraisal and inspection fees or title fees. While this can lead to some initial cost savings, it will actually increase the total mortgage cost, as youâll pay interest on these expenses over the life of the loan.

Can Closing Costs Be Included In A Va Loan

If youre an eligible veteran, service member or surviving spouse, a VA loan can help you purchase or refinance a home with low upfront costs. However, low costs dont necessarily mean no costs. Like other types of home loans, VA loan borrowers will have to pay fees known as closing costs to lenders for processing their loan.

Fortunately, VA loan borrowers have options to reduce the amount they pay out of pocket. In this article, well answer what VA loan closing costs are and if closing costs can be included in a VA loan.

You May Like: What Should My Mortgage Payment Be Based On Income

Pros And Cons Of Rolling Closing Costs Into Your Mortgage

Borrowers who roll closing costs into a mortgage spend less money out of pocket and keep more cash in hand. Thats a big argument in favor of rolling in closing costs.

However, you are also paying interest on those costs over the life of the loan.

For example, lets assume:

- The closing costs on your new mortgage total $5,000

- You have an interest rate of 3.5% on a 30-year term

If you roll the closing costs into your loan balance:

- Your monthly mortgage payment would increase by $22.50 per month

- And you would pay an extra $3,000 over the 30-year loan term, meaning your $5,000 in closing costs would actually cost $8,000

Heres another con: By adding the closing costs to your new mortgage balance you are increasing the loan-to-value ratio. Increasing the LTV lowers the amount of equity in your home.

Less equity means less profit when you sell your home because youd have a bigger lien to pay off after the sale. You would also have less equity if you wanted to take a home equity loan.

The cons losing equity and paying more interest may be OK with you if youre still saving more from your lower refinance rate than youre losing by financing the costs.

Dont Overlook Lender Fees

Many lenders charge loan costs, including those for origination and underwriting. You might not be able to get out of them, but you can try to get your lender to knock them down. Its better to ask for a discount and get denied than to not ask at all.

Its also a good idea to compare offers from other lenders. If you can get an estimate before you submit your application, try to get different loan estimate forms from different lenders to compare. For an accurate basis of comparison, get these estimates on the same day and at the same time, since pricing changes so frequently.

Read Also: Who Qualifies For A Fha Mortgage Loan

Can We Roll Closing Costs Into The Loan On A Purchase

This is one of the most common misconceptions in the mortgage industry. You may have heard a friend or family member mention they were able to roll their closing costs into their mortgage loan however this is not entirely true.What this really means is that they were able to secure either a seller credit, which is when the seller agrees to pay the costs because they sold the house at more than the market value, or lender credit, which is when a lender will pay the closing costs in exchange for a higher interest rate. See below:

- Fannie Mae : The only way to not pay your closing costs out of pocket would be to include a seller credit as a contingency of your offer or speak to your loan officer about a lender credit.

- Freddie Mac : The only way to not pay your closing costs out of pocket would be to include a seller credit as a contingency of your offer or speak to your loan officer about a lender credit.

- FHA: The only way to not pay your closing costs out of pocket would be to include a seller credit as a contingency of your offer or speak to your loan officer about a lender credit.

- USDA: You can roll the closing costs into your loan only if the house appraises above the purchase price.

- VA: The only way to not pay your closing costs out of pocket would be to include a seller credit as a contingency of your offer or speak to your loan officer about a lender credit.

How Long Does It Take To Close On A House

It usually takes roughly 8 to 10 weeks for a property to go from being on sale to the new owners moving in. As is the case in many markets, motivated sellers may expedite the process and seek closing closer to 4 weeks. In additoin, snags or hold-ups in the process may unfortunately delay the process.

Read Also: What Do I Need To Become A Mortgage Broker

What’s The Right Call For You

No matter how much you end up spending on closing costs, think about the best way to pay those fees. If you can afford the extra money at closing, you may decide to just fork it over and be done. But if you’d rather keep more money in savings, you may want to roll closing costs into your mortgage instead. This holds especially true if you’re buying a home that needs a lot of work. You may need that money in the near term to get it into better shape.

Seek A Mortgage Lender That Allows You To Put 3% Down

You may be able to find a conventional loan with less stringent mortgage requirements, such as a 3% down payment. These mortgages are designed for low-income homebuyers who cannot afford a bigger down payment, and they can also be combined with down payment assistance programs.

Keep in mind that youll have to pay private mortgage insurance on most home loans with a down payment of less than 20%.

Read Also: Who Is Rocket Mortgage Owned By

You May Like: Should You Buy Down Mortgage Rate

Do Closing Costs Need To Be Added To Your Mortgage Balance

It is important to consider the financial implications of rolling your closing costs into your mortgage before you make a decision about whether or not you want to do so. You will pay interest over the loans life if you roll your closing costs into your mortgage.

Lets say that your closing costs are $10,000, and that your mortgage interest rate is 4% for a 30-year term. You would be paying $17,187 per year and your monthly mortgage payment would go up by nearly $48.

Your lender may offer you an alternative: increase your mortgage rate in return for a credit that lowers your closing costs. Premium pricing is when the lender credits you a portion of your loan amount to reduce out-of-pocket costs at closing.

Lets assume you have a $300,000. mortgage. You are eligible for a rate increase of 0.125%. The lender might offer you credit up to 1% or 3000 in exchange for a 0.1255% increase in your rate. This increase will only cost you $21 per month, and $7753 over the term of your loan.

LTV is the ratio of the loan amount to the homes value. This happens because the higher mortgage balance you use to pay closing costs will increase the LTV.

There will be less equity available if you later want to take out a line of home equity credit. Your net benefit when you sell your house will also be lower if your LTV is higher.

What Are Closing Costs For A Mortgage And How Much Are They

Closing costs usually amount to around 2% to 5% of the cost of your home loan.

When buying a new home, many people focus on how much of a down payment they’ll need to secure a mortgage. But you also need to factor in the additional expenses that come with the transaction — including closing costs.

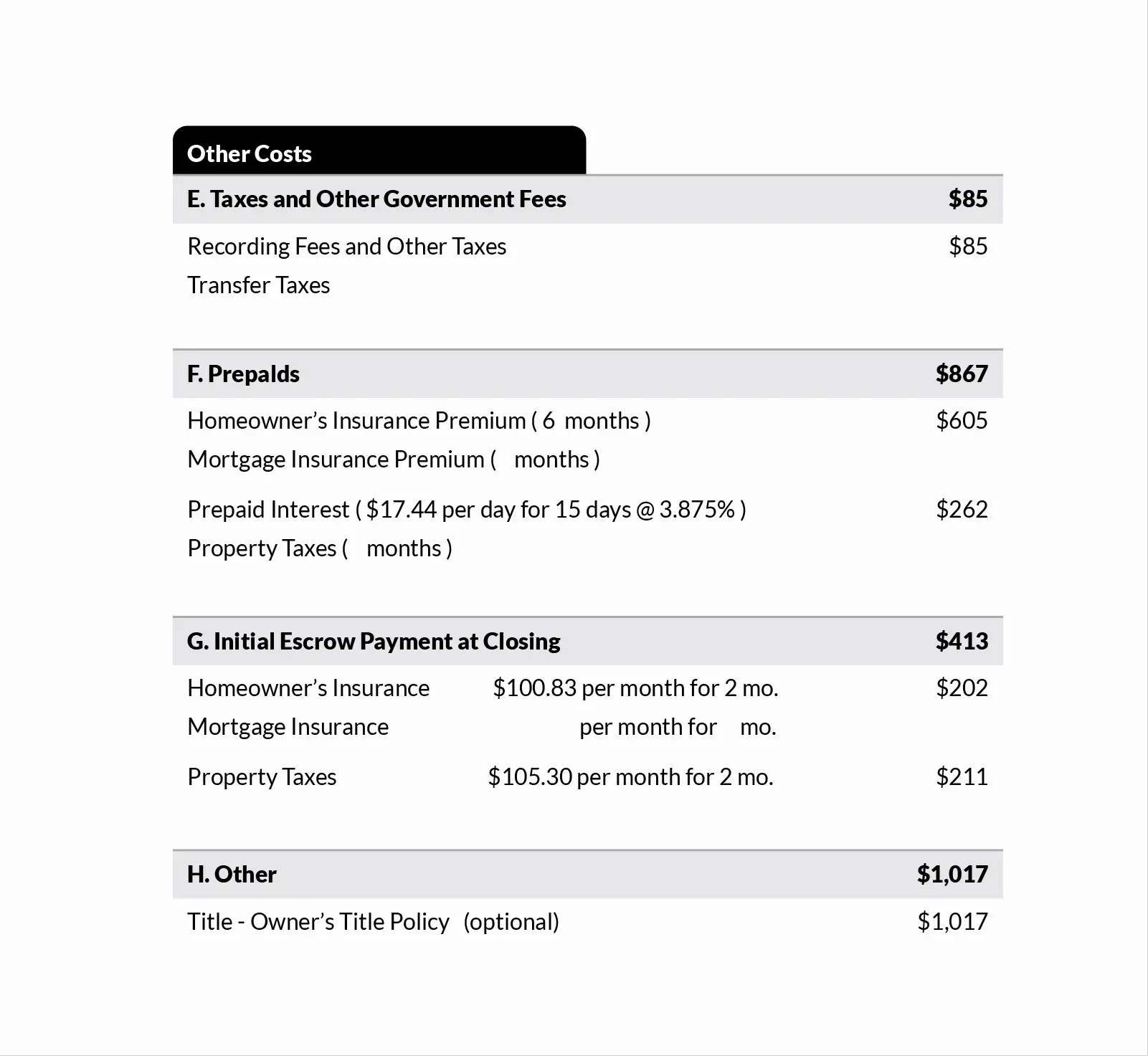

Closing costs refers to the assortment of fees you must pay to your mortgage lender when closing on your home. They’re due when you finalize your mortgage and take over the property title. They usually range from 2% to 5% of the amount you’re borrowing, and will add up to thousands of dollars. Most are paid by the buyer, but the seller may be on the hook for a few charges, too.

Closing costs can be significant and should be included in your homebuying budget. Here’s everything you need to know about closing costs, how much they will cost you and how to avoid any last-minute surprises when closing on your new home.

Don’t Miss: How Long Does A Mortgage Take

How Can I Avoid Paying Closing Costs

How to avoid closing costs

Ways To Lower Your Closing Costs

Of course, there are ways for savvy buyers to lower potential closing costs for themselves as well. Generally, you have two options for reducing closing costs here: Seller concessions and lender credits.

- Seller concessions:Seller concessions are extended when a seller agrees to cover part of the closing costs for a prospective buyer. Negotiating for concessions works best if youre dealing with a motivated seller or the property has been on the market for an extended period of time. But remember, all loan options place limits on how much the seller can contribute to closing cost expenses. For example, the limit is 3% of the total loan amount when purchasing a primary residence with a conventional loan and a down payment of less than 10%.

Lender credits: Another way to lower closing costs is to convince your lender to cover some or all of these expenses in exchange for accepting a higher interest rate. Doing so operates in reverse of discount points and by accepting a higher interest rate, your closing costs are effectively paid for over the lifetime term of the loan instead of covered up-front at closing.

Also Check: How Much Should You Pay A Mortgage Broker

What Are Closing Documents

One of the key documents you’ll get before the final signing is the closing disclosure, which outlines the details about your loan, including your closing costs. The lender should provide you with that document three business days before the scheduled loan closing.

It’s important to review this document to make sure all the information is correct and that the terms of the loan are accurate and clear. This closing disclosure explainer can help you as you review the document. You want to make sure your closing costs match the most recent loan estimate.

Other important closing documents include:

Promissory note: A legal document stating that you will repay your mortgage.

Mortgage, security instrument or deed of trust: Gives the lender the right to take your property by foreclosure if you do not pay your mortgage according to the terms you’ve accepted.

Initial escrow disclosure statement: Details the charges that you pay into an escrow each month.

Right to cancel form: Outlines the rules for when and how you can cancel your loan, usually used as part of the refinancing process.

If you have questions about any of these, ask your lender, broker, or lawyer for help.

Is It Possible To Roll Closing Costs Into A New Mortgage

Directly rolling your closing costs into your mortgage might not be possible if your mortgage is for a purchase. There are still ways to cut down on upfront costs. To reduce your closing costs, you can lower your down payment.

Keep in mind, however, that a lower down payment will increase the LTV ratio. Private mortgage insurance will be required if your LTV exceeds 80%.

Another option is to try to negotiate a sellers concession, in which the seller will pay certain fees on behalf of the buyer.

This will allow you to save loan fees and put it towards your downpayment. This will reduce the initial cost of the mortgage. Sellers wont accept such concessions unless its possible to make a greater profit and close the sale more quickly.

Refinances can be rolled into closing costs, provided that the additional costs do not exceed the lenders LTV or DTI thresholds. The loan amount must not exceed the maximum loan to value ratio that your lender will allow.

If your home is valued at $100,000, and your maximum LTV is 88%, your lender will only lend you $80,000. This amount will not be increased to cover closing costs.

Don’t Miss: How Many Tax Returns For Mortgage

What’s Your Cash Flow Situation

How much cash you have not to mention how much you need should also play a role in your decision. Do you have the funds to cover the closing costs upfront? Would doing so deplete your emergency savings or leave you lacking in funds needed for repairs? If so, rolling those costs in might be your only option.

On the other hand, if you have plenty saved up or some equity you can pull on from another property, paying closing costs upfront is likely your best bet. It might mean a bigger chunk of change now, but it will reduce your monthly payment and interest costs, ultimately freeing up more cash flow in the future.

Fha Loans: For Buyers With Lower Credit Scores And Limited Savings

Federal Housing Administration loans are popular among first-time home buyers since they offer lower credit score and down payment requirements. They often have more flexible lending requirements than conventional loans. Even with a weaker credit score, you may only be required to put 3.5% down. Keep in mind, putting less down could result in a higher interest rate.

All FHA loans require mortgage insurance. It protects the lender against any loss if you fail to pay your mortgage. A mortgage insurance premium includes an upfront fee and a monthly cost . You may be able to roll the upfront fee into your mortgage if you dont have enough cash on hand to pay the upfront fee. But, your loan amount and the overall cost of your loan may increase.

Recommended Reading: Who Is Rocket Mortgage Owned By

Also Check: Where To Compare Mortgage Rates

How To Avoid Closing Costs As A Home Buyer

If you are buying a home, you likely wont be able to roll the closing costs into your mortgage. This option is open only to those refinancing an existing home loan.

But home buyers can find other ways to cover the closing costs. For example:

- Ask the home seller to help: The seller could pay some, or all, of your closing costs if you negotiate that into your contract to buy the home. Tell your real estate agent in advance if you plan to ask for these seller concessions

- Buy up the interest rate: You could pay a higher mortgage rate in exchange for the lenders help covering closing costs

- Ask friends or family members for help: Most loan types allow you to use gift money money given by close friends or family members. Tell your loan officer in advance if youd like to use gift money

- Apply for grants and loans: Many first-time home buyers qualify for down payment and closing cost assistance programs. These programs tend to be local, and their qualifying rules vary

Its also important to know that different closing costs can be paid in different ways. Closing costs include a variety of fees such as attorney fees, underwriting fees, and home appraisal fees.

For instance, if youre using an FHA loan, the 1.75% upfront mortgage insurance premium is typically rolled into the loan amount and not paid out of pocket. The same goes for VA loan funding fees.

Ask your lender about which closing costs can be financed and which ones cant.

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Recommended Reading: How Much Are Monthly Payments On A 200 000 Mortgage