How Can I Avoid Paying Closing Costs

How to avoid closing costs

Are There Other Ways To Get A Low

If youre thinking that a no-closing-cost mortgage isnt the right option for you, there are other ways to save on the upfront costs to make sure you get a low-closing-cost mortgage.

You can try negotiating with your lender, as some fees can be either waived or reduced. Talking with your lender can give you a better idea on your options, and you might find a way to reduce upfront costs. Many cities and states also offer first-time home buyer programs to help assist with down payments and closing costs.

Another option is to ask the seller to cover the closing costs for you. Depending on the situation, some sellers may agree to help by covering some of the closing cost.

List Of Closing Costs

Property evaluation fee:

A recognized home appraiser provides a professional opinion confirming the market value of the property. This may be required by the lender to determine whether the selling price is reasonable for the market.

Estimated cost: $300 or more, depending on the location of the property, is paid to the lender to arrange for an appraisal.

Land survey fee or certificate of location cost:

If the seller cannot produce an up-to-date survey or certificate of location, you may have to pay for one before finalizing the mortgage loan. Title insurance may be accepted in lieu of a survey.

Estimated cost: $1,000 – $2,000, depending on the size and type of the property.

Don’t Miss: How Do You Refinance Your Mortgage

The Bottom Line: Is A No

The truth is, no-closing-cost mortgages can make a ton of sense for some people and zero sense for others. As a general rule, youre probably going to pay less over the entire life of a loan if you pay closing costs upfront.

That said, coming up with the necessary funds to do this isnt always easy, so spreading out the cost of closing over the whole loan term might be the right choice for some. You should do as much research as you can, and dont stop asking questions to hold your lender accountable in terms of transparency and their laying out every possible option for you.

Dont know where to start? Check out more mortgage basics articles in the Rocket Mortgage Learning Center. If you think youre ready to get started, you can apply online or give us a call at 326-6018.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Do Sellers Pay Closing Costs

The main closing cost paid by sellers is real estate commissions, which are typically split between the buyers and sellers agent.

In some cases, a seller will pay for a pre-inspection by a home inspector to help set buyers minds at ease that theyre making a sound investment in buying this property.

You May Like: Do I Own My Home If I Have A Mortgage

What Are Fha Closing Costs

When you buy a home with a home loan, youll need two piles of cash ready to go at the closing table. One for your down payment and one for closing costs.

No matter the type of home loan you choose, all mortgages come with closing costs. The general rule of thumb is to plan on having between 3% 6% of your total loan amount on hand for closing costs.

The closing costs that come along with an FHA loan are generally the same as conventional ones, although the mix of costs and fees might look a little different.

Are Closing Costs Negotiable

While there is no way for you to outright dodge paying closing costs, there are ways that you can pay considerably less.

According to HUD, the Real Estate Settlement Procedures Act seeks to reduce unnecessary high closing costs by requiring lenders to give you a good faith estimate for the itemized list of fees. One thing to note here is that these are still estimates.

Some closing costs are negotiable such as title and attorney fees, commission rates, and recording fees. Also, watch out for miscellaneous fees like delivery and funding fees. If the fees seem vague, you may be able to lower or eliminate them.

As different lenders may have different requirements, the closing costs can vary widely. So before you finalize your mortgage, make sure to shop around.

Most people dont realize that buying a home is going to be one of their most expensive purchases. Also, mortgage is one of the longest term loans that is out there. If you are considering a 30-year fixed mortgage, youll most likely be in touch with your lender for 30 years.

The lenders understand this, and they will try their best to get your business. This is your only opportunity to set the numbers, so give it your best to bring it down as much as you can.

Stay ahead in your financial journey by taking advantage of our most recommended tools and resources

Read Also: What Are The Current Best Mortgage Rates

How Do Seller Concessions Work

One strategy for home buyers is to ask the seller to cover some or all of the closing costs. This is known as a seller concession.

A seller concession works like this:

- Determine the amount of closing costs youd like the seller to pay

- Assuming the seller agrees, that amount is added to the sale price

- You get a mortgage for the new sale price which now includes some or all closing costs

- The seller pays back that extra amount to cover your closing costs

There are many ways this may look depending on what is negotiated between the buyer and seller.

How Else Can I Avoid Paying Closing Costs

As we mentioned above, you can usually roll closing costs into your mortgage only when you refinance.

But there are other ways to reduce your closing costs when buying a home.

The first is asking your mortgage lender to waive some or all of your upfront fees. They might agree, but theyll charge you a higher interest rate in return. This is known as a lender credit.

You might also ask your seller to cover some of your closing costs. Known as a seller concession, this is more likely in a buyers market than a sellers market.

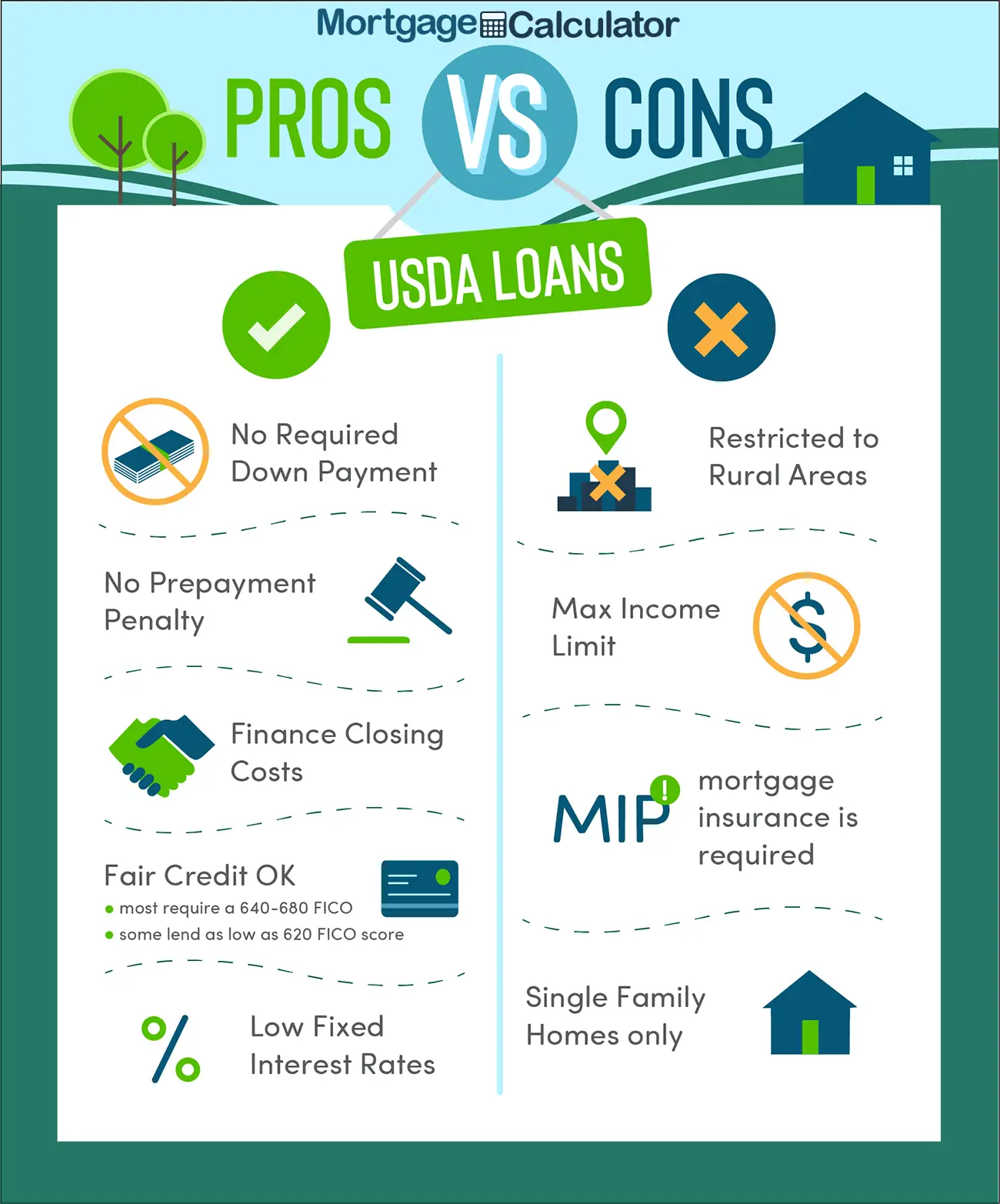

USDA borrowers can roll closing costs into their USDA loan if the appraised value is higher than the purchase price. More on that here.

You May Like: Why Does My Mortgage Payment Keep Going Up

Is It Possible To Get A Mortgage With Zero Closing Costs

No. It doesnt matter where you live in Canada every mortgage has closing costs.

Some mortgage lenders may offer low mortgage closing costs compared to others and there are even some lenders in the U.S. that provide no-closing-cost mortgages, but its not something you can escape here in Canada.

Increase Your Interest Rate In Exchange For A Credit

Some loans will allow you to increase your interest rate while giving you a credit that offsets some or all of your closing costs. However, keep in mind that this means youll be paying more on all of the money you borrow for the entire life of the loan .

If you hear about zero-down loans, they often work this way. The lender covers your closing costs in exchange for a higher interest rate. Theyre not usually the fantastic deal they seem to be.

Also Check: How Much Is A Mortgage On A 400k House

Applicable Fees Taxes And Remaining Costs

Like any other purchase, the government may charge tax. When you buy a home, you pay the following costs.

- Land transfer tax. The government may charge land transfer tax when you buy a property. The tax is based on the homes purchase price, and sometimes other factors. Most provinces charge provincial land transfer tax, but some cities charge their own municipal land transfer tax, too. Taxes vary by province and first-time home buyers may sometimes receive a rebate for part of the cost.

- GST or HST. Newly constructed and substantially renovated homes may be subject to GST or HST. If you pay GST and HST, you may qualify for a new housing rebate.

- Property taxes, utilities and condo fees. The seller may have prepaid property taxes, utility bills or condo fees before you take ownership of the property. You reimburse the seller for the portion of the costs from the closing date forward.

Va Loan Closing Costs & Fees

Like every mortgage, the VA loan comes with closing costs and related expenses. For many homebuyers, closing costs are one of the most confusing parts of this entire journey.

In fact, closing costs is really a catchall term. There are all different kinds of costs and fees that can be part of finalizing this process. In the mortgage world, youll also hear these referred to as settlement charges.

Some of these costs represent the actual costs of doing a loan. Others involve third-party expenses like homeowners insurance and property taxes. Some fees need to be paid before you get to the closing table, while others can wait until that happy day arrives.

Also Check: Is Usaa Good For Auto Loans

You May Like: How To Become A Licensed Mortgage Loan Officer

What Are Closing Costs

Closing is the stage in the house buying process when the previous property owner transfers the title over to you, the new owner. At this point, the buyer has to pay the fees for the services and expenses for finalizing the mortgage. These are the Closing costs and can run between 2% to 5% of the homes market value.

To give an example, if the home is valued at $400,000, you can expect to pay somewhere between $8,000 and $20,000 in closing costs. Here is a closing cost calculator by SmartAsset that you can use to get an estimate.

When you initially submit your loan application, your lender will provide you with a loan quote that includes the terms, estimated mortgage payments, and closing costs.

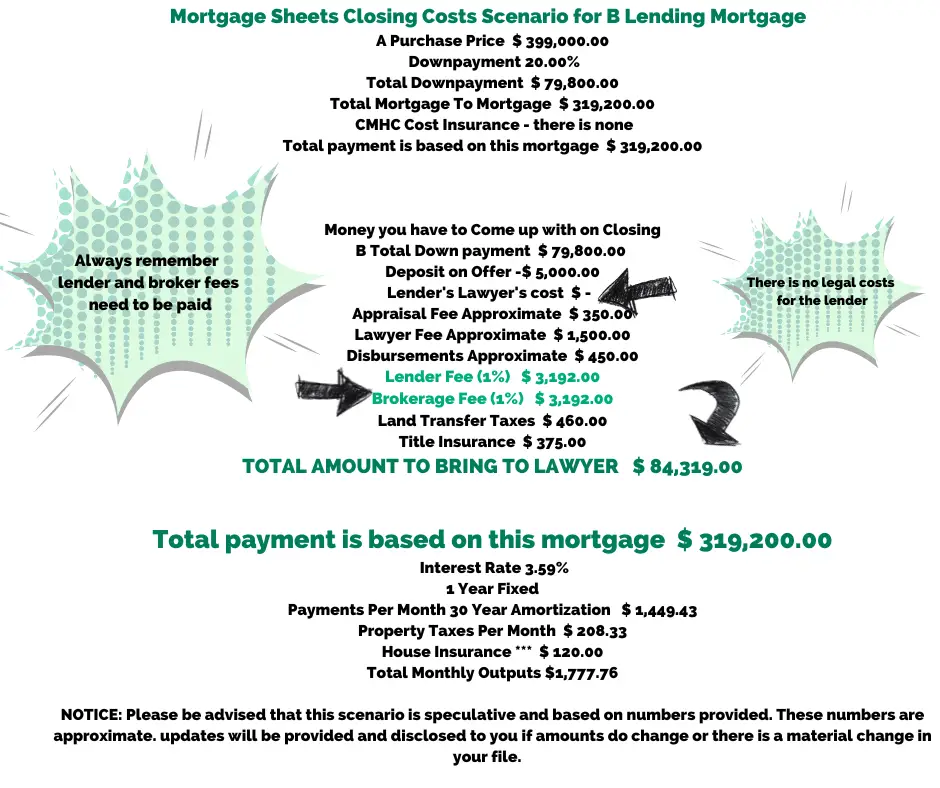

Here is a sample estimated closing cost breakdown for a home purchase price of $400,000 2-unit duplex with 20% downpayment and no mortgage points in Pierce County, Washington state. It can give you a ballpark estimate of the fees that you can expect in your loan quote.

Costs That Are Less Than $1000

Property Survey

Both your mortgage provider and your lawyer require a currentproperty surveycertificate on the home and the cost is typically part of the legal fee. If the certificate does not reflect additions and improvements to the property and your lawyer is not covering the cost, then yourreal estate agentshould negotiate with the other agent as to who will cover the expense of a new certificate. The cost varies by location, type of survey, type of property, and geographical and legal complications. Overall, the general range can be expected to be between $350 and $600.

Home Inspection Fee

It is highly recommended that you make your purchase offer conditional on a positive home inspection by a professional home inspector. TheCanadian home inspectionwill catch any hidden problems in the home that could have future consequences or be expensive to repair. This is especially important for a freehold property in comparison to a condo or apartment, as you will be responsible for all future costs of the property. The inspection fee is generally around $500, but it could save you thousands if not more in repairs versus having discovered the homes flaws after youve signed the contract. Sometimes, you can ask the seller to give the maintenance costs as a credit or discount to the original agreed-upon sale price or even cancel the contract if the inspector finds a huge problem.

Property Appraisal Fee

Also Check: Aiq Ellie Mae

You May Like: How Do Banks Make Money On Reverse Mortgages

Where Can Closing Cost Money Come From

Closing costs may include fees related to the origination and underwriting of a mortgage loan, real estate commissions, taxes, and insurance premiums, as well as title and record filings. Closing costs must be disclosed in advance by law to buyers and sellers and agreed upon before a real estate deal can be completed.

Sellers Closing Costs And Fha Loans

With the unavoidable fact that the lender in a mortgage is the one who chooses the home appraiser that will check up on the property. But as a wise buyer, you can present yourself in covering these expenses and save the sellers time to find for his home appraisal. It is wise to try, notwithstanding the fact that your seller might have the home appraiser, he wants to do the job.

Also, if you have a good negotiation with the homeowner, you might have a great-hot shot to get rid of some closing costs your seller will cover. A good negotiation will be beneficial for buyers that might be having trouble with cash or handles a lot with their home insurance company.

The FHA closing costs benefit.

The Federal Housing Administration has policies that allow the home seller to cover six percent of the total closing costs related to the purchase price. It could give you less payment for your title insurance, escrow fees, property tax, and lender fees, thats a great deal! But this takes over a generous and willing seller. If your home buy landed on a motivated sellermore likely a homeowner that rushes sell his house. But heres a quick fact, sellers generally dont give this privilege for free. It cost an additional six percent of the purchase price. But as long as you have a higher appraisal of the property, you as the buyer can have the upper hand.

So, in the short end, your closing costs can be rolled into an FHA loan.

Applying for mortgage insurance

Mortgage insurance subtleties

Recommended Reading: Which Bank Has The Cheapest Mortgage Rates

Or Negotiate A Seller

Another way to reduce your cash needed at settlement is to negotiate a seller-held second mortgage to cover some or all of your down payment. Its one of the many ways you can minimize your down payment and buy with less cash.

Say you put a property under contract for $200,000, with a $180,000 loan . You negotiate with the seller to lend you a $15,000 seller-held second mortgage. Now you only have to come up with $5,000 as a down payment!

How To Compare Two Mortgages

Among the many variables in arranging for a mortgage when you buy a home are items like closing costs, points and homeowners insurance. Because closing costs are a large line item when you complete the purchase of a home, buyers should be aware of these costs to decide how best to handle them. While it’s possible to finance your closing costs, you should know the pros, cons and alternatives before you do so.

TL DR

You can often roll your closing costs into your mortgage loan, but it may be beneficial to ask for help from the seller, lender or real estate agent.

Also Check: What’s The Monthly Payment On A 300 000 Mortgage

Home Buyer Assistance Programs

There are a wide variety of programs at all levels of government and housing nonprofits whose mission it is to help first-time or low- and moderate-income wage earners attain homeownership, which remains one of the most important ways to accumulate wealth in the U.S.

First-time home buyer assistance programs are generally available to anyone who hasnt lived in a home they owned for the past 3 years. One aimed specifically at helping first time buyers with closing costs is Fannie Maes HomeReady program. If you complete an online home buying class and go on to buy an eligible home, you can benefit from reduced down payment and mortgage insurance requirements offered by Fannie Mae.

The Department of Housing and Urban Development maintains a database of all local resources offering home buying assistance. Take a look and see if your state or city offers assistance that can help you get to closing with the cash you need.

Prepaid Property Taxes Utility Bills And Other Charges

Sometimes known as “adjustments”, the tax and utility costs that the seller has pre-paid must be reimbursed by the purchaser. The lawyer calculates the amount owing.

Estimated cost: Allow about $1,000 to $2,000 payable to the lawyer with the legal fees.

Home inspection fee

It’s always a good idea to make your offer conditional upon a positive home inspection.

Estimated cost: Usually depends on the size and complexity of the home. For a typical urban or suburban home, budget around $500, paid directly to the inspector you hire.

Water quality inspection fee

If the home sources drinking water from a well, you will need to have the quality of the water tested to ensure the water is potable/healthy for human consumption.

Estimated cost: You can usually negotiate the cost with the vendor and list them in the Offer to Purchase.

Recommended Reading: Can You File Bankruptcy On A Second Mortgage

Compare Loan Estimates And Closing Disclosure Forms

When you get your initial loan estimate, review it with a fine-tooth comb. If youre unsure about what a fee entails or why its being charged, ask the lender to clarify. A lender who cant explain a fee or pushes back when queried should be a red flag.

Likewise, if you notice new fees or see noticeable increases in certain closing fees, ask your lender to walk you through the details. Its not uncommon for closing costs to fluctuate from preapproval to closing, but big jumps or surprising additions could impact your ability to close. This is especially true for new items that may not have appeared on prior estimates.

Be wary of a lender adding on unnecessary junk fees that duplicate existing ones or that havent been disclosed in advance.