When Home Values Rise Cancel Your Fha Mip

Paying FHA mortgage insurance doesnt have to be permanent. You just have enough equity to refinance into a conventional loan.

According to the National Association of REALTORS®, the median home listed for sale in the U.S. was $269,600 in July 2018. Thats 4.5% higher than one year ago.

Some experts predict continued appreciation for years to come.

That means more homeowners will be in a position to refinance out of FHA, and very soon.

Once homeowners reach 20% equity based on current value, they can refinance into a conventional loan one that does not require any mortgage insurance whatsoever.

Refinancing Out Of Fha Mip

If youve built up a fair amount of equity in your home, refinancing out of the FHA loan program can eliminate FHA mortgage insurance premiums.

Most homeowners with FHA loans refinance into a conventional loan. Conventional loans do not have insurance from the federal government so borrowers will need stronger credit scores and enough home equity to qualify.

Most conventional lenders require 20 percent home equity for refinance loans. That means your current loan balance cant exceed 80 percent of your property value. For a home with a value of $300,000, youd need to pay your loan balance down to $240,000 or lower to refinance.

Rising home values also help you build equity more quickly and since prices have been going up, many homeowners will reach 20% equity faster than they would through regular loan payments alone.

Keep in mind that rising home values also help you build equity more quickly. And since prices have been going up across the nation, many homeowners will reach 20% equity faster than they would through regular loan payments alone. If you think you have enough equity to refinance out of MIP due to rising home values, your lender can check via an appraisal during the refi process.

Refinancing wont always save money, even if you get rid of FHA MIP. If your new refinance rate exceeds your current rate, for example, you will likely pay more in interest on your new loan than youre paying in MIP right now.

When Can You Drop Pmi On An Fha Loan

To eliminate the annual mortgage insurance premium on an FHA loan, you can either:

- Wait for MIP to expire If you put down at least 10% when you bought the home, your FHA MIP expires after 11 years

- Refinance into a conventional loan Replacing your FHA loan with a conventional loan eliminates the FHAs MIP requirement. This is the only FHA MIP removal option if you put less than 10% down

The good news is that home values are rising nationwide. So many FHA homeowners have enough equity to refinance into a conventional loan and cancel mortgage insurance even if they only bought a few years ago.

You can check your FHA removal eligibility with a lender.

Read Also: What Is The Veterans Mortgage Relief Program

Making The Right Choice

You have many options at your disposal. Sit down and look at each payment. Dont focus on the interest rate. Instead, focus on the total cost of the loan. Youll want to compare:

- The cost of keeping your current loan

- The cost of paying for an appraisal and keeping your current loan

- The cost of refinancing and taking on a new loan

Look at the total cost and interest youll pay over the life of the loan. Also, consider how quickly youll pay the loan off. Refinancing often means restarting your term. If you already paid many years on your current term, do you want to start over?

Every borrower will have a different situation and answer that is right for them. Borrowers with homes with a lot of appreciation may benefit from paying for a new appraisal. A borrower whose home didnt appreciate much probably wouldnt benefit.

Weigh the pros and cons and talk to your lender before refinancing. There may be a simpler option. Unless you refinance out of a risky loan or you can lower your interest rate, you may be better off using a different option. Look closely at your Loan Estimate to see the true cost of each loan and option. This way you can make the financially smart decision for your home loan while eliminating mortgage insurance from your life.

How To Get Rid Of Mip On Fha Loans

You can avoid paying mortgage insurance after paying down your loan-to-value ratio on your FHA loan to 78% by refinancing your FHA loan to a conventional loan.

Contact your lender and ask them if youre eligible to have your annual insurance premium removed.

If you put less than 10% down on an FHA loan you will have to pay the MIP for the life of the loan. You can remove MIP after 11 years if your down payment is higher than 10%.

Also Check: How To Qualify For A Va Loan Mortgage

Canceling Mip On Fha Loans

Depending on when you applied, FHA guidelines may allow for MIP to be canceled if you:

- Applied between January 2001 and June 2013: Please contact us when you meet all three of the following conditions, and we will review your loan for MIP removal eligibility:

- Applied after June 2013: If your original loan amount was less than or equal to 90% LTV, MIP will be removed after 11 years.

- Closedbetween July 1991 and December 2000

- Closed before December 28, 2005 on a condo or rehabilitation loan

- Applied after June 2013 and your loan amount was greater than 90% LTV

When Can You Drop Pmi Insurance

Most mortgages require that borrowers pay for private mortgage insurance if they are unable to make a down payment of 20% or more. However, once you have built up enough equity in your home, you may be able to cancel your PMI payments.There are a few different ways to drop PMI insurance, but the most common is to simply reach a certain level of equity in your home. For conventional loans, this typically means having at least 20% equity in the home. Once you reach this point, you can contact your lender and request that they cancel your PMI payments.There are a few other circumstances where you may be able to drop PMI insurance, even if you dont have 20% equity in your home. For example, if your home has appreciated significantly in value, you may be eligible for alender buyout. In this situation, the lender agrees to pay off the remaining balance of your loan in exchange for ownership of the property. This option is typically only available if you are facing foreclosure or are otherwise unable to keep up with your mortgage payments.If you have an FHA loan, there is no set timeline for when you can drop PMI insurance. However, you may be eligible to do so once you have built up 22% equity in your home through regular monthly payments and/or appreciation.

Don’t Miss: How Much A Month Is A 200k Mortgage

How Much Equity Do I Have

To establish 20% equity, you can either have a home appraisal that states you have 20% equity in your home or pay down your current loan down to get to 20% equity.

The end result of refinancing could be a lower monthly payment and big savings. Contact us today for a mortgage review to discuss your refinance options.

Automatic Removal Of Fha Mortgage Insurance

If you received the FHA loan prior to June 3, 2013, then you were eligible for cancellation of your MIP after 5 years. However, you should have had at least 22 percent equity in the property and must have made all payments on time.

If your FHA loan was issued on or after June 3, 2013, you must refinance into a conventional loan and have a current loan-to-value ratio of 80 percent or lower. The loan-to-value ratio is another way of measuring home equity.

If you owed $160,000 on a home valued at $200,00, your LTV would be 80 percent since the loan balance is 80 percent of the value of the home . An LTV of 80 percent means that you have 20 percent home equity which should be sufficient to refinance into a conventional loan without PMI.

You May Like: Are Mortgage Rates Different For Second Homes

How Is Mortgage Insurance Calculated

The amount you pay is based on several factors including:

- Amount of your original down payment

- Your credit score

- Current loan type

- Your debt-to-income ratio

As a rule, you can expect to pay 0.5% to 1% of your total loan amount per year in mortgage insurance. For example, if you have a $250K home loan, that will equal anywhere from $1,250 to $2,500 per year or between $104 and $208 per month.

If your payments are current and in good standing, your lender is required to cancel your PMI on the date your loan is scheduled to reach 78% of the original value of your home. If you have an FHA loan, youâll pay MIP for either 11 years or the entire length of the loan, depending on the terms of the loan.

Who Can Remove Mortgage Insurance

The exact rules governing your mortgage insurance will depend in part upon the type of mortgage you have and some specific factors pertaining to your loan. But many borrowers can remove mortgage insurance after surpassing a certain amount of equity.

- If you took out a conventional mortgage and you put down under 20%, you have PMI. But after you surpass 20% equity, you may be able to get rid of the PMI. This is at the discretion of your lender.

- If you took out an FHA mortgage, you have MIP. Based on various factors, you may or may not be able to get rid of your MIP once you have a certain amount of home equity.

You May Like: What Is The Downside Of Refinancing Your Mortgage

Has Your Home Value Appreciated It May Be Time To Drop Mortgage Insurance January 18th 2022

Are you paying for mortgage insurance in the form of MIP or PMI? It is to your financial advantage to get rid of mortgage insurance as soon as you can.

If your home value has increased recently, it may be worth checking whether that means you can now shed your mortgage insurance. In todays post, we will explain exactly how this works.

Read Also: Rocket Mortgage Requirements

How Is Mortgage Insurance Calculated By Fha

All FHA loans require 1.75 percent of the loan amount as upfront MIP. Annual MIP can vary from 0.45 percent to 1.05 percent depending on your loan amount, loan term, and down payment amount. If you get a 30-year loan and make the FHAs minimum down payment of 3.5 percent, your annual MIP would add 0.85 percent of the loan amount per year.

Recommended Reading: Is Total Mortgage A Good Company

Canceling Conventional Private Mortgage Insurance

You have more options to cancel mortgage insurance if you have a conventional loan with PMI.

You can simply wait for it to drop off. By law, lenders must cancel conventional PMI when you reach 78% loan-to-value.

Many home buyers opt for a conventional loan, because PMI drops, while FHA MIP typically does not.

Keep in mind that most lenders base the 78% LTV on their last appraised value. If your property value has gone up substantially, contact the current servicer and check its requirements to cancel early.

The servicer may require a new appraisal, or rely on their own internal valuation tools to determine your homes up-to-date value.

You can also cancel conventional PMI with a refinance. The appraisal for your refinance loan serves as proof of current value. If your loan amount is 80% or less of your current value, you do not incur new PMI.

How To Cancel Fha Mortgage Insurance

Most FHA homeowners today have a loan with the following characteristics

- Opened after June 2013

- Less than 10% down original down payment

Such a loan is not eligible for mortgage insurance cancellation. The good news is that there are no restrictions on refinancing out of FHA into a conventional loan with no PMI. There are never any prepayment penalties on FHA loans, so you can refinance any time you want.

House values have risen dramatically over the past few years. A home you put just 3-5% down on a few years ago could have enough equity to refinance without taking on new PMI.

You only need about 20% equity to do so.

Also Check: Can You Take Out Two Mortgages

What Is Pmi Or Private Mortgage Insurance

PMI is a type of mortgage insurance that protects the lender in case you default on your mortgage.

Homebuyers who use a conventional mortgage with a down payment of less than 20 percent usually are required to get private mortgage insurance. This is an added annual cost about 0.3 percent to 1.5 percent of your mortgage, although it can vary. According to Freddie Mac, each month, borrowers generally may pay between $30 and $70 in PMI for every $100,000 of loan principal. How much you pay depends on your credit score and the amount of your down payment. Your PMI is recalculated each year based on the current size of your loan, so the premium will decrease as you pay down the loan.

Private mortgage insurance protects the lender from the elevated risk presented by a borrower that made a small down payment, says Greg McBride, CFA, Bankrates chief financial analyst. Once the borrower has a sufficient equity cushion, the PMI will be removed.

PMI doesnt apply to all mortgages with down payments below 20 percent. For example, government-backed FHA loans and VA loans with low or zero down payment requirements have different rules. Private lenders sometimes also offer conventional loans with small down payments that dont require PMI however, there are typically other costs, such as higher interest rates.

What Is An Fha Mortgage Insurance Premium

FHA mortgage insurance protects against the risk that you default, or stop making payments, on your FHA loan. The Federal Housing Administration insures your FHA loan in the event that this happens and you wind up being unable to pay it back. Your FHA mortgage insurance premium , along with the premiums paid by more than 817,000 other FHA loan borrowers last year, helps cover the cost of that insurance.

You already paid one portion of the MIP when you closed on your home that was your upfront insurance. The upfront MIP equals 1.75 percent of the amount you borrowed, and was likely bundled into your loan and all those papers you signed before you got the keys to your home.

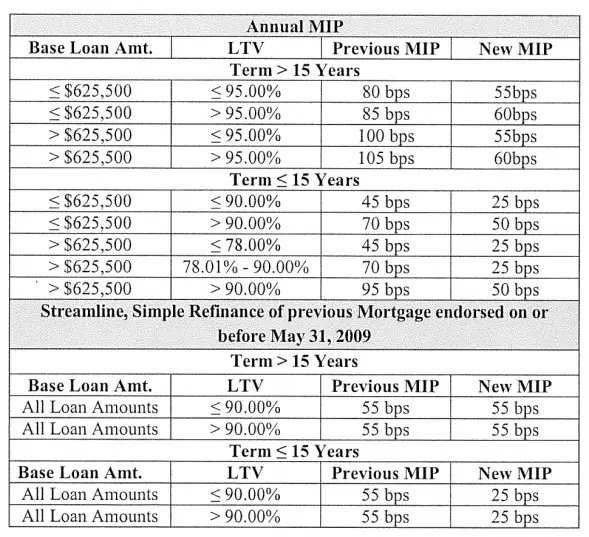

The second portion of the MIP is the part youre paying now, your annual MIP, which varies based on individual loan terms. Annual MIP rates depend on three key factors:

Based on these factors, youll pay between 0.45 percent and 1.05 percent of the loan principal for your annual MIP.

- The 0.45 percent rate applies if you have a 15-year loan and more than 10 percent equity in your home.

- The 1.05 percent rate applies if you have a loan term longer than 15 years, and the amount you borrowed exceeded $625,500.

- More than likely, youre paying an annual MIP of 0.85 percent, which is the rate that applies to borrowers who put down less than 5 percent on a 30-year FHA loan for $625,500 or less.

Also Check: How Do You Know If You Can Get A Mortgage

Three Ways To Drop Mortgage Insurance

Real estate is full of otherwise rarely used terms and concepts – one of these is “mortgage insurance.”Mortgage insurance is a type of insurance that protects against default on home loans – assigned in the form of a monthly fee to most FHA or Conventional home loans when buyers put down less than 20% as a downpayment.

Mortgage Insurance normally costs 0.5% to 2% of your original mortgage amount per year, so we commonly see it range from $50 to $300 each month for new clients.DROPPING YOUR MORTGAGE INSURANCE EARLY CAN SAVE YOU THOUSANDS OF DOLLARS. There are three main ways to “drop” your mortgage insurance.

How To Cancel Mortgage Insurance On Fha Loans

FHA loans carry a government guarantee to the lender. Should the loan ever go into foreclosure, the lender is compensated 100 percent of the outstanding balance. Thats quite a benefit to the lender, as long as the lender approved the loan using current FHA guidelines. Yet this guarantee comes at a cost and is funded by an upfront mortgage insurance premium and an annual mortgage insurance premium, or MIP.

The upfront premium, currently 1.75 percent of the loan amount, is rolled into the principal balance and not paid out of pocket. The annual premium is paid in monthly installments. The annual premium amount will vary based upon loan term and down payment. Today, the annual premium is 0.85% of the loan with a 30 year term and a 3.5 percent minimum down payment. The premium for a 15 year loan with 5.00 percent down is 0.70%, for example. But FHA mortgage insurance premiums dont always have to be forever.

Lender Requirements

Current guidelines for all FHA loans with case numbers issued prior to June 3, 2013, the annual MIP will automatically be cancelled on a 30 year note when the balance is naturally amortizes to 78 percent of the original value and the note is at least five years old. The annual premium is also cancelled automatically on 15 year loans when the loan balance falls to 78 percent of the original value. There is no five year waiting period for 15 year FHA loans.

Refinancing Out of an FHA Loan

Also Check: Do Mortgage Applications Affect Credit Score