How Much Can I Afford To Spend On A House

The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach.

When lenders evaluate your ability to afford a home, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if youre expecting a baby and want to save additional funds.

Since you can alter the information you provide to play out different scenarios, as well as reflect your current financial situation, NerdWallet’s Home Affordability Calculator helps you easily understand how taking on a mortgage debt will affect your expenses and savings.

How Much Mortgage Can You Afford Based On Your Salary Income And Assets

There are signals that U.S home prices may be falling– a drastic difference from trends prospective homebuyers were seeing during the coronavirus pandemic. But while these price cuts may tempt you to snatch up a house quickly, you should still stop to consider what your price range is and prepare a home buying budget.

Think about questions like: How much can you afford to pay for your mortgage each month? What price point does that payment equate to? What mortgage rates do you qualify for?

In order to get a better idea of what mortgage you can afford, you should first check your rates. An online marketplace can help you find out what you qualify for and calculate the potential savings over the life of your loan. Check your rates today!

Understanding these numbers can help you set realistic, manageable expectations and keep your home search on track. Here’s how to determine them.

How Much Mortgage Can I Afford

Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so sheâs not right at that maximum of paying 36% of her pre-tax income toward debt.

The problem is that some people believe the answer to âHow much house can I afford with my salary?â is the same as the answer to âWhat size mortgage do I qualify for?â What a bank is willing to lend you is definitely important to know as you begin house hunting. But ultimately, you have to live with that decision. You have to make the mortgage payments each month and live on the remainder of your income.

So that means youâve got to take a look at your finances. The factors you should be looking at when considering taking out a mortgage include:

- Private mortgage insurance

- Local real estate market

Plugging all of these relevant numbers into a home affordability calculator can help you determine the answer to how much home you can reasonably afford.

But beyond that youâve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you donât want to buy the most expensive home that fits in your budget.

You May Like: Have Mortgage Rates Gone Up Or Down This Week

How Much Of My Income Should Go Towards Paying A Mortgage

There are no set rules regarding how much of your income should cover a mortgage payment. However, lenders will look at how much of your income is going to other outstanding debts before approving another loan. Check out this guide for the different methods for determining how much of your income should go to your mortgage.

How Much Should I Make To Afford A 400k House

According to this calculation, a prospective homebuyer looking to purchase a $400K house should make roughly $100,000 a year. Again, this number may vary with other considerations such as budget limitations, other loan obligations, and the details of your mortgage.

How much should you make to afford a 400k house?

What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981.

Read Also: Can I Get A Mortgage With A 630 Credit Score

How Much Of A Mortgage Can I Afford Based On My Salary

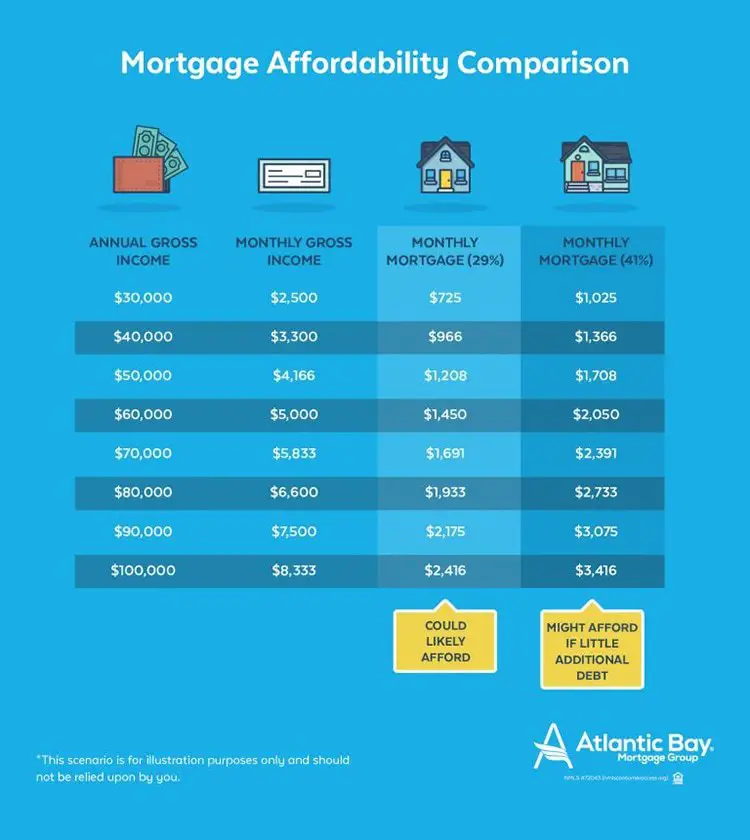

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

Use A Piggyback Loan To Put 20% Down

Another strategy that could help increase your budget is to finance your home with two different home loans simultaneously. This strategy is known as an 801010 loan or piggyback loan.

An 801010 mortgage means youd get:

- A first mortgage for 80% of the homes cost

- A second mortgage for 10%

- A cash down payment of 10%

This gives you the benefit of having a bigger home buying budget . It also eliminates the need for private mortgage insurance , which is usually required on conventional loans with less than 20% down.

Also Check: How To Know How Much Mortgage I Can Afford

You May Like: What Do Mortgage Lenders Use For Credit Score

Mortgage Affordability & How To Qualify For A Home Loan

Purchasing a home is one of the most costly transactions people make. It entails ample financial preparation and commitment to make timely payments. Thus, long before you submit your mortgage application, its crucial to assess your financial eligibility and how much you can afford.

What does it take to qualify for a mortgage? Our guide will discuss vital factors that determine your mortgage affordability. Well also talk about the importance of maintaining a good credit score and how major credit issues hinder chances of favourable mortgage rates. Well give a rundown on the required debt-to-income ratio, deposit, and primary costs you must consider before taking a mortgage. If youre looking for effective government schemes, we also included a section on Help to Buy mortgage assistance programs.

Understand Your Mortgage Options

The type of mortgage loan you choose to apply for can affect how much house youre able to afford. As such, its important to have a clear sense of what each loan option will entail as you begin your home buying journey.

All three government-backed loans have mortgage limits, which is a handy way to help you stay in a healthy debt-budget range. At this time, Rocket Mortgage doesnt offer USDA loans.

Also Check: What Is Naca Mortgage Program

Estimate Your Monthly Mortgage Payments

In addition to using the above affordability calculator, you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios.

The following calculator automatically updates payment amounts whenever you change any loan input, so if you adjust the interest rate, amount borrowed or loan term you will automatically see the new monthly fixed-rate and interest-only repayments.

Total Cost

We also offer a calculator with amortisation schedules for changing loan rates, so you can see your initial loan repayments and figure out how they might change if interest rates rise.

Documents Needed For Mortgage Application

Here are a few documents you should gather to help you understand your financial situation and how much house you can afford. This information will also be required when you apply for a pre-approved home loan.

- Recent statements from all bank and investment accounts

- Pay stubs and W-2 income tax forms

- Total monthly expenses, including all bills, groceries, clothing budgets, etc.

- All of your assets, including stocks, 401, IRAs, bonds, cash, rental properties, etc.

- All debt including credit cards, student loans, car loans, mortgages, etc.

- Profit and loss statements if you are self-employed

- Gift letters if you are using a gift to help with your down payment

You May Like: How Much Is A 30000 Mortgage Per Month

I Like To Have A Cushion In Case Our Household Income Declines

You never know when your household income might take a hit. Many experts are warning of a recession next year, and if the economy takes a dive, it’s hard to say how it might impact us. I may find that clients aren’t willing to give me as much work because they need to cut back, for example.

That’s why I like keeping our housing expenses low relative to our income. It gives us more flexibility to absorb an income loss without having to worry about falling behind on bills.

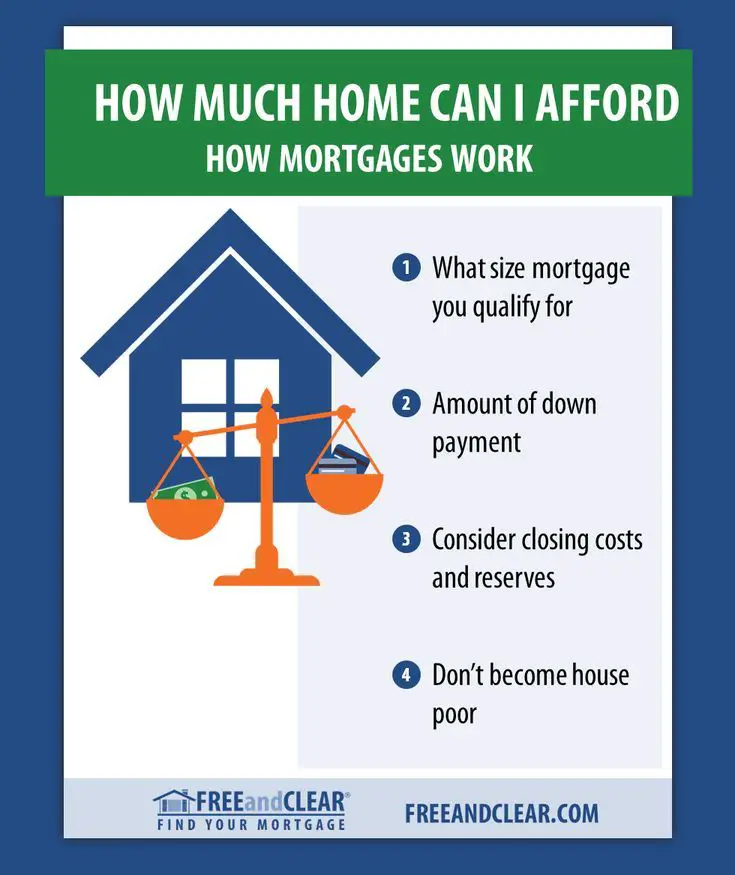

Dont Forget To Factor In Closing Costs

All right, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, you should hold off on your home purchase until youve saved up the extra cash or shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Don’t Miss: How Long To Wait To Refinance Mortgage

Types Of Mortgage For First

Youre considered a first-time homebuyer if you have never owned residential property in the UK or abroad. It also applies if youve only owned a commercial property with no attached living space, such as a pub with a small upstairs flat. If you fit this profile, you qualify as a first-time homebuyer.

On the other hand, you are not considered a first-time homebuyer if:

- Youve inherited a home, even if youve never lived in the property since its sold

- Youre buying a house with someone who owns or has previously owned a home.

- Youre having property purchased for you by someone who already owns a house, such as a parent or guardian.

There are a variety of mortgage products which are suitable for first-time buyers. Before finalizing a mortgage deal, look into the following types of mortgages:

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Also Check: How To Get A Mortgage In Jamaica

How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

Help To Buy Equity Loan

The equity loan scheme finances the purchase of newly built houses. You can borrow a minimum of 5% and a maximum of 20% of the propertys full price. As a requirement, you must make a 5% deposit and obtain a mortgage to shoulder 75% of the loan. The house must also be bought from a builder recognized by the program. As an advantage, interest is not charged during the first 5 years of the equity loan. For more information on this government scheme, visit the Help to Buy equity loan page.

Don’t Miss: What Do Lenders Look For When Applying For A Mortgage

Why Start With The Monthly Payment

Loan officers often offer to start by looking at the maximum mortgage amount you could qualify for, based primarily on your credit score and debt-to-income ratio. While it can feel pretty cool to see a big number, maxing out what a lender will offer could leave you house poor. That would mean too much of your income would go toward housing, leaving you scraping to pay your other bills, let alone save for retirement, travel or have fun.

Before you start talking to lenders, you should have a strong sense of your current financial situation. That includes money coming in, money going out and money goals. For example, if you want to start a family or plan to increase your contributions to your 401, include that extra spending even if it’s not part of your current budget. If you’re considering a career change or going back to school down the line, think about how that would affect your household income. Use those numbers to figure out what mortgage payment amount would be comfortable for you.

What Costs Are Built Into A Monthly Fha Mortgage Payment

NerdWallets FHA loan calculator considers the following costs when estimating your monthly FHA loan payments:

-

Principal. This is the amount you owe on the loan, or what you borrowed minus your down payment. For example, if you buy a $250,000 home and put down 10% , the principal would be $225,000.

-

Interest. This is the cost of borrowing the money from a lender, expressed as an annual percentage of the principal.

-

FHA mortgage insurance premium, or MIP. Mortgage insurance protects lenders from losing money if a borrower defaults on the loan. FHA loan requirements mandate mortgage insurance premiums. Youll make an upfront payment at closing. Then, ongoing FHA mortgage insurance premiums are factored into your monthly payment.

-

Property taxes. Annual taxes on your home and land, assessed by a government authority, are often collected as a part of your payment and paid through an escrow account.

-

Homeowners insurance. This helps pay for damage if your home or belongings are damaged by an event covered under your policy. In certain instances, it can also pay your legal bills if you injure someone. When you have an FHA loan, your homeowners insurance is also paid through an escrow account.

With good credit, you can make a down payment as low as 3.5% on an FHA loan. But then you have to pay mortgage insurance for the life of the loan. Consider making a down payment of at least 10%. At this threshold, your mortgage insurance premiums will end after 11 years.

Read Also: Do You Still Own Your Home With A Reverse Mortgage

How Much Income Do You Need For A $500000 Mortgage

Keep in mind, an income of $113,000 per year is the minimum salary needed to afford a $500K mortgage.

What income do you need for a $600000 mortgage?

What income is required for a 600k mortgage? To afford a house that costs $600,000 with a 20 percent down payment , you will need to earn just under $90,000 per year before tax.

Where Should I Stash My Down Payment

You could stash your down payment in a simple money market savings account. Youre not going to make tons on interest, but you wont lose money either. Keep in mind: Saving a down payment is not the same as investing for retirement. Saving a down payment should only take you a year or twoso you want to keep your savings in a place thats easy for you to access.

Recommended Reading: Can I Be Added To A Mortgage

Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

Recommended Reading: Are Mortgage Rates Higher For Townhomes

What Home Can I Buy With My Income

A quick recap of the guidelines that we outlined to help you figure out how much house you can afford:

- The first is the 36% debt-to-income rule: Your total debt payments, including your housing payment, should never be more than 36% of your income.

- The second is your down payment and cash reserves: You should aim for a 20% down payment and always try to keep at least three monthsâ worth of payments in the bank in case of an emergency.

Let’s take a look at a few hypothetical homebuyers and houses to see who can afford what.

Recommended Reading: What Is Credit Approval For Mortgage